Newsletter - Sharon Calderini, Financial Planning Specialist, joins TE Team, Congrats Adam. Property, Stock, Currency, YouTube, Podcasts Updates and more

Firstly, we are excited and proud to announce Sharon Calderini has joined THE EXPATRIATE (TE) Team. Sharon is our Middle East and UK Financial Planning Specialist. She has a wealth of knowledge and experience in providing expert financial advice for 16 years, joining St James’s Place in 2011. If you are based in the UK or UAE, we highly recommend reaching out to Sharon.

If you missed it on socials, the Founder of TE, Director of Australian Expatriate Finance flew down to Sydney last week for the finals of the NAB Australian Broker of the Year Awards.

Adam was nominated as a finalist for “Thought Leader of the Year” for his creation of TE. Congratulations Adam!

In this newsletter, you will find links to the following. reports;

CoreLogic 1st August HVI

How to buy the right investment property in Melbourne?

Stanford Brown SB Talks Podcast

Stanford Brown Market Monthly Report

Send Currency Update

Adam from the Australian Expatriate Finance blog on how banks access risk for Australian Expats answers the question. “How much can I borrow?”

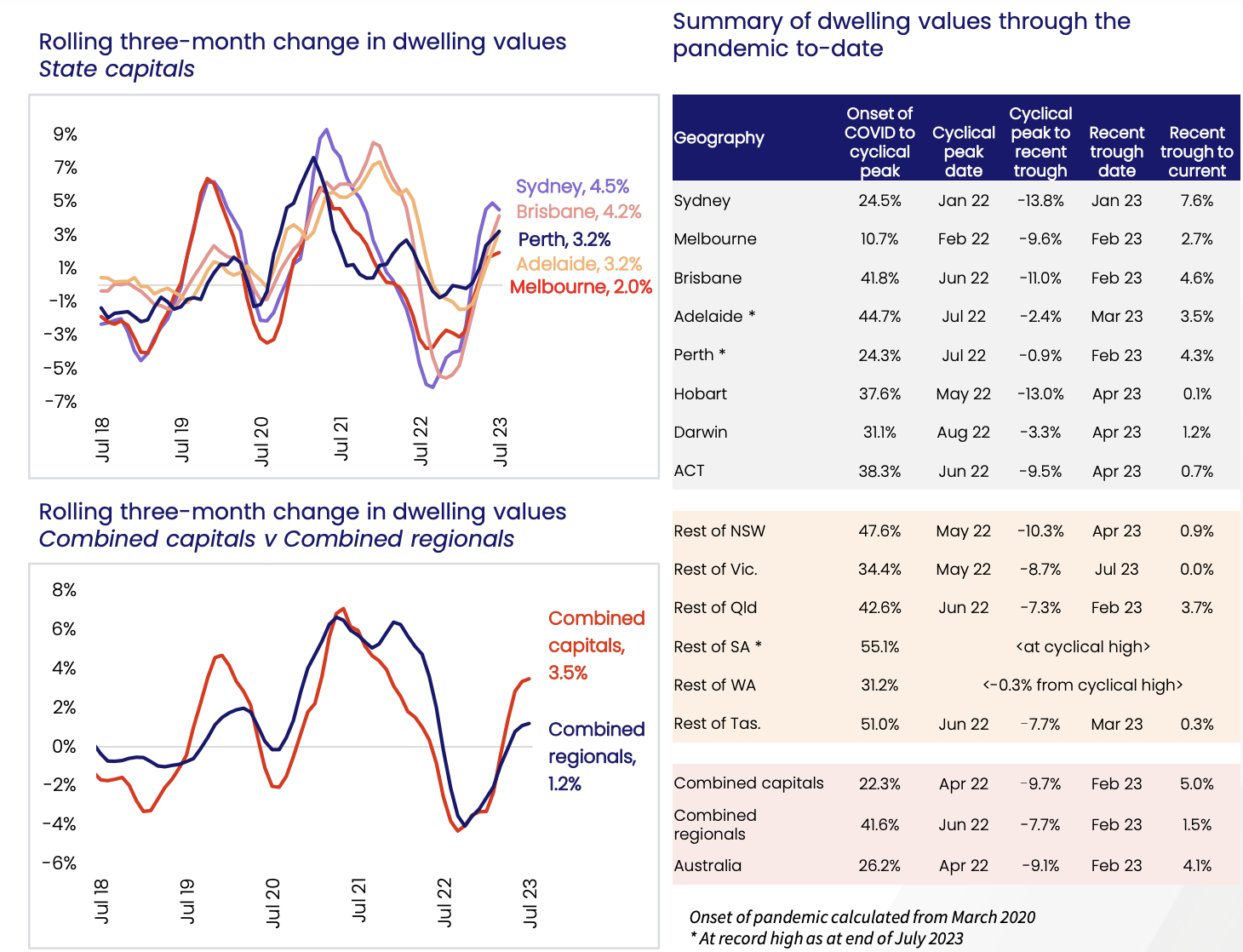

Australians love property! CoreLogic Monthly Home Value Index (HVI) Report is a fantastic guide to help you make informed, emotion-free choices when looking for an Australian Property.

In the latest report from 1st August, CoreLogic Research Director, Tim Lawless, noted the most substantial reduction in growth has occurred in Sydney.

“After leading the upswing, the monthly pace of growth in Sydney housing values has halved from a recent high of 1.8% in May to 0.9% in July. Sydney has also seen a significant rise in the number of fresh listings added to the market, 9.9% higher than the same time last year and 18.0% above the previous five-year average. An increased flow of new listings provides more choice and may be working to reduce some of the urgency felt among prospective buyers,” he said.

Leading the way for July were Adelaide and Brisbane, both recording an increase in HVI +1.4%. Perth was strong for the month with a 1.0% increase, as was Regional SA, with 1.1% growth and is experiencing its cynical high. Sydney and Brisbane have experienced the most robust growth for the quarter, recording 4.5% and 4.2%, respectively. The softest markets were Canberra, -0.1 for the month and 0.7% for the quarter and Hobart, 0.0% for the month and 0.1% for the quarter.

Regions are also experiencing an easing in HVI as new listings are rising. The nation experienced its 5th consecutive growth month in July 31st, with dwelling prices increasing nationally by +0.7%, Cities recording +0.8%, and regional growth slowing to+0.2%.

Tim’s Key Take Aways

Overall, the housing market remains resilient to a double-dip downturn

The trend in advertised stock levels will be a key factor determining housing market outcomes.

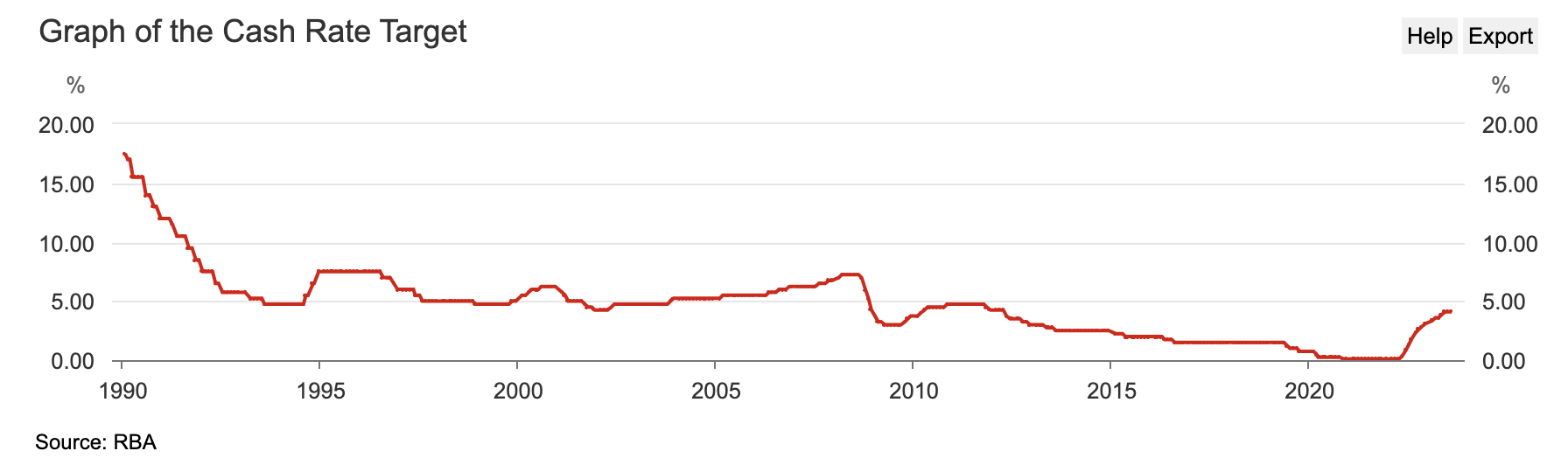

On the demand side, there is evidence that buyers have become more active despite the highest interest rates since 2012 and sentiment levels holding around GFC lows.

With inflation coming in lower than expected for the June quarter, it’s looking increasingly likely the interest rate cycle is at or near a peak.

Even with interest rates potentially stabilising, borrowers aren’t yet out of the woods. The coming months will see more borrowers experience the full extent of rate hikes as variable rates follow the cash rate with a lag. Also, the transition of more than 800,000 home loans from very low fixed mortgage rates to variable rates at around 6% or higher is currently moving through a peak.

Although the rate hiking cycle is topping out, interest rates aren’t likely to reduce any time soon. Most forecasters don’t see the cash rate coming down until the second half of next year.

But a significant rise in mortgage defaults is unlikely considering the outlook for labour markets.

Housing demand from strong population growth is set to remain a feature over the coming years, and we are yet to see any material supply response.

Source - CoreLogic Australia 1st August HVI.

2. How to buy the right investment property in Melbourne?

Lauren Staley, THE EXPATRIATE Property Specialist in Melbourne, sits down with infolio Property Advisors North West Melbourne and Geelong Specialist Tristian Utting to discuss what key attributes a property must have for them to purchase in the Melbourne, Geelong and Deep Bayside Areas.

“When purchasing for an investor, it is not dissimilar to an owner occupier, except the emotion is removed. Location, floor plan, orientation, and development within the area are key things he’d look for.” Says Tristian.

Why is yield important? Asks Lauren.

“Interest rates and land tax increases mean good yields are important to an investor.” Says Lauren. She then asks Tristian how he decides where to purchase a property to achieve a yield that will support the ongoing costs.

3. Stanford Brown SB Talks Podcast

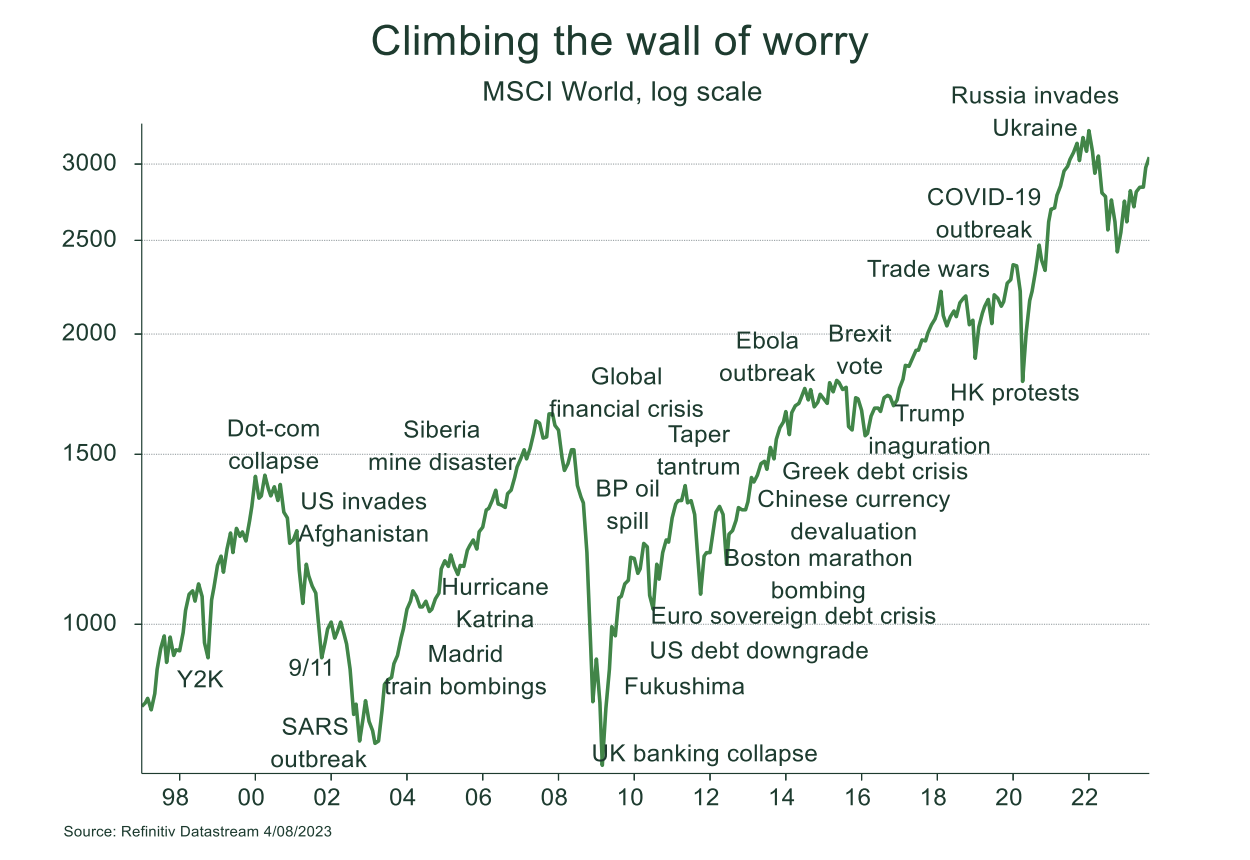

Investment Market gurus from Stanford Brown (SB) CEO Vincent O’Neill and Chief Investment Officer (CIO) Nick Ryder explore the important elements of your financial world with our community. You can catch the YouTube Movie Podcast Links here.

The 16-minute Podcast/YouTube video they discuss:

Why the RBA’s latest rate pause might give hope that inflation is waning

Services and rent are the biggest drivers of inflation

The divergence between cashed-up and stressed homeowners

Why Europe’s inflation remains sticky

Japan’s increased flexibility surrounding bond yield caps

US earnings reporting season

4.Stanford Brown Market Monthly Report

If you need to know more, Stanford Brown also shared their Monthly Investment Markets Report for July 2023.

This month, Nick tackles some of the most pressing questions for longer-term investors:

What happened over the month

Performance of major financial markets

Current investment outlook and portfolio positioning

Views on major asset classes

Current portfolios allocations

5.Send Currency Update

International Currency Specialist Ian Cragg from Send Payments, has been working hard and keeping us in the loop on how the Australian Dollar is fairing against U$D, EURO, Pound Sterling and NZD. To read his latest report from Monday 14th of August and says;

“The AUD has faced downward pressure against different currencies, impacted by factors such as safe-haven demand, economic data, risk aversion, and monetary policy outlook. This situation is not likely to improve anytime soon, which means that AUD is likely to remain weak for the time being.

Let’s dive in for more details.”

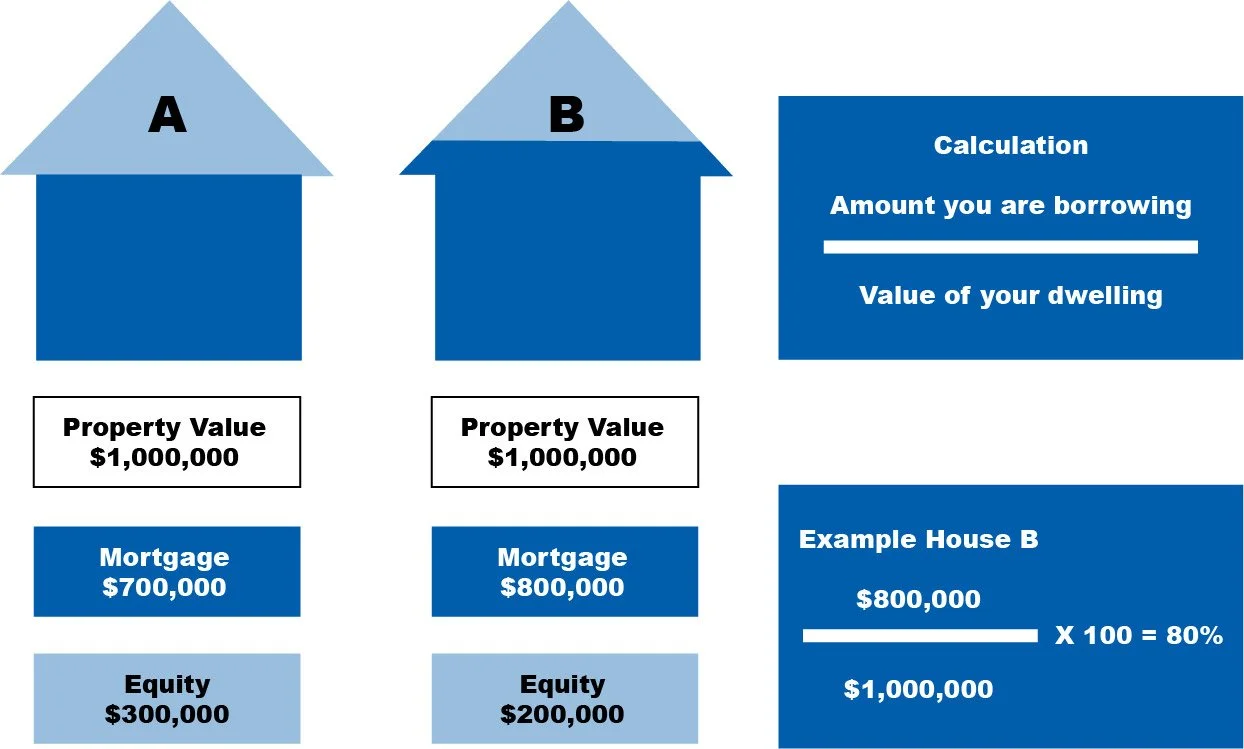

6. “How much can I borrow?”

“How much can I borrow?” This is the million-dollar question prospective Australian Expat Home buyers ask a mortgage broker when purchasing a new property.

Australian Expats are accessed differently than Non-expats when applying for a property loan. There may only be a few lenders who will accept the currency your salary is paid in. Therefore, choosing the right lender is essential for a successful loan application.

In a nutshell, banks or lenders have a five-point checklist for Australian Expats wanting to purchase property in Australia. This checklist needs to be met before a lender will finance your mortgage. They are;

Income types

Loan to Value Ratios

Currency factoring

Application of tax

Interest rates and buffers

Source - Australian Expat Finance “How much can I borrow?” Blog written by Adam Kingston

We look forward to informing you of the latest news that impacts Australian Expats. Stay tuned for an upcoming announcement of our next events in London, Dubai and Abu Dhabi.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.