Interest Rates on Hold at 3.6%. Changes to the Housing Australia Guarantee, Cotality Property Market Update.

RBA Holds Cash Rate at 3.6% – Steadier Ground for Borrowers Abroad

The Reserve Bank of Australia has kept the cash rate steady at 3.6%, offering stability in a climate where inflation is easing but not yet resolved.

For Australians abroad:

A stable rate environment makes it easier to plan for currency transfers and mortgage serviceability back home.

Lenders are less likely to raise stress test buffers in the immediate future.

Expats considering buying property should view this as a window of opportunity before the next rate move.

Housing Australia Scheme Changes – Indirect Impacts on Expats

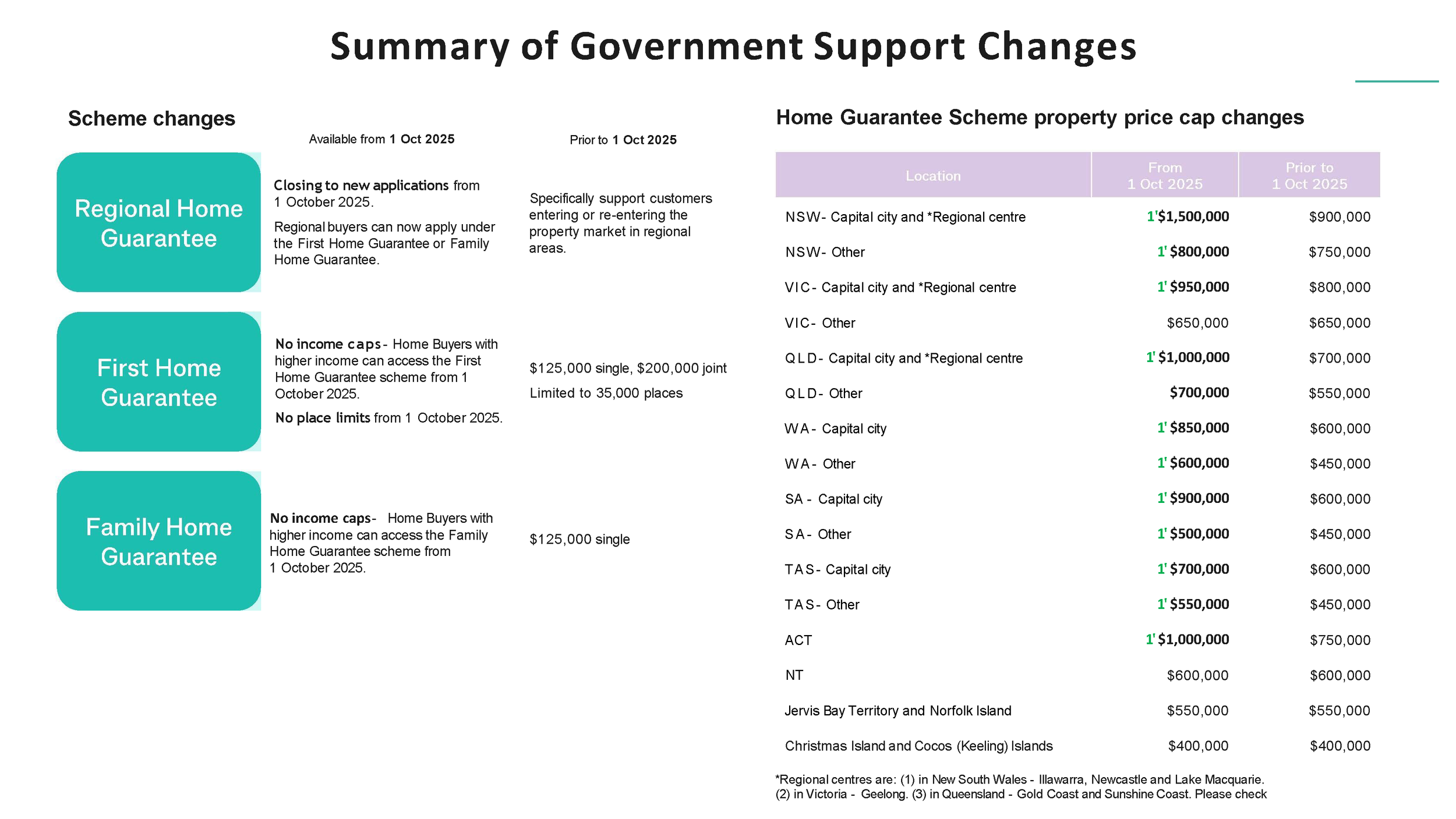

From 1 October 2025, the Housing Australia Guarantee Schemes have expanded dramatically Government Grants Schemes Cheat…:

No income caps and no place limits mean more Australians back home can access the schemes.

Higher property price caps: Sydney up to $1.5M, Melbourne up to $950k, Brisbane up to $1M, with increases across all major cities and regions.

Eligible first home buyers can enter the market with just a 5% deposit (2% for single parents) without paying Lenders Mortgage Insurance.

🔑 What this means for expats

Even though Australians living overseas are not eligible for these schemes, the changes are likely to drive increased demand from first-home buyers. That creates flow-on effects:

Property prices may rise faster in suburbs newly unlocked by higher price caps.

Rental supply may tighten further, as buyers who were previously renting move into ownership.

Investors (including expats) could benefit from rising rents, but will also face more competition when purchasing.

Cotality Property Market Update – Spring Surge Continues

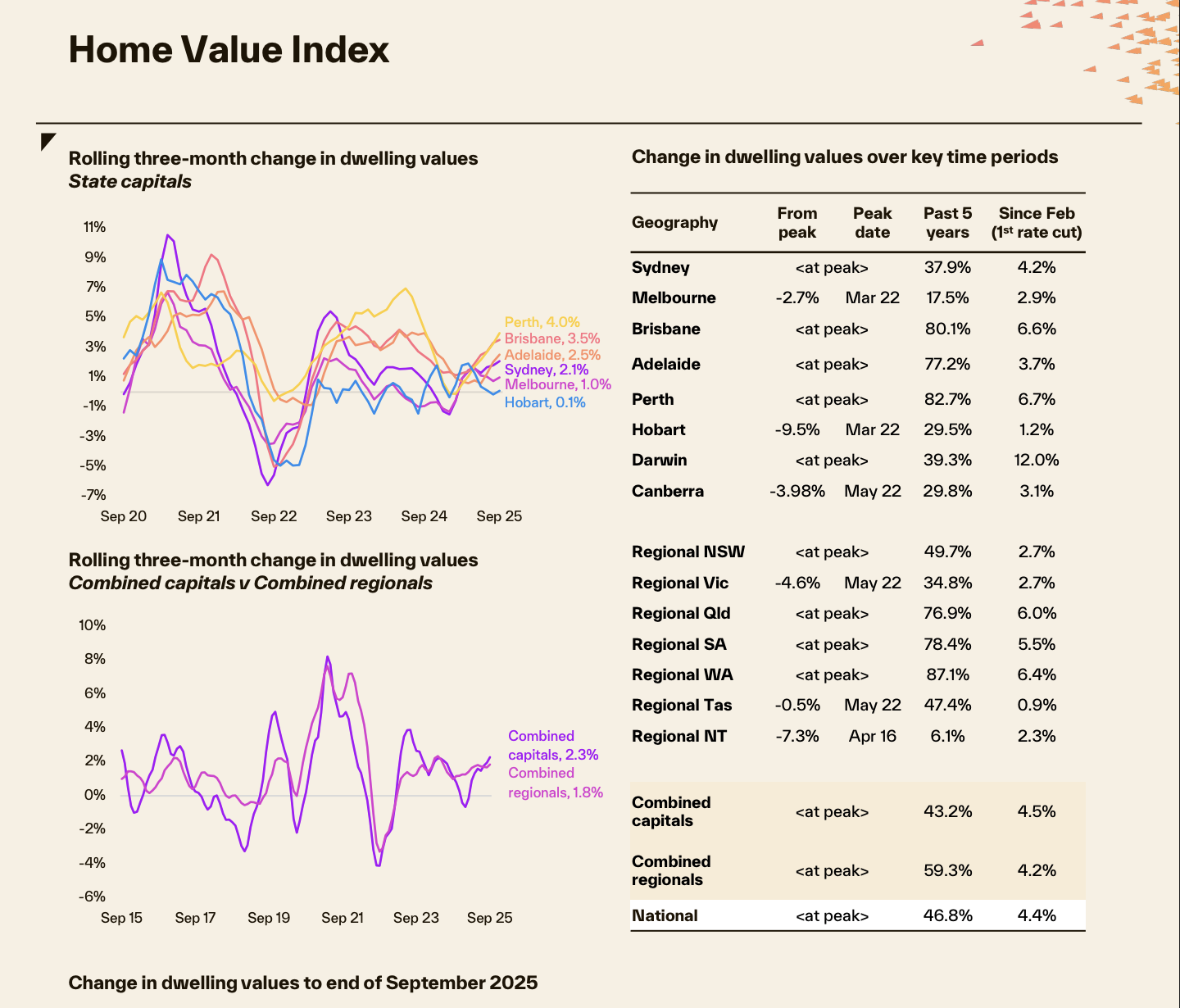

According to the Cotality Home Value Index (Oct 2025):

National dwelling values rose 0.8% in September, the most substantial monthly gain since 2023.

Brisbane (+3.5% quarterly), Perth (+4.0%), and Darwin (+5.9%) are outperforming.

Sydney median values now sit at $1.24M (+2.1% for the quarter).

Rental markets remain under pressure, with vacancy rates at a record low of 1.4%.

For expats:

Property prices are moving upwards again, with demand strong and listings 18–45% below average in some cities.

Rental demand is surging, creating strong yield opportunities for those investing.

With government-backed buyers entering the market, competition could increase in popular metro and lifestyle hubs.

🌍 Key Takeaways for Expats

Indirect Pressure on Prices – More local buyers means heightened competition in the $700k–$1.5M range.

Rental Market Tightness – Expect rising rents as first-home buyers leave the rental pool.

Investor Advantage – Expats may benefit from stronger yields, but acting sooner rather than later could be critical before prices accelerate further.

At THE EXPATRIATE, we help Australians living overseas secure property finance, navigate expat lending rules, and leverage strong rental conditions to build wealth back home.

📞 Get in touch today to learn how these changes could shape your buying or investment strategy.

The information contained is general information only and does not consider your personal objectives, financial situation and needs. We strongly recommend that you do not act on any information provided in this website without individual advice from your trusted advisor. You should also obtain a copy of and consider the Product Disclosure Statement for all financial products before making any decision.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.