Send Currency Update with Ian Cragg

The AUD-USD cross has been pressured by the U.S. debt ceiling deadlock, risk aversion, and a resilient U.S. economy supporting the dollar. The AUD-GBP pair also saw the Australian dollar depreciating due to its risk-sensitive nature and higher Bank of England rates supporting the pound. Lastly, the AUD-NZD cross experienced an upward shift for the AUD after the Reserve Bank of New Zealand's dovish rate hike announcement.

Overall, the AUD faces challenges against major currencies, with market dynamics and central bank policies being key factors to watch.

Let’s dive in for more details.

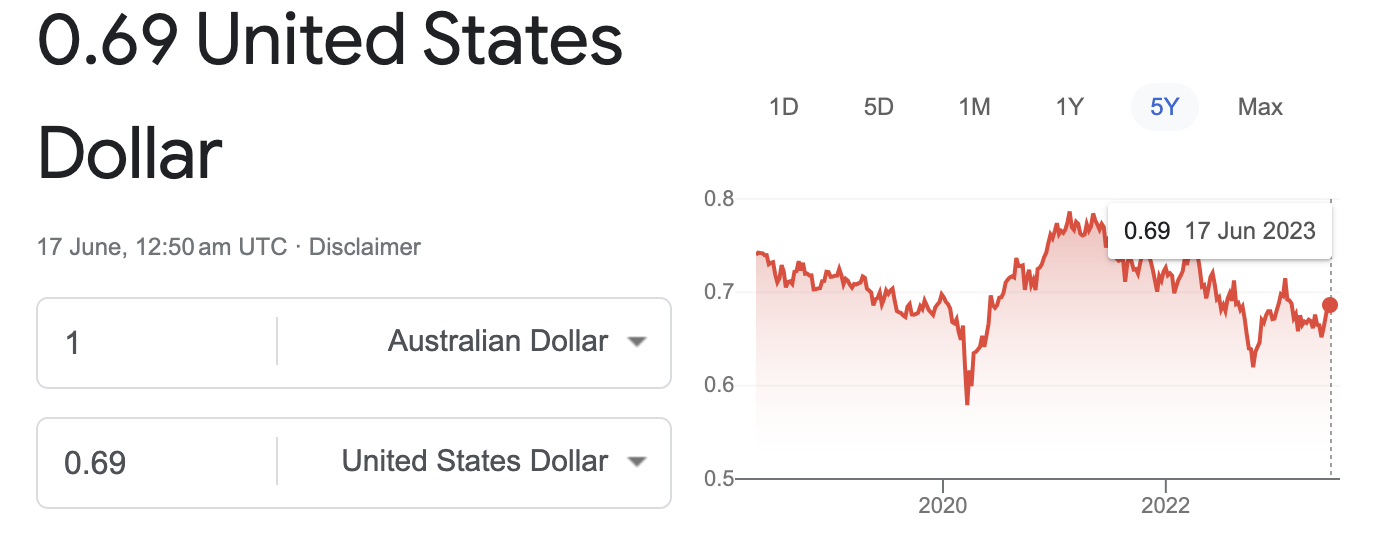

AUD - USD

The AUD-USD cross has experienced a significant downward shift as the Australian dollar weakens to its lowest levels since November, while the USD reaches a two-month high against a basket of major currencies. This depreciation in the AUD can be attributed to the ongoing U.S. debt ceiling deadlock, which raises the risk of default and has triggered a flight to safety in the markets. Risk-sensitive currencies, such as the AUD, have been negatively impacted by this uncertainty.

Despite concerns over the potential consequences of the debt ceiling impasse, recent signs of a robust U.S. economy have bolstered the USD. Analysts maintain that the USD does not pose an immediate risk unlike specific Treasury securities. Market expectations for the Federal Reserve to initiate interest rate cuts have waned due to resilient U.S. economic data, providing the USD an advantage and causing the AUD-USD cross to be further affected.

The Atlanta Federal Reserve Bank's projection of a 2.9% growth rate for the U.S. economy in Q2 signifies continued support for the USD in the forex market. However, UniCredit FX strategist Roberto Mialich points out that global risk aversion and the repricing along the U.S. forward curve are major drivers currently influencing the market. These factors keep the USD in demand and may prevent a complete reversal of the currency's strength, even if a debt ceiling agreement is reached and risk appetite resumes.

As for the possibility of a recession in 2023, current economic indicators suggest it is less likely. The Commerce Department reported that U.S. consumer spending in April exceeded expectations, increasing by 0.8%. This rise in consumer spending, which accounts for over two-thirds of U.S. economic activity, further bolsters the economy's growth prospects for the second quarter.

In contrast to the strengthening USD, the AUD remains under pressure due to the heightened risk aversion in the markets resulting from the U.S. debt ceiling deadlock. Investors are closely monitoring the situation, as any developments could significantly impact the AUD-USD cross and the broader forex market. The AUD lost almost 1.38% of its value against the USD last week, with the market sentiment still favouring selling the AUD.

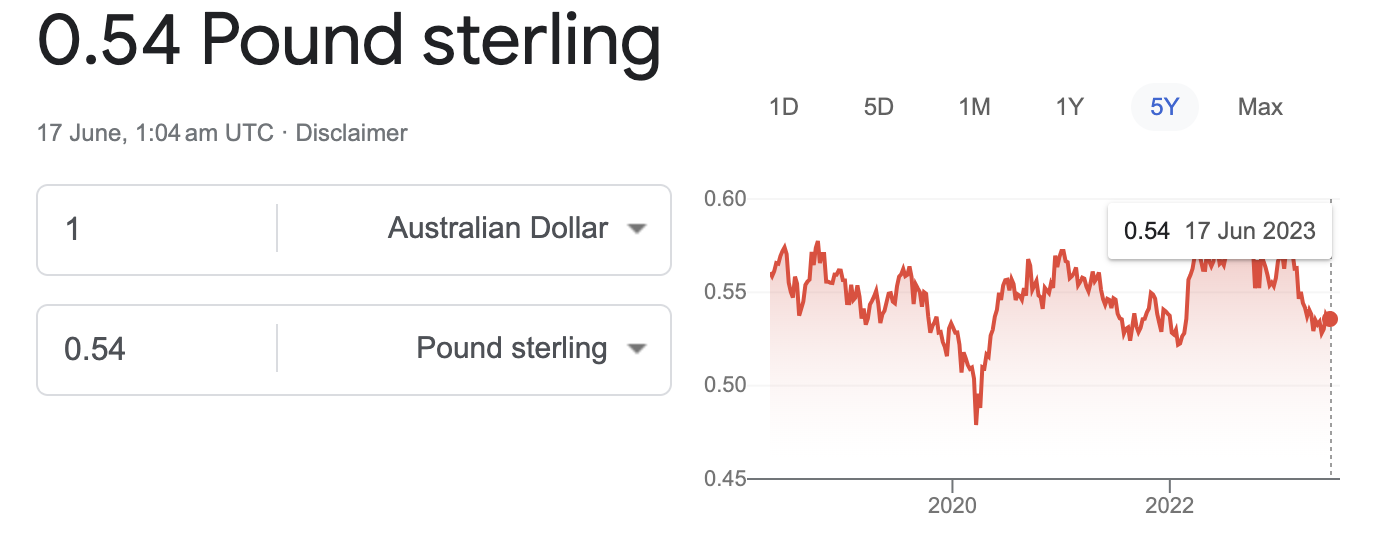

AUD - GBP

The AUD-GBP currency pair has experienced notable fluctuations due to several contributing factors. The Australian dollar has depreciated against the British pound, primarily driven by the risk-sensitive nature of the AUD and the current market environment pushing investors towards safe-haven assets.

In recent months, elevated inflation levels and the prospect of a prolonged period of higher Bank of England (BOE) rates have underpinned the pound's strength. Robust UK macroeconomic momentum, as evidenced by the two-year high in the UK Economic Surprise Index, has further bolstered the currency. Although April's inflation data revealed a more moderate rate than anticipated, the possibility of an additional BOE rate hike next month remains on the table. Nevertheless, the muted market reaction to the GBP suggests that much of this positive outlook may already be factored into its valuation.

The sterling appreciated by 0.3% following data release indicating increased consumer spending in April. Retail sales figures for April demonstrated a rebound from the 1.2% decline in March, with sales volumes rising by 0.8% in the three months leading up to April 2023 – the highest rate since August 2021.

The AUD's depreciation against the GBP can also be attributed to the interest rate differential between the two currencies. As investors seek refuge in safe-haven assets like the GBP, which boasts higher interest rates and relative stability, the AUD experiences downward pressure within the AUD-GBP currency pair. Moving forward, market participants should closely monitor these dynamics and their potential impact on the cross.

The AUD lost 1.1% of its value against the GBP this week, with the market leaning towards selling the AUD.

AUD - NZD

The Australian dollar has been depreciating, reaching its weakest levels since November due to the U.S. debt ceiling deadlock, which raises the risk of default and has triggered a flight to safety in the markets. Risk-sensitive currencies like the AUD have suffered as a result. Compounding these issues, signs of an unstable economic recovery in China, Australia's largest trading partner, and softening domestic economic data have further weighed on the aussie.

The recent slide in the Australian dollar has caught bulls off guard, with T.D. Securities potentially facing a 2.37% loss on its long position, according to Mark McCormick, global head of F.X. and E.M. Strategy at T.D. Securities. McCormick attributes this shift in market dynamics to the collapse of China data surprises, recovery in U.S. data, and the repricing of the Fed and global growth expectations.

Domestically, weakening economic data has led to speculation that the Reserve Bank of Australia (RBA) may pause its interest rate hikes next month. Recent data showed that manufacturing activity in Australia remained contractionary in May, while services activity slowed. Additionally, the country's unemployment rate unexpectedly increased to 3.7% in April, defying market forecasts for no change at 3.5%.

In contrast, the New Zealand dollar and local yields slumped after the Reserve Bank of New Zealand (RBNZ) delivered a dovish rate hike and signaled that further increases are essentially done. This unexpected move sent the Australian dollar climbing against the kiwi. The RBNZ raised interest rates by 25 basis points to 5.5% and anticipates rate cuts beginning in the third quarter of next year.

Currency strategists believe the AUD may set a new year-to-date low, with Commonwealth Bank of Australia's Carol Kong expecting more negative Australia-U.S. interest rate differentials and China's disappointing economic growth to further weigh on the AUD-USD cross.

Both the Australian and New Zealand dollars are headed for heavy weekly losses after hitting six-month lows due to a disappointing China recovery, the U.S. debt ceiling impasse, and hawkish Federal Reserve pricing bolstering the dollar. Kong explains that weak near-term data for China will continue to point to a soft consumption recovery, adding another weight to the Australian dollar, which is often used as a liquid proxy for the Chinese yuan.

The AUD gained almost 2% against the NZD this week and the market sentiment is set to buy AUD. This sentiment is likely to stay for a while.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.