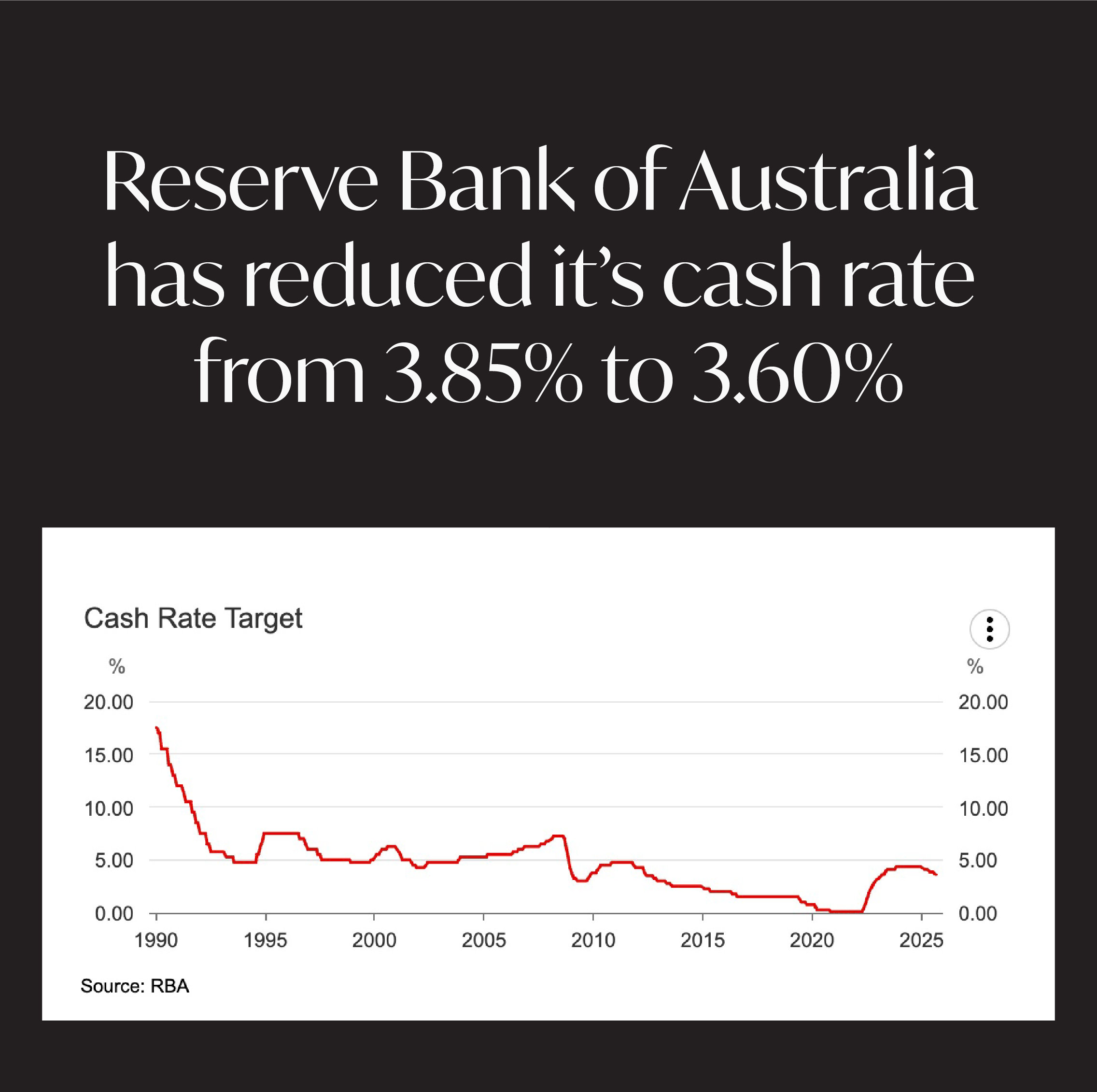

RBA Cuts Cash Rate to 3.60% — What It Means for Australian Expats.

The Reserve Bank of Australia (RBA) has lowered the cash rate by 25 basis points, bringing it down to 3.60% — the third cut this year.

Why the RBA made the move

Inflation back in the target band – Annual trimmed mean inflation is now 2.7%, down sharply from the 2022 peak.

Labour market softening – Unemployment has risen to 4.3% and wages growth is slowing.

Slower demand at home – While real household incomes have improved, business confidence and productivity growth remain weak.

Global uncertainty – US tariffs, global trade tensions, and cautious corporate investment are weighing on the outlook.

What this could mean for expats

Better lending conditions – Variable mortgage rates are likely to edge lower, making it a good time to review your loans or explore new property purchases in Australia.

Increased borrowing power – Lower rates can improve serviceability assessments with some lenders, particularly for Australian citizens earning income overseas.

Potential AUD impact – Rate cuts often put downward pressure on the Australian dollar, which could benefit expats transferring funds from stronger foreign currencies.

Refinancing opportunities – If you haven’t reviewed your mortgage in the past year, the combination of rate cuts and favourable exchange rates could create a significant saving.

Perfect timing for your next move

This is the ideal moment to refinance your property and unlock the equity you’ve built over recent years. You could use that equity to:

Purchase another property in Australia

Diversify into the stock market

Strengthen your investment portfolio

We’ll be exploring these strategies in detail at our upcoming THE EXPATRIATE Networking & Insights Evening in Hong Kong:

Join us to learn how you can make the most of this rate environment and position yourself for long-term financial growth.

The information contained is general information only and does not consider your personal objectives, financial situation and needs. We strongly recommend that you do not act on any information provided in this website without individual advice from your trusted advisor. You should also obtain a copy of and consider the Product Disclosure Statement for all financial products before making any decision.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.