Newsletter 25 - StanfordBrown Quarterly , SB Podcast, CoreLogic HVI, Your Empire Market YouTube Update, How a Card caught a thief, and more.

First up our Australian Based finance specialist Ashley Owen, Chief Investment Officer from Stanford Brown, has shared the SB February 2023 Quarterly Market Review of Investment Markets and the SB Portfolio Changes with us.

Key Points from the Stanford Brown Quarterly Review are as follows:

Inflation – has it peaked? Why is inflation falling in the US but not in Australia?

Interest rates – how much further will they rise?

Share markets point to good times ahead, but bond markets point to recessions – which is right?

How are we positioning portfolios for both outcomes?

Summary of major risks for investors - some have deteriorated, but some have improved

Portfolio returns to January 2023

Two new funds that are being added to portfolios.

To read the full report, click on the button below.

If you’d like something to listen too when out on a walk or driving to work the team at Stanford Brown (SB) has shared the latest edition of our SB Talks podcast. The podcast explores the important elements of your financial world – investments to strategy, retirement planning, and intergenerational wealth.

In the February edition of SB Talks, Stanford Brown CEO Vincent O'Neill speaks with Chief Investment Officer Ashley

In the February edition of SB Talks, Stanford Brown CEO Vincent O'Neill speaks with Chief Investment Officer Ashley Owen.

We discuss:

Has inflation peaked? – why Australia is different?

How many more rate hikes this year?

What will cause economic slowdowns, and where will it start?

Why we prefer Australian over international shares?

Why we prefer ‘floating rate’ over ‘fixed rate’ bonds?

What is the difference, and why is it important?

Where are the opportunities, and what to avoid?

Chris Gray from Your Empire Sydney, Lauren Staley from Infolio Property Melbourne, and Zoran Solano from Hot Property Buyers Agency Brisbane shared their February 2023 Property Market Report.

10 Key Points

Buyers are researching now and getting ready to buy from March onwards across all states.

Brisbane recorded a record price for a new build in the suburb Kedron - Always markets within markets.

Brisbane - The best opportunity is to buy an unrenovated property and be prepared to renovate it.

Lack of good quality Blue Clip Stock on the market

Softest Market in 10-20 years in Melbourne

Run Your Own Race and buy when you have the money. When buying and selling in the same market, timing is irrelevant.

All agents recorded a tight rental market with less than -1% Vacancy rates.

Tenants willing to accept rental increases

Landlords are prepared to terminate leases to achieve $200-$300 rent increases.

Reserve Bank Australia's (RBA) interest is predicted to reach around 3.5-4%.

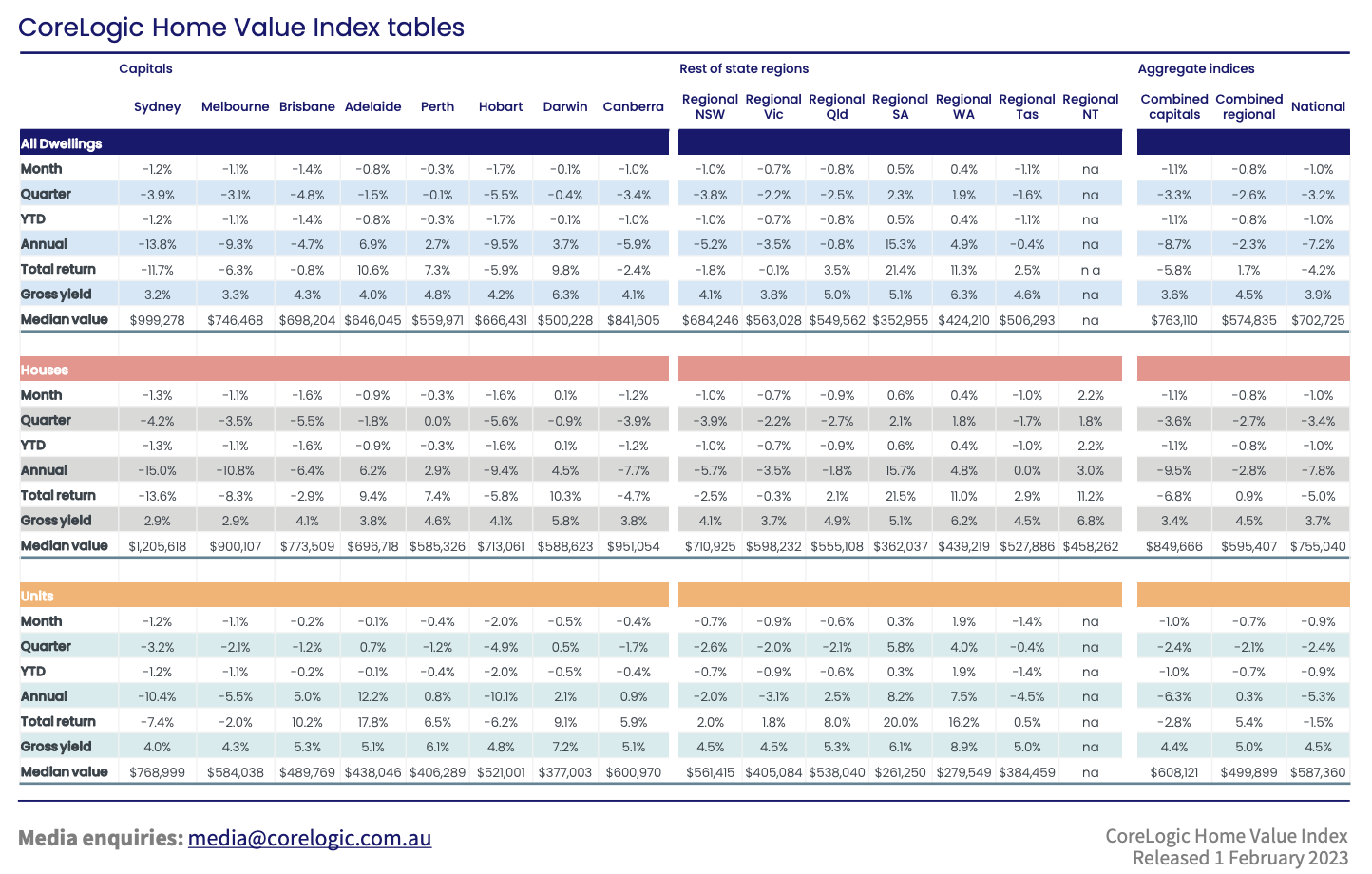

Tim Lawless, Executive, Research Director, Asia-Pacific CoreLogic Australia, has shared the Home Value Index (HVI) report for January 2023.

HVI recorded its lowest fall in property prices since June 2022. The national HVI average recorded was -1.0% for January 2023.

“The quarterly trend in housing values is clearly pointing to a reduction

in the pace of decline across most regions, however at -1.0% over the

month and -3.2% over the rolling quarter, national housing values are

still falling quite rapidly compared to previous downturns”

— Tim Lawless - CoreLogic Australia

The Reserve Bank of Australia (RBA) met on the 8th of February 2023 to determine the Cash Rate for unsecured overnight loans for banks which impact the interest rates that are passed onto the mortgage home loans for Australians.

Adam has written about his personal experience of how the “Real-Time” Recording and information of the Revolut Card helped the police in Brisbane, Queensland, Australia, catch a thief in less than 24 hours. If you’d like to read his blog explaining his willingness to embrace technology with home monitoring cameras and the latest tech in card security, click on the link below.

We wish Adam Kingston from Australian Expatriate Finance the best of luck at The Adviser Better Business Awards which is on this coming Thursday night. Adam has been nominated for two following categories ;

Thought Leader

Best Community Engagement, for the creation of THE EXPATRIATE

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.