Thank You, Ian Cragg, from SEND Payments, for the Market Update.

The AUD experienced a mixed performance this week, as central banks appear to be approaching the end of their hawkish phase. The coming months will be crucial in determining the direction of central bank policies. Market participants anticipate that interest rates will remain elevated for some time before banks adopt a dovish stance once more. This shift towards dovishness is expected to occur by the end of this year at the earliest, depending on various economic factors and indicators that will influence policy decisions in the interim. As these developments unfold, the AUD's trajectory will likely be influenced by global monetary policy shifts and the overall market sentiment.

Let’s dive in for more details.

AUD - USD

The USD experienced a decline against other major currencies on Wednesday, following the release of data indicating slower-than-expected U.S. inflation, which in turn increased the likelihood of the Federal Reserve pausing its interest rate hikes. According to the U.S. Labor Department, April inflation cooled to 4.9% YoY, marking the smallest increase in two years.

Despite this, core inflation remained relatively stable at 5.5%, suggesting that interest rates may need to remain high for some time to curb it. Market sentiment had already been boosted by hopes for a less hawkish Federal Reserve, as U.S. inflation measures also showed a slight easing overnight.

If the central banks of the world's two largest economies adopt a dovish stance later in the year, the outlook for global growth could potentially improve.

Historically, the Australian Dollar has been sensitive to shifts in such sentiments. The dollar rebounded later in the week against the euro and other major currencies after initially sliding due to slowing U.S. inflation. This resurgence was driven by the release of Chinese data, which revealed nearly stagnant consumer inflation last month.

The number of Americans filing new unemployment claims rose to a one-and-a-half-year high last week, highlighting potential weaknesses in the labor market as demand slows. This development could provide the Federal Reserve with the opportunity to halt further interest rate increases next month.

Conversely, U.S. producer prices exhibited a moderate increase last month, showing the smallest annual rise in producer inflation in over two years, further supporting the notion that inflation pressures are easing.

Market participants are likely encouraged by the weak U.S. economic data, continuing to price in aggressive rate cuts by the Fed this year. The AUD/USD currency pair maintains its well-known fluctuating trend, most recently influenced by weak Chinese inflation and credit data.

The Aussie Dollar may find support from additional tightening by the Reserve Bank of Australia (RBA), given how little has been priced in by markets so far. Upcoming wage growth data will play a crucial role in determining the RBA's decision.

Markets currently anticipate the RBA to maintain steady rates at the next meeting in June, with a possible rate hike in August. The AUD lost almost 0.8% of its value against the USD last week and the current market sentiment is to sell the AUD.

AUD - GBP

Sterling experienced a decline of 0.8% to $1.2522, despite trimming losses earlier due to the Bank of England's(BoE) decision to raise interest rates for the 12th consecutive time.

On Thursday, the BoE increased its key interest rate by 25 basis points to 4.5%. Governor Andrew Bailey emphasized that the bank would "stay the course" in its efforts to control the highest inflation rate among major economies.

NatWest strategists pointed out that the absence of any dovish dilution in the BoE's policy guidance leaves room for additional tightening measures. However, they also noted that inflation might ease throughout the year, which could potentially lead to a halt in further rate increases.

In the upcoming week, the focus for GBP will be on UK employment and wage data, as the BoE has indicated that these releases will determine their policy direction in June. With two policymakers already voting to pause rate hikes, wage growth holds the key. BoE Business Survey hints at a potential moderation, but Tuesday's data release will provide more clarity. An unexpected rise in wage growth could boost rate hike probabilities and strengthen GBP, while a decline may support expectations of a BoE pause in June.

The AUD lost almost 0.19% of its value against the GBP last week and the current market sentiment is to sell the AUD for the GBP.

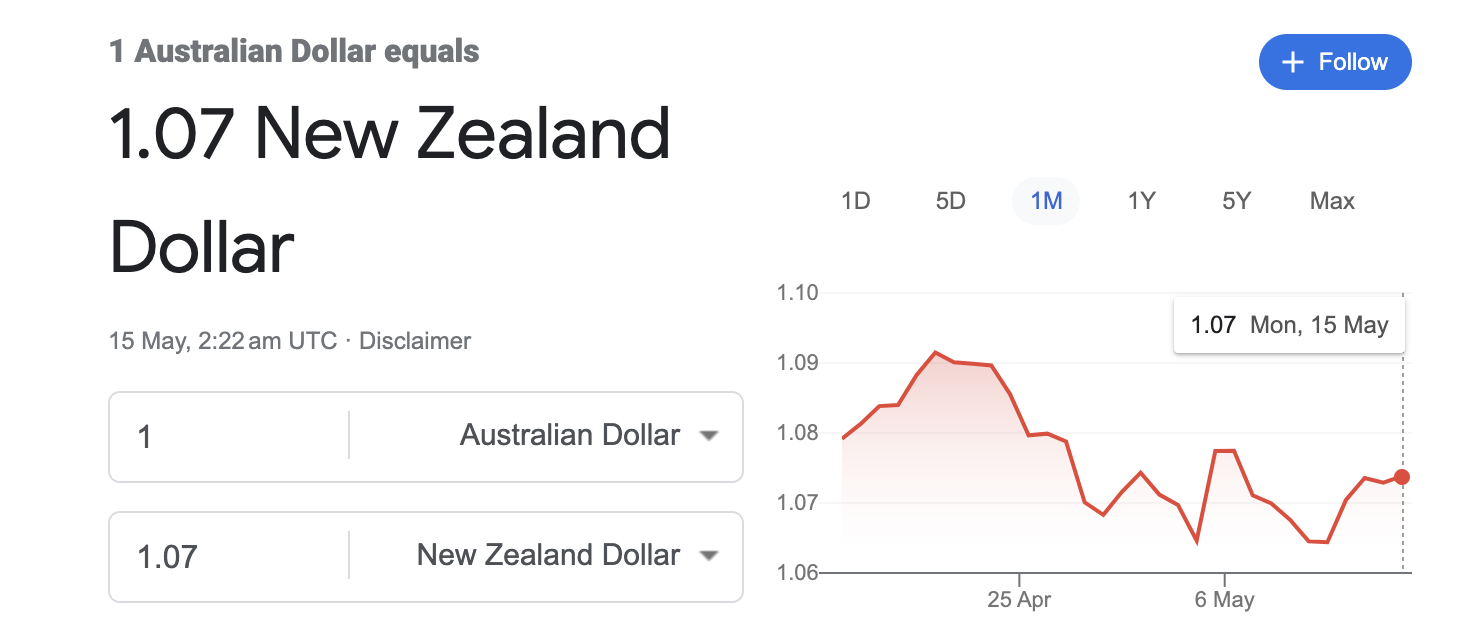

AUD - NZD

The Australian Dollar experienced a slight uptick following the release of Chinese CPI data, which showed a 0.1% YoY increase by the end of April, compared to the predicted 0.3%. This has fueled speculation that the People's Bank of China may expedite plans for economic stimulus. The anticipated post-pandemic revival in China's economic activity has yet to materialize, prompting concerns from both the government and market participants. As a major destination for Australian exports, any measures taken to bolster China's economy could potentially enhance Australia's trade balance, which is currently at record highs. A resurgence in China's economy might also drive demand for industrial metals, such as iron ore and copper.

The Australian and New Zealand dollars maintained their upward trajectory against the U.S. dollar on Thursday, supported by a U.S. inflation report that met expectations and reinforced the belief that U.S. interest rates have reached their peak, with potential rate cuts anticipated later this year.

After sliding down against the NZD all week, the AUD has gained almost all of its lost value over the weekend. The current market sentiment is to sell the AUD.