CoreLogic Property Pulse Report is out - The Gap widens between house and unit values

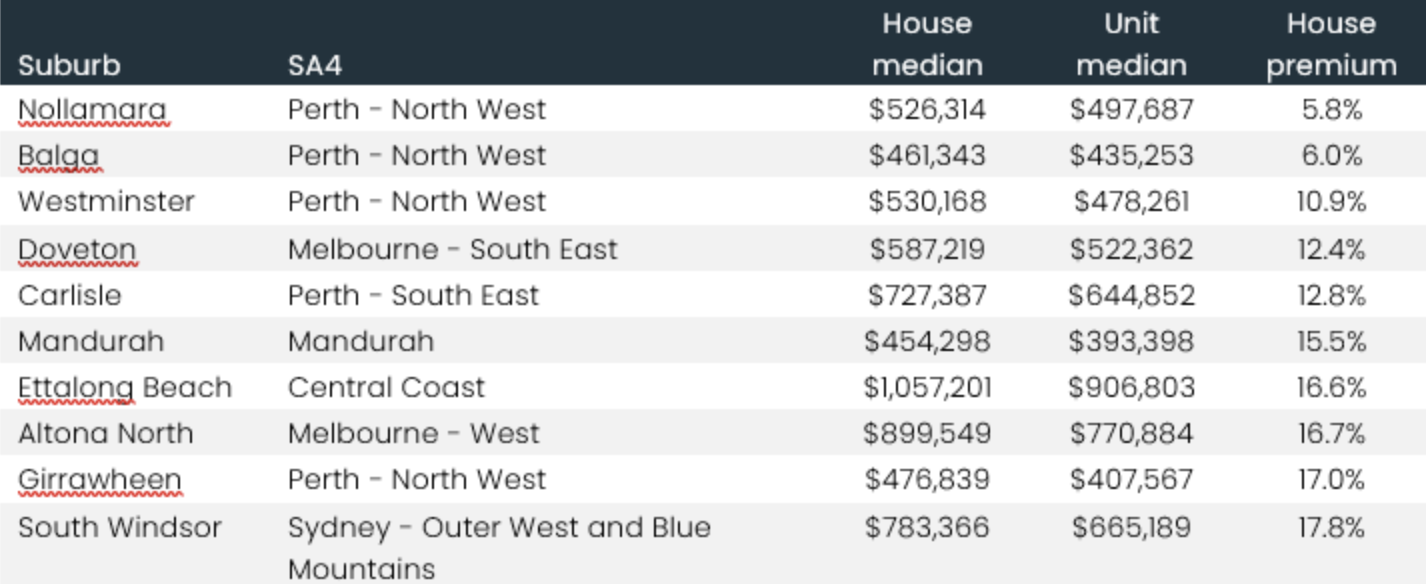

CoreLogic Property Pulse Report has found there has been a growing gap between house and unit dwelling values. As house prices rise more than unit prices, we show which areas have the biggest and smallest price differences.

Factors like land value, scarcity, and the need for more space during the pandemic have caused house prices to increase much more than unit prices in the last four years. Fast forward almost four years later to March 2024, and that premium has jumped to 45.2% or $293,950.

CoreLogic Property Pulse Report author and research director Tim Lawless says houses have historically attracted a price premium over units and have shown a higher rate of capital gain; several factors have led to the accelerated value growth for detached dwellings over recent years.

“The house premium rose sharply through the pandemic upswing as more people sought out space and were more willing and able to live further afield in our cities. While we saw the premium contract through the early part of the rate hiking cycle as house values fell more than unit values, across the combined capitals the gap between house and unit values has since rebounded to a new record high as house values once again rise at a faster pace than units.”

“Over the past 12 months, we see a different picture. While Sydney tops the table again for largest 12-month change in premium followed by Canberra, several cities have seen the premium shrink back a little, including Brisbane and Adelaide. This could be reflective of homebuyers seeking out more affordable housing options, which has diverted more demand towards units”

To read the full report, click on the link below;

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.