Housing Australia Guarantee Changes + TE HK Event Highlights

Big changes are coming to the Housing Australia Guarantee Scheme (HGS), and if you’re living abroad, it’s time to get strategic. Plus, a huge thank you to everyone who joined us for the 20th August TE Event in Hong Kong!

It’s a Wrap – TE Event, 20th August 2025, Hong Kong

Thank you to everyone who joined us at Staunton's SoHo, Hong Kong, for an evening filled with valuable insights, networking opportunities, and property market updates. It was lovely to connect with the Hong Kong Australian expat community.

Event highlights included:

Adam Kingston: Changes to Expat Lending, Currency, Interest rates and lenders’ policies.

Erika Humby-Freiman: Australian Property Market Overview & Focus on Sydney

Michael Purvis: Financial Planning Insights – Is This the Golden Time to Act?

Have questions?

Feel free to reach out to any of our expert speakers — they’re more than happy to assist and provide guidance.

Housing Australia Guarantee Scheme – Changes Brought Forward to 1st October 2025.

Just after we informed you that the changes were scheduled for 1 January 2026, on Sunday, the 24th of August, the Australian Government moved them forward by three months to 1st October. We are speculating that it is due to pressure on the Australian property market.

So what are the changes?

✅ Unlimited places – all eligible first home buyers can apply

✅ No income caps – higher-income buyers are now eligible

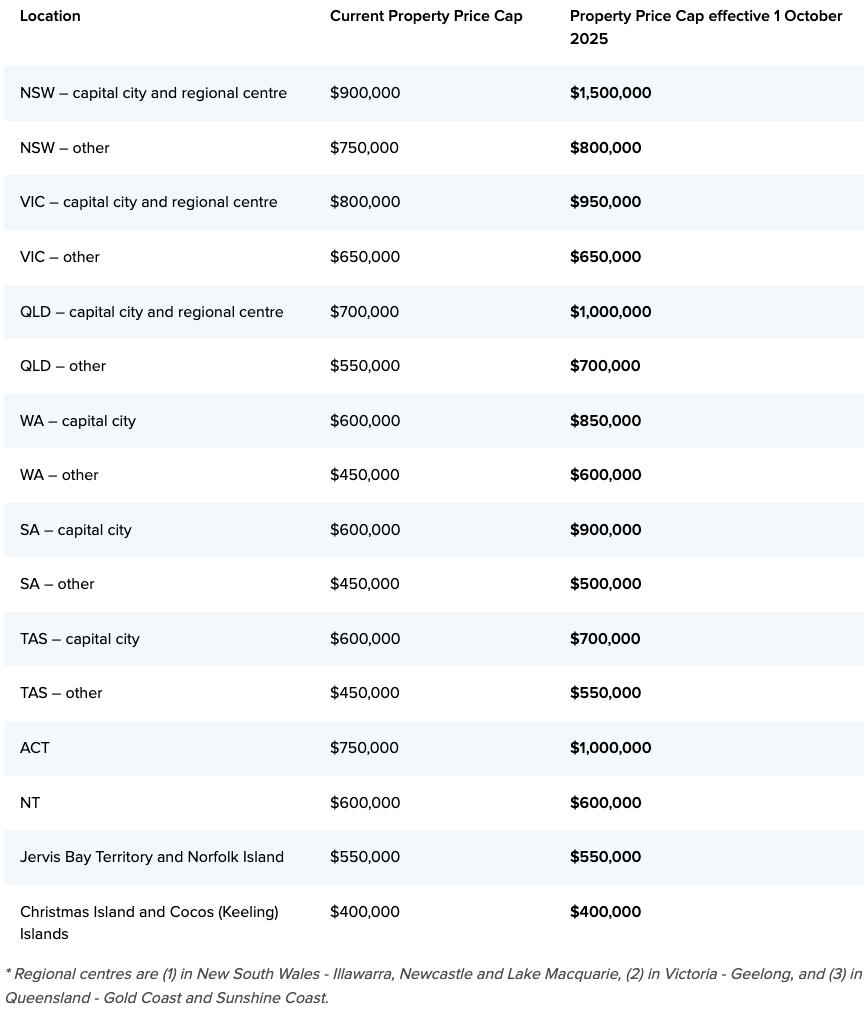

✅ Higher property price caps – capital city properties now up to $1.5 million

✅ Simpler access in regional areas – the First Home Guarantee replaces the Regional Guarantee

Investor Alert: Market Pressure Ahead

If you’re an investor, these changes will undoubtedly put pressure on the housing market. Now is the time to connect with your buyer’s agent, mortgage broker, and financial adviser to stay ahead of Australian Government policies while living abroad. Early planning is crucial for making informed, strategic decisions in a rapidly changing market.

Next Steps

Discuss the changes with your broker to determine if they will impact our borrowing capacity, or consider increasing the equity in your current properties and refinancing. Reach out to Adam Kingston, Director of Australian Expatriate Finance.

Stay ahead of the property market with advice from your team of experts. Chat to Erika Humby-Freiman, Buyers Agent, MCA Buyers Agency.

Connect with your financial planner and stay ahead of the global markets. Connect with Michael Purvis, Partner, Eight Wealth Management, Partner, St. James’s Place Asia and Middle East.

We wish you a fantastic week ahead and look forward to catching up with you soon!

TE Team.

The information contained is general information only and does not consider your personal objectives, financial situation and needs. We strongly recommend that you do not act on any information provided in this website without individual advice from your trusted advisor. You should also obtain a copy of and consider the Product Disclosure Statement for all financial products before making any decision.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.