TE “Cheat Notes” from the CoreLogic HVI March 2024

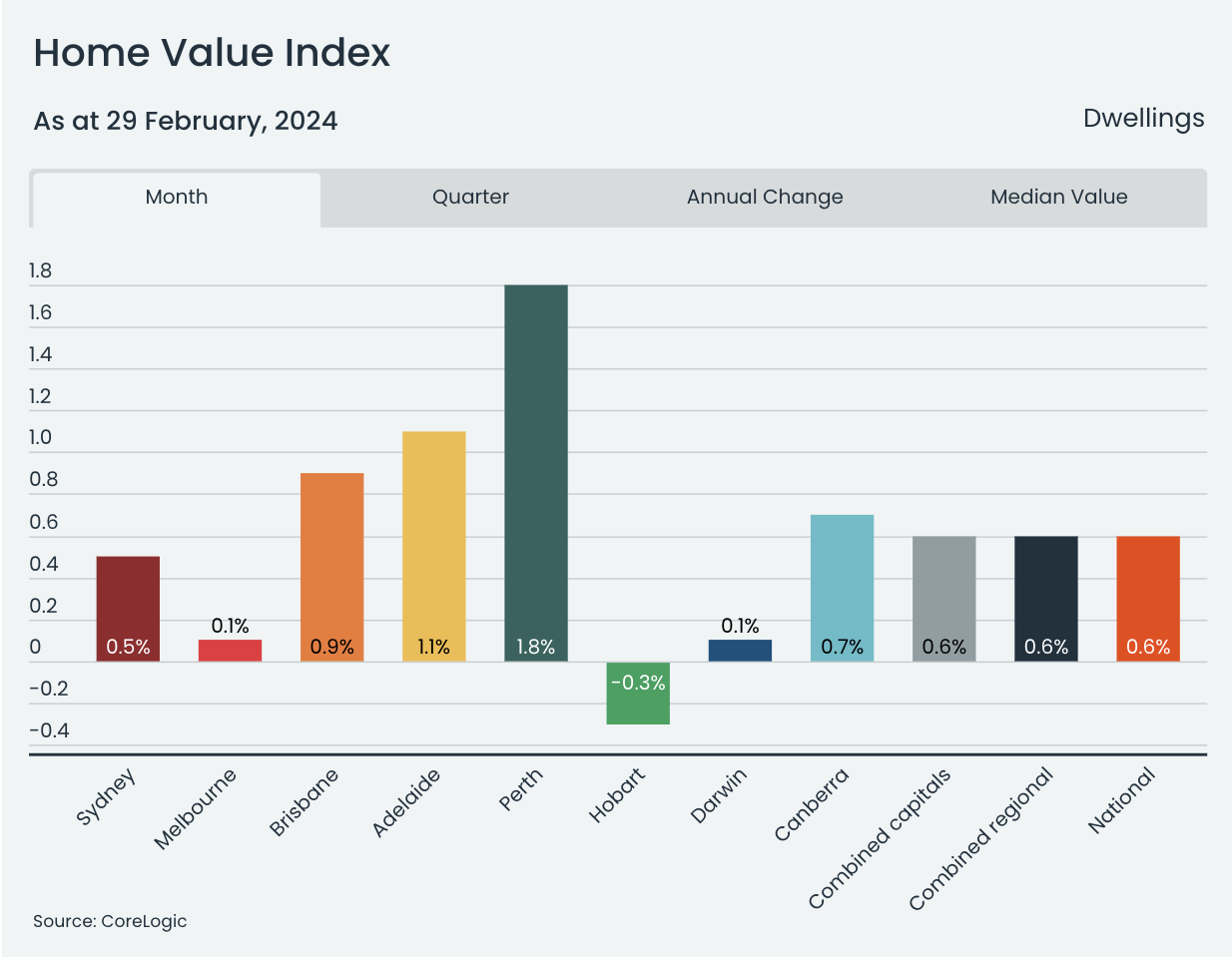

Housing values recorded a subtle re-acceleration in February as sentiment improved. The month saw a broad-based rise in housing values, reflected positively in CoreLogic's national Home Value Index (HVI) with a 0.6% increase. This upturn signals a potential shift in the real estate landscape for the better.

Perth leads the way.

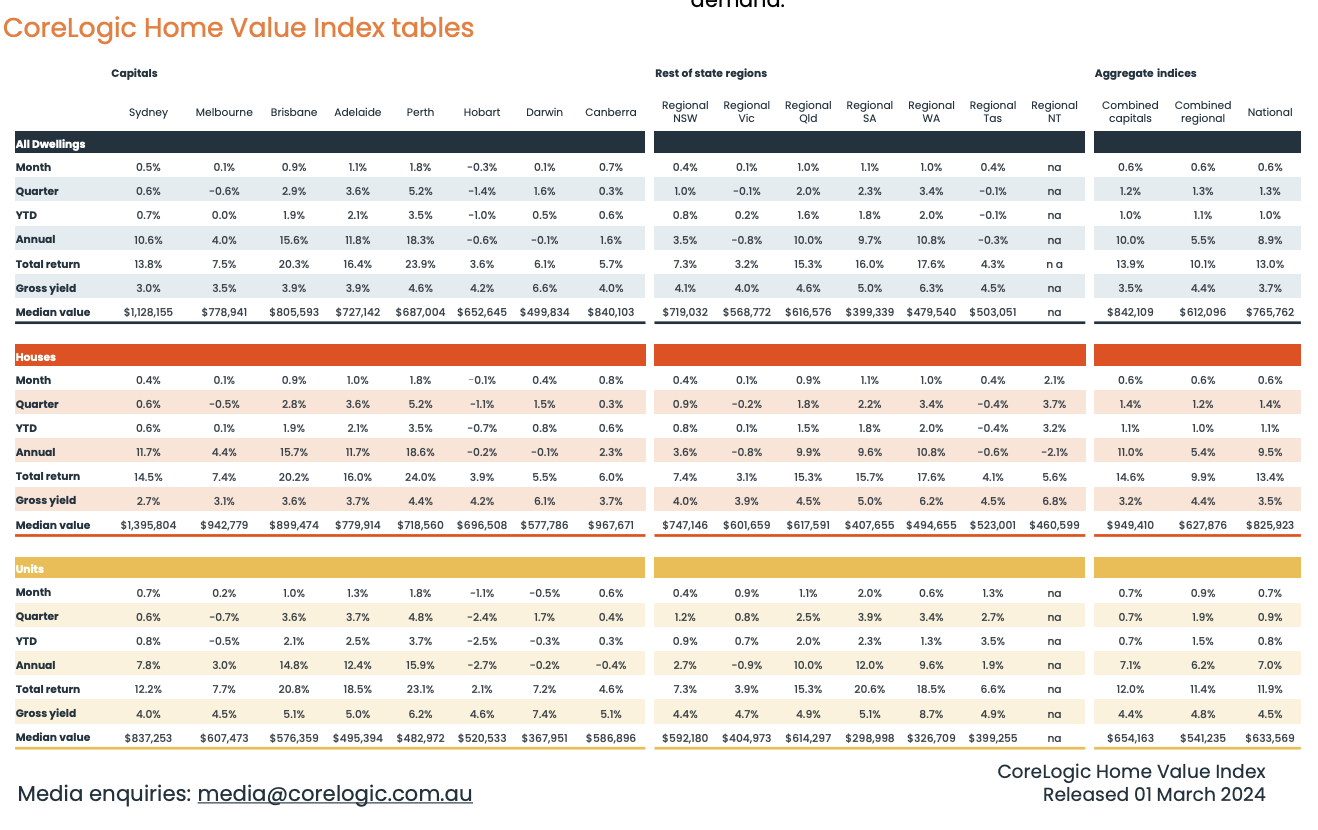

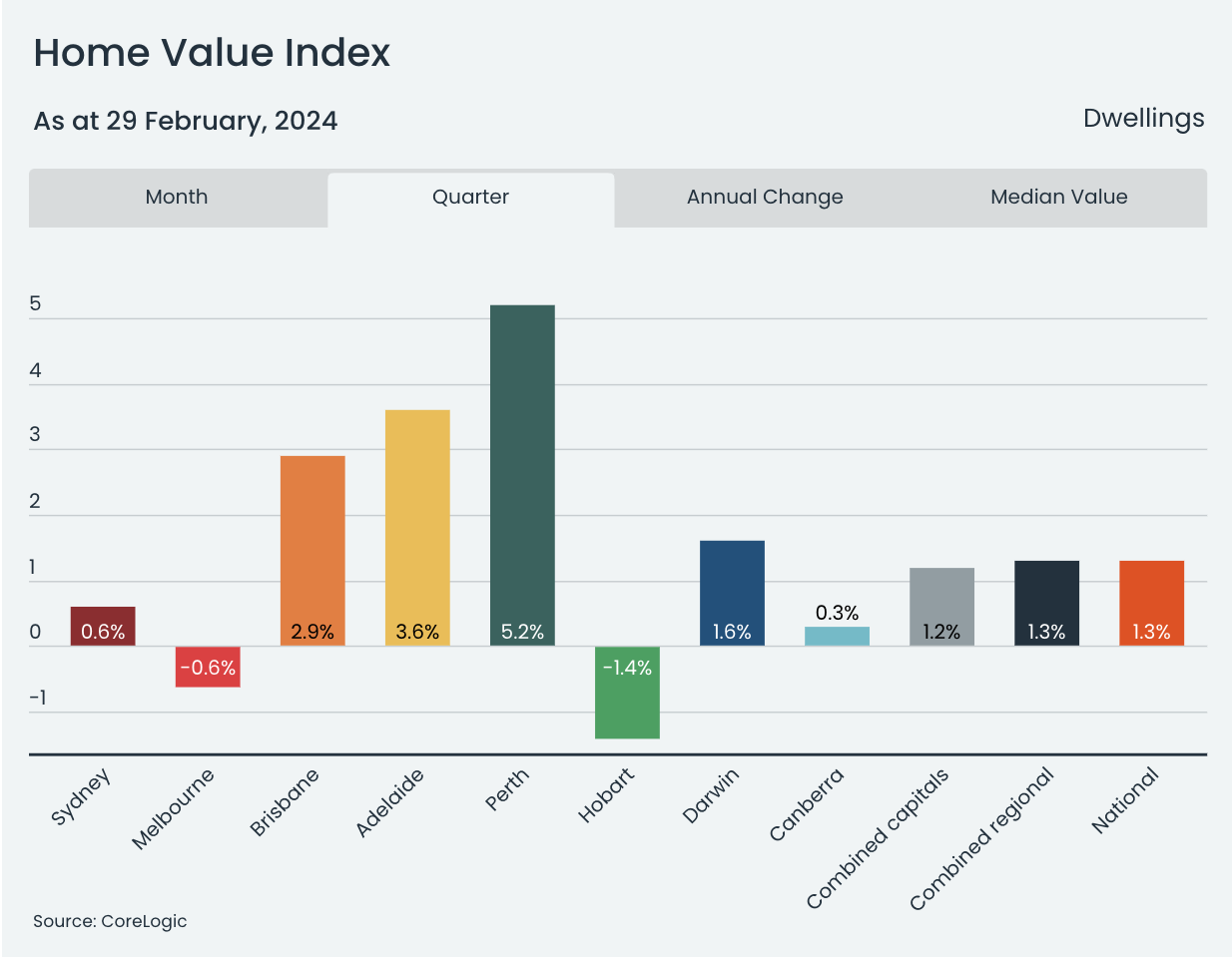

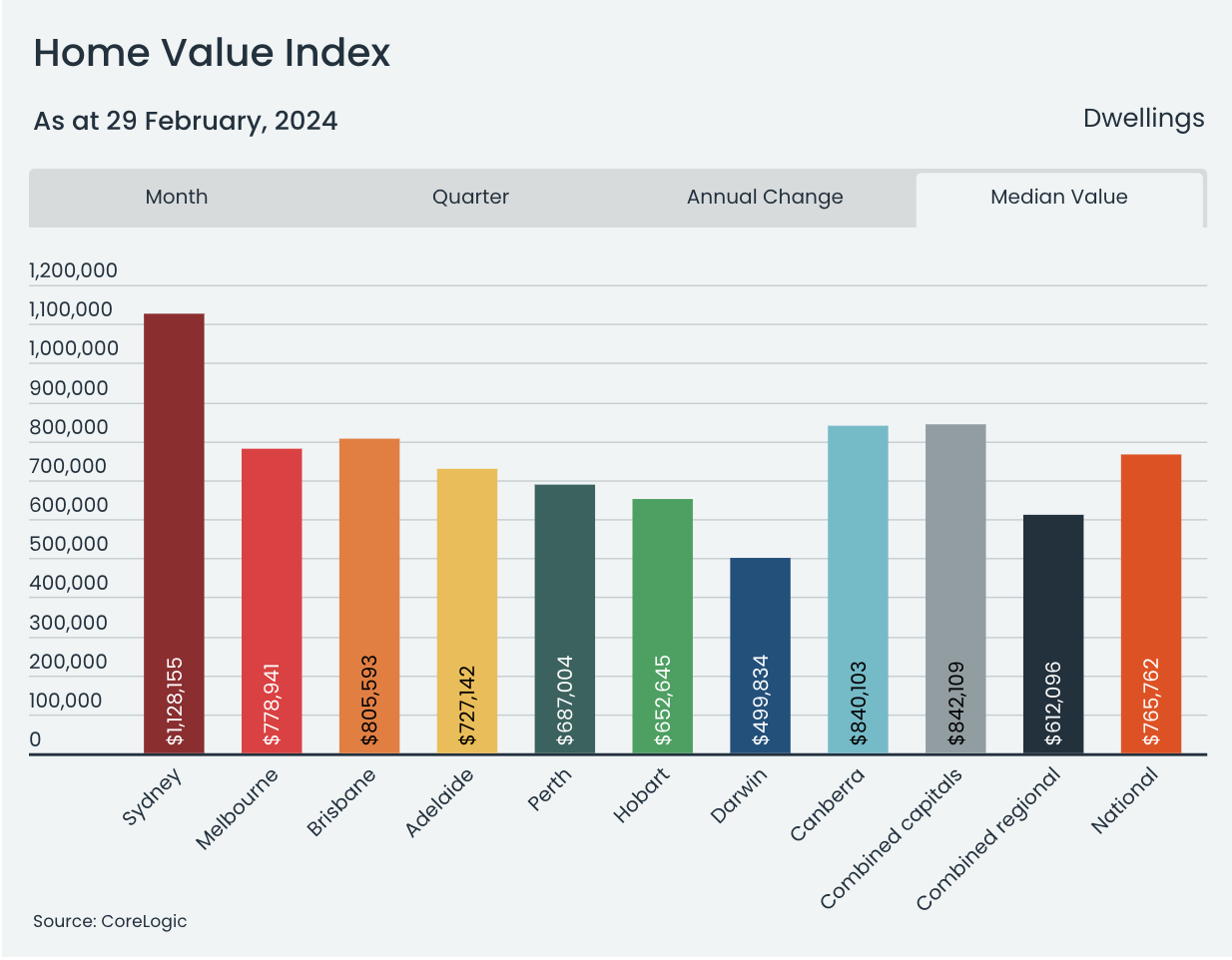

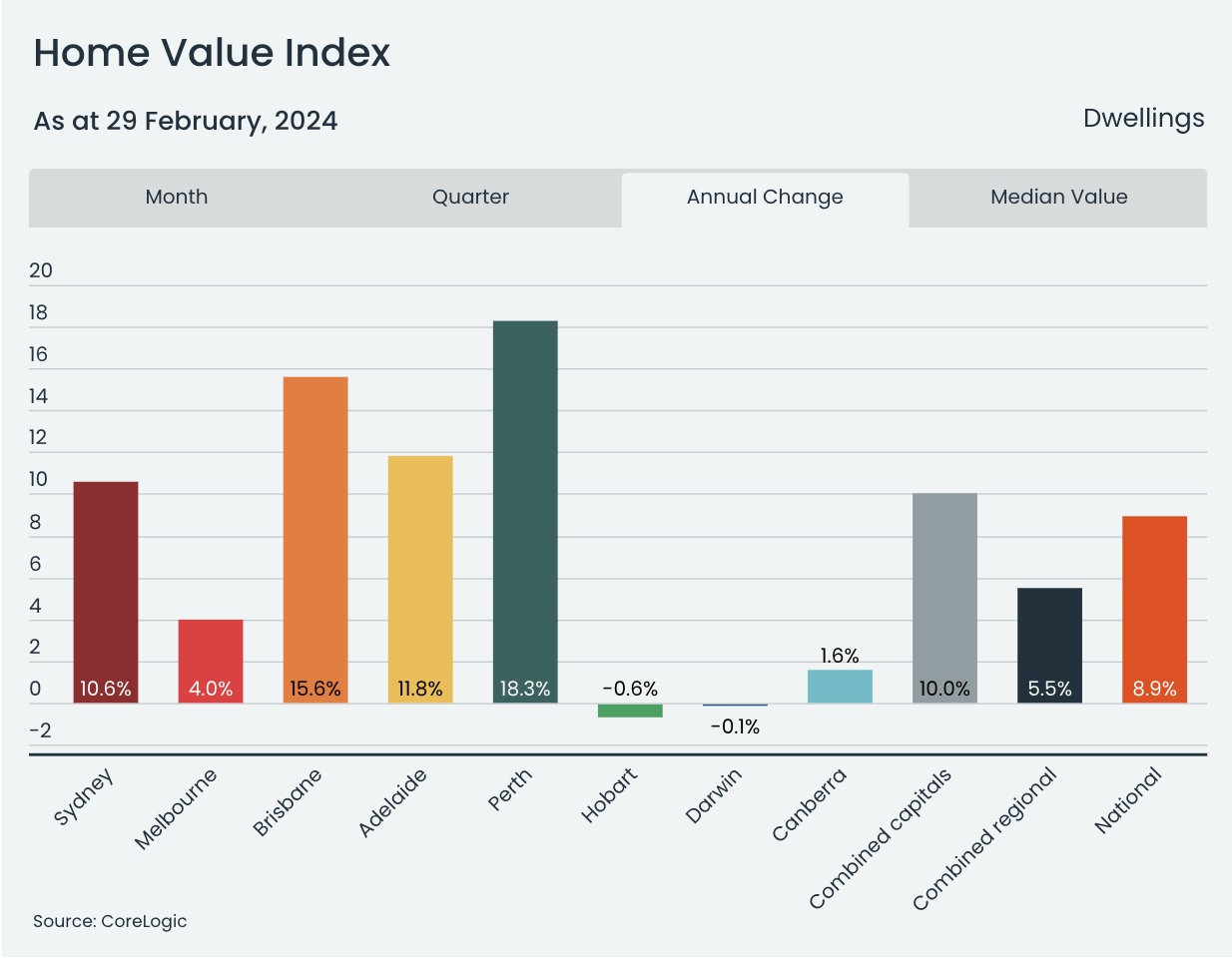

Perth has a substantially higher growth rate than any other region, up 1.8% over the month. Adelaide (+1.1%), Brisbane (+0.9%) and the regional areas of SA (+1.1%), WA and Queensland (both +1.0%) also show a consistently high rate of capital growth month-to-month. Canberra (+0.7), Sydney (+0.5), and Victoria had minimal growth (+0.1). Only Hobart (-0.3) recorded a negative for the month of February.

Perth +1.8

Adelaide +1.1

Brisbane +0.9

Canberra +0.7

Sydney +0.5

Darwin and Vic +0.1

Hobart -0.3

“Although growth rates in Sydney and Melbourne home values have levelled out, the monthly trend has accelerated, with Melbourne emerging from a three-month slump of negative monthly movements to record a subtle 0.1% rise in February. ”

National Auction Clearances Bounced Back

Value growth and higher auction clearance rates have picked up, averaging in the high 60% range for February 2024. Consumer confidence also increased notably, indicating more robust optimism. Despite some improvement, most areas see slower value growth than last year's peak. The value outlook has slightly enhanced since last year, with a gradual increase in value gains in the first two months of this year. Historically, increasing consumer confidence tends to boost housing activity, leading to more home sales. Westpac and the Melbourne Institute noted a 6.2% rise in the monthly consumer sentiment index, reaching the highest level since June 2022.

“Even with the February rise, sentiment remains in deeply pessimistic territory, but given strong demand-side pressures, we have seen a divergence between home sales and sentiment through 2023. This suggests that any lift in confidence could be amplified amid an ongoing mismatch of housing supply relative to demand.

How sensitive the market is to rate cuts remains a key unknown. We would need to see a bit more than seven cash rate cuts of 25 basis points each before interest rates returned to the pre-COVID decade average of 2.6%.

With housing affordability an ongoing challenge and lenders are generally cautious towards borrowers with high debt to income or loan-to-income ratios, it’s hard to see a material lift in housing values until interest rates come

down significantly,”

Key points for consideration.

The lower inflation trend continues into 2024, boosting confidence and forecasting a rate cut.

Housing turnover is up from last year, slightly below the 5-year average.

National dwelling sales are 4.7% higher Year on Year.

Capital cities are 6.0% stronger than this time last year.

Home sales are down 5.0% nationally, -1.5% in capitals vs. the 5-year average.

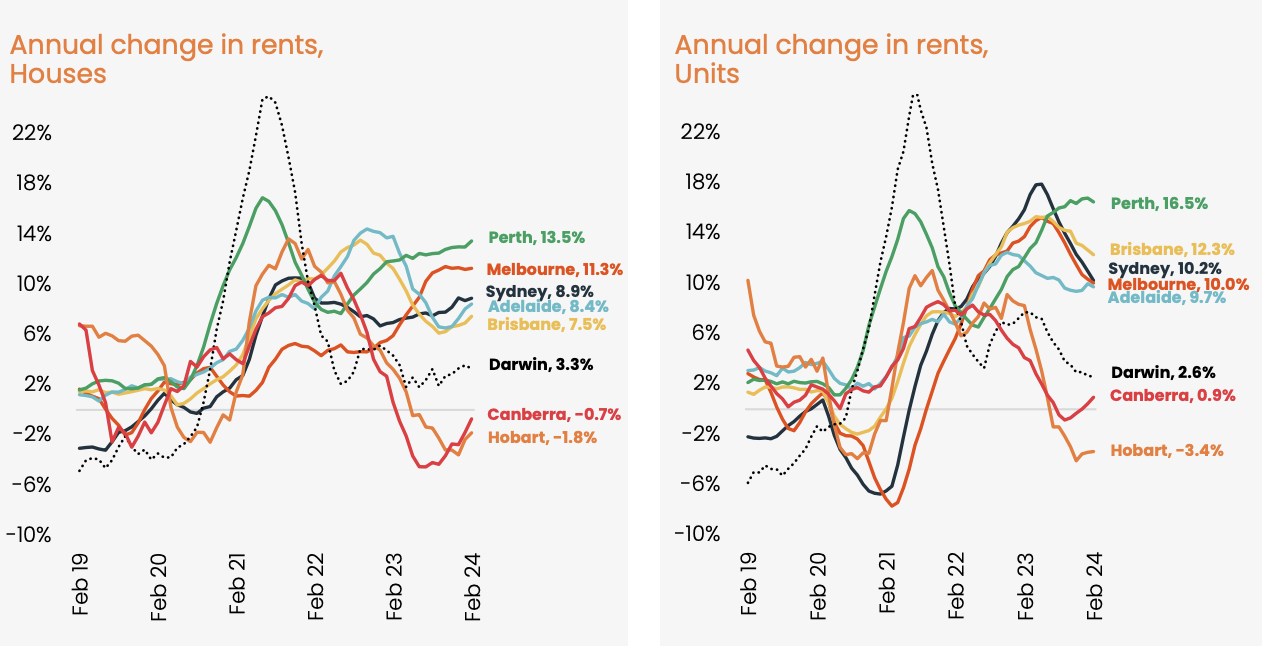

Reexceration in growth in rental values has also re-accelerated through early 2024, with the monthly pace of change rising to 0.9% in February, the highest reading since March last year and a quarterly rent change rise to 2.4%, the highest since May last year.

The re-acceleration in rents is primarily seasonal in the first quarter of each year, a historical trend. However, there has also been a pick-up in the annual growth trend for rents, with the national rental index up from a recent low of 8.1% in October last year to 8.5% over the 12 months ending February.

So What does Tim Think?

“We could see the volume of home sales picking up later this year if sentiment continues to improve,”

A trend that seems more certain going forward is the sheer diversity in market conditions that have emerged through the second half of 2023 and into 2024.

The underlying fundamentals of the WA housing market look set to continue for some time, with Perth and parts of regional WA continuing to show an affordability advantage alongside solid demand from high interstate and overseas migration levels. With substantially higher rental yields and prospects for capital gains, WA is likely to be a favourite among investors.

At the other end of the spectrum is Hobart where housing values have been flat to falling since the market peaked in March 2022. Hobart dwelling values were -12.2%, down on the 2022 highs at the end of February. Tasmanian housing is relatively less affordable following a significant period of overperformance between 2017 and 2022. The latest ABS population data suggested the population declined slightly in the June quarter of last year, driven by negative interstate migration, which would also be detracting from demand.

To read the CoreLogic Austrlia’s March 1st HVI for February 2024 click on the button below;

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.