Event: TE in HK Stauntons, Refinance and Save, Melbourne Property Insights, SJP Financial Market Watch.

📰 THE EXPATRIATE | August 8th, 2025 Edition

Smart Lending, Market, Finance and Property Insights, for Global Australians

🇦🇺🌏 Time to connect with your Aussie Expat community!

Join us for an evening of drinks, nibblies, and expert insights at the iconic Staunton’s Bar in SoHo.

🍷 What to expect:

• Great conversation

• Tailored advice

• Your first drink on us!

Mingle with fellow Aussies and hear from our TE Team as we dive into everything you need to know about property, finance, and building wealth while living offshore — all in a relaxed, welcoming setting.

📍 Staunton’s Bar, SoHo

🗓️ 20th August, 6pm

💡 Complimentary event – but spaces are limited. RSVP essential!

🎯 What We’ll Cover:

✔️ The Australian property market & how to invest from Hong Kong

✔️ Lender policy changes & currency updates for expats

✔️ Wealth-building strategies tailored for offshore Australians

✔️ Live Q&A with our expert panel

✔️ Networking with fellow professionals

Let’s catch up, learn, and laugh—Expat style.👉 Lock in your spot.

We were recently approached by a new client—an Australian expat investor—who had been with their Big 4 lender for five years. Despite maintaining their investment property loan without issue, they had the sense they were no longer receiving a competitive rate and wanted to understand their options.

Initially, their loan was set up with an 80% loan-to-value ratio (LVR). Over time, with steady repayments and some capital growth, they suspected the LVR had improved—but weren’t sure if that translated to better loan terms.

🔍 What We Discovered:

We arranged a formal property valuation and confirmed the property was now worth $2 million. With a loan balance of $1 million, their LVR had dropped to 50%—a significant shift that improved their lending profile.

✅ The Outcome:

This opened the door to sharper pricing. We helped them refinance with a new lender offering 5.69%, which is over 1% lower than their previous rate.

Monthly repayment comparison on $1M (30 years, P&I):

At 5.69%: $5,783

At 6.69%: $6,432

Monthly Savings: $649

Annual Savings: $7,788

💡 Lessons for Expats:

Your bank might not reward loyalty—you need to review and ask.

Lower LVR = lower risk = better rates—but only if you assess and act.

Review your loan every two years, or after significant financial or property changes occur.

St. James’s Place WeekWatch - In The Picture.

🌍 Global Market Context: What’s Moving the Needle?

In this week’s St. James’s Place WeekWatch (4 August 2025), several key takeaways affect how global Australians might think about money, investment, and property:

📉 Rate Cut Anticipation Builds:

As global inflation shows further signs of easing, investors are increasingly optimistic that central banks—particularly in the US and Australia—may begin easing interest rates later this year or early 2026. The Bank of England hinted at dovishness, while the RBA’s decision is due next week.

📊 Markets Move on Inflation Data:

Global share markets were mixed, but broadly positive, as US PCE inflation came in at 2.4%—closer to the Fed’s target—reinforcing hopes that peak interest rates are behind us.

🌐 Geopolitics and Diversification:

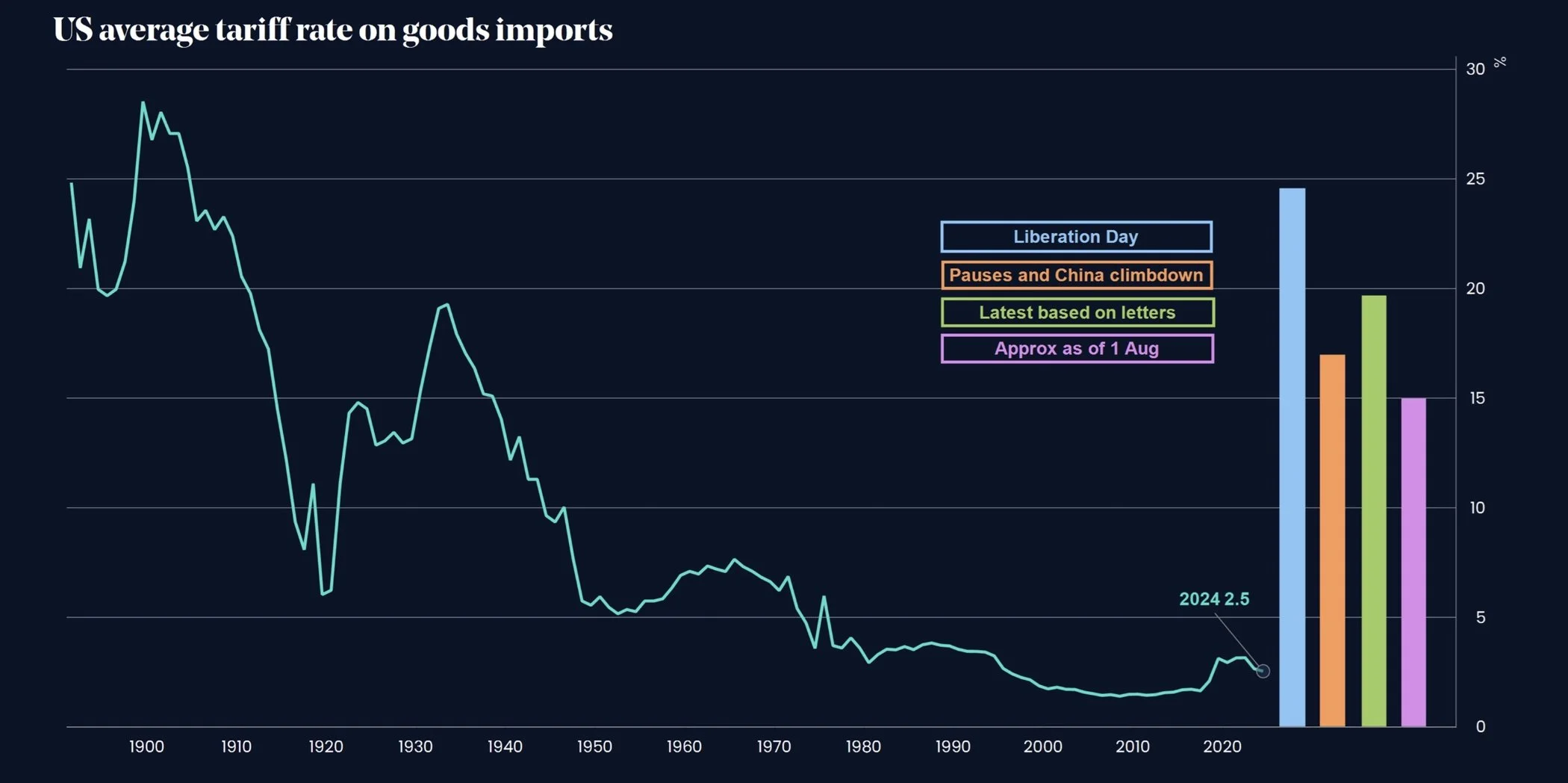

There’s growing awareness among global investors of the need for diversified strategies. As the US election looms and trade dynamics shift in the Asia-Pacific, many Australians abroad are reassessing how their assets are positioned globally—property included.

🏠 Investor Implication:

If interest rates soften in the coming 6–12 months, now could be a strategic time to lock in better lending terms, refinance, or prepare for acquisitions before competition and prices increase.

🏡 Market Watch: Melbourne’s Momentum Is Building

According to Lauren Staley of Infolio, there’s growing energy in the Melbourne market:

“There’s a quiet confidence returning to Melbourne—and it’s catching the attention of buyers offshore. We’re seeing a sharp rise in demand from expats in Singapore, Hong Kong and Dubai, many of whom are briefing us now to secure quality assets before prices lift again.”

Why the urgency?

Listings remain tight

Buyers are active and motivated

Agents are tipping more stock by spring

The likely result? Upward pressure on prices.

The information contained is general information only and does not consider your personal objectives, financial situation and needs. We strongly recommend that you do not act on any information provided in this website without individual advice from your trusted advisor. You should also obtain a copy of and consider the Product Disclosure Statement for all financial products before making any decision.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.