CoreLogic HVI, Stanford Brown Monthly, Anti-Aging Research and Investment - Why should we pay attention? What’s new in Visas for 2024? Send Currency Update.

It’s always an eventful start to the month, with the reports from November flowing in from Corelogic Australia, Your Empire Property Market Update, Stanford Brown Monthly Report and Podcast, Reducing your Bio-Age with Chi Longevity, Claymore Thistle update on the Visa Announcements, and Send Payments Currency Updates. First, let’s head to the Australian Property Market with the CoreLogic Australia HVI RP Data.

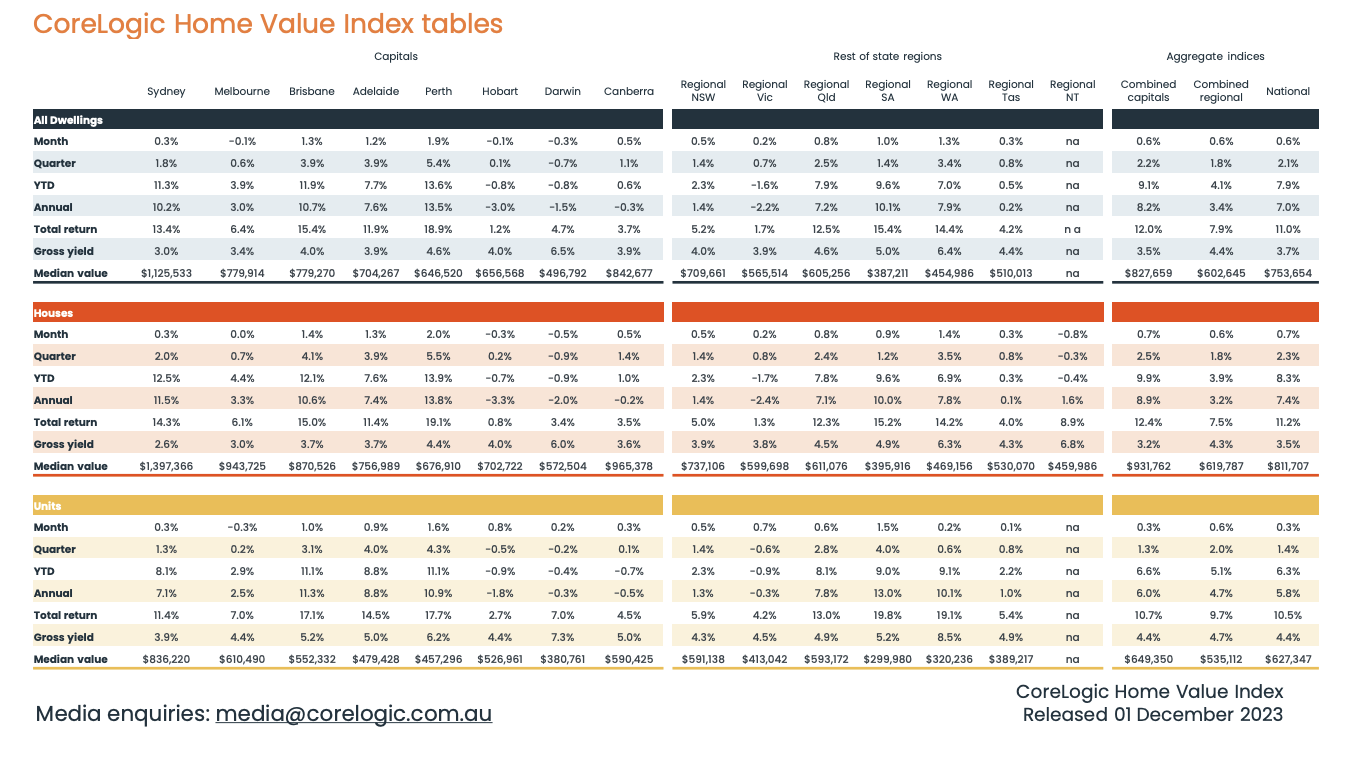

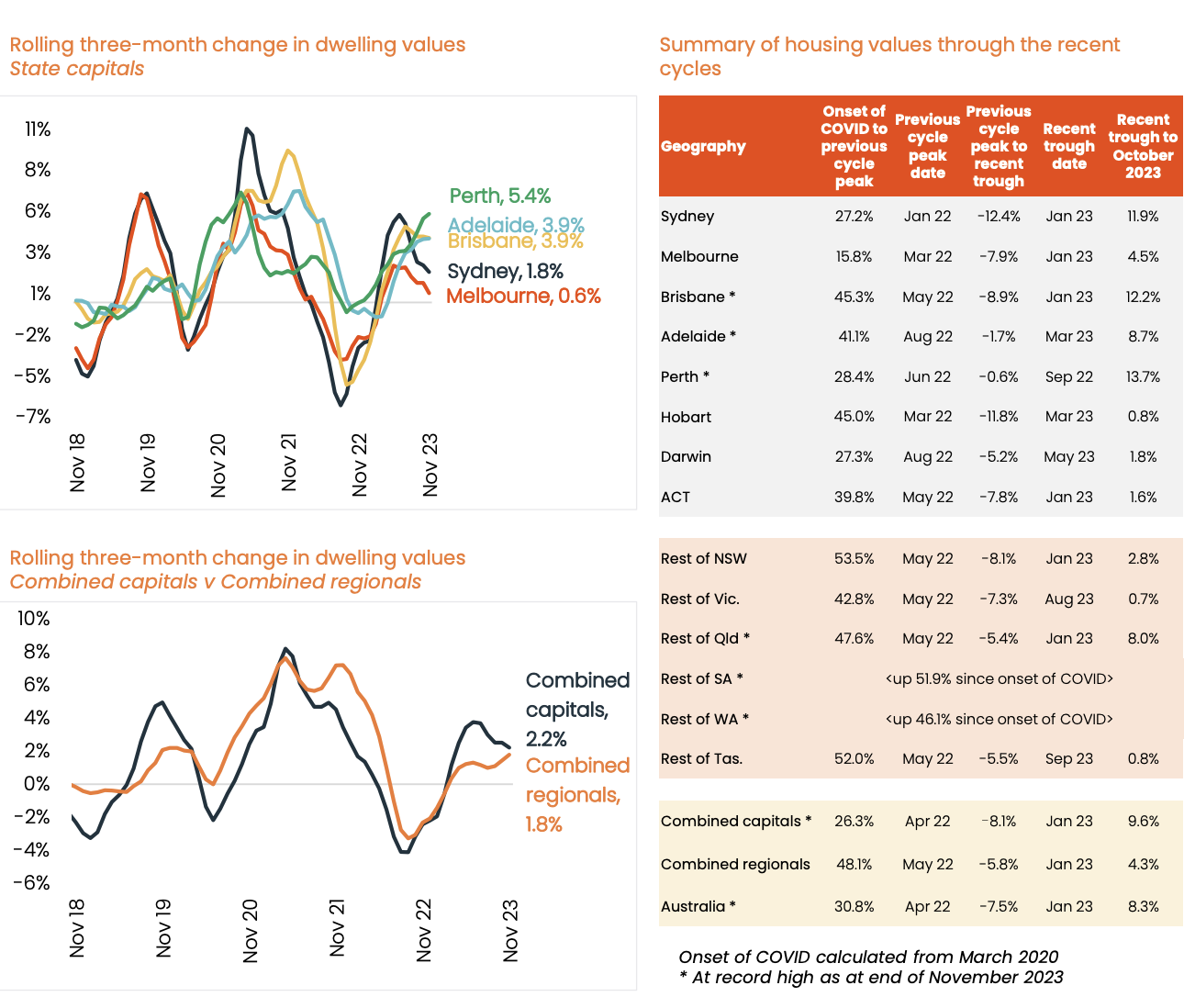

Despite the Australian economic slowdown, house prices in the country reached a new record high in November. After dropping by 7.5% from the highest point in April 2022 to the lowest in January 2023, National home values have increased by 8.3% over the past ten months, showing an apparent recovery. While the overall trends have slowed down, different cities are experiencing varying conditions. In Melbourne and Hobart, house prices declined by 0.1%, while in Darwin, prices decreased by 0.3%. Sydney also saw a significant slowdown in house price growth, with an increase of only 0.3%, the smallest gain in the recovery period. The upper quartile experienced the biggest slowdown in growth, which impacted the Melbourne and Sydney markets.

“This imbalance between available supply and demonstrated demand is keeping strong upwards pressure on housing values across these markets, despite the downside factors leading to weaker housing market conditions across the lower eastern seaboard,

The Melbourne Cup day rate hike has clearly taken some heat out of the market, but other factors like rising advertised stock levels, worsening affordability and persistently low consumer sentiment are also acting as a drag on value growth in some markets,” Mr Lawless said.

Tim Lawless , Head of Research Asia/Pacific

Rolling 3-month data Capital Cities

Sydney Trough -12.4% Recovery +11.9%

Melbourne Trough -7.9% Recovery 4.5%

Brisbane Trough -8.9% Recovery +12.2% Record High

Adelaide Trough -1.7% Recovery 8.7% Record High

Perth Trough -0.6% Recovery +13.7% Record High

Hobart Trough -11.8% Recovery +0.8%

Darwin Trough -5.2% Recovery +1.8%

ACT Trough -7.8% Recovery 1.6%

Regional Areas

NSW Trough -8.1% Recovery +2.8%

VIC Trough -7.3% Recovery +0.7%

QLD Trough -5.4% Recovery +8.0%

SA +51.9% Record High

WA +46.1% Record High

TAS Trough -5.5% Recovery 0.8%

To read our key takeaways and to access the link to the full report click on the link below

Your Empire Last Property Update for 2023.

The Expatriate property gurus, Chris Gray from Your Empire Sydney, Lauren Staley from Infolio Property Advisors Melbourne, and Zoran Solano from Hot Property Buyers Agency Brisbane gathered to discuss the real estate market and to offer their key insights and tips for you now and into 2024 on a YouTube Video and discuss how to read the CoreLogic Data. One of their key takeaways is that property in Australia can not be compared equally, Blue Chip Suburbs with facilities and infrastructure V areas where there is mass development. Press play to learn more;

Stanford Brown Monthly

Thanks, Nick Ryder, Chief Investment Officer (CIO) from Stanford Brown, for sharing their latest update. The update aims to help investors cut through all the media noise and hype and understand what is really driving investment markets and portfolio returns.

This month, the SB Team tackled some of the most pressing questions for longer-term investors:

What happened over the month

Performance of major financial markets

Current investment outlook and portfolio positioning

Views on major asset classes

Current portfolios allocations

To read the full report, click on the link below.

This week, Stanford Brown CEO Vincent O'Neill meets once again with CIO Nick Ryder to discuss:

The RBA's recent pause post-rate hike

The rollercoaster of US bond yields

Santa Rally: what it is and what it means for investors

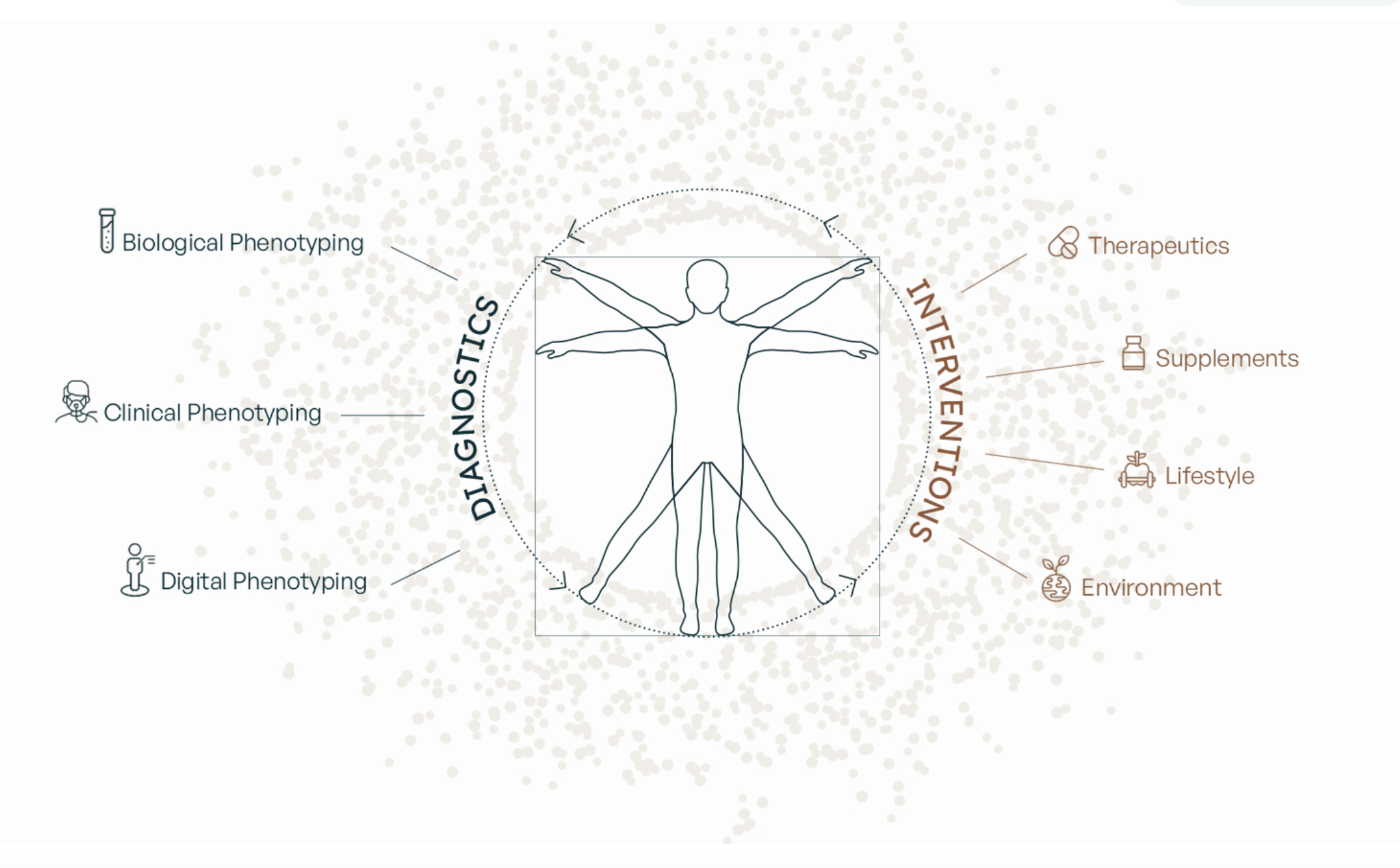

Anti-Aging Research and Investment - Why should we pay attention?

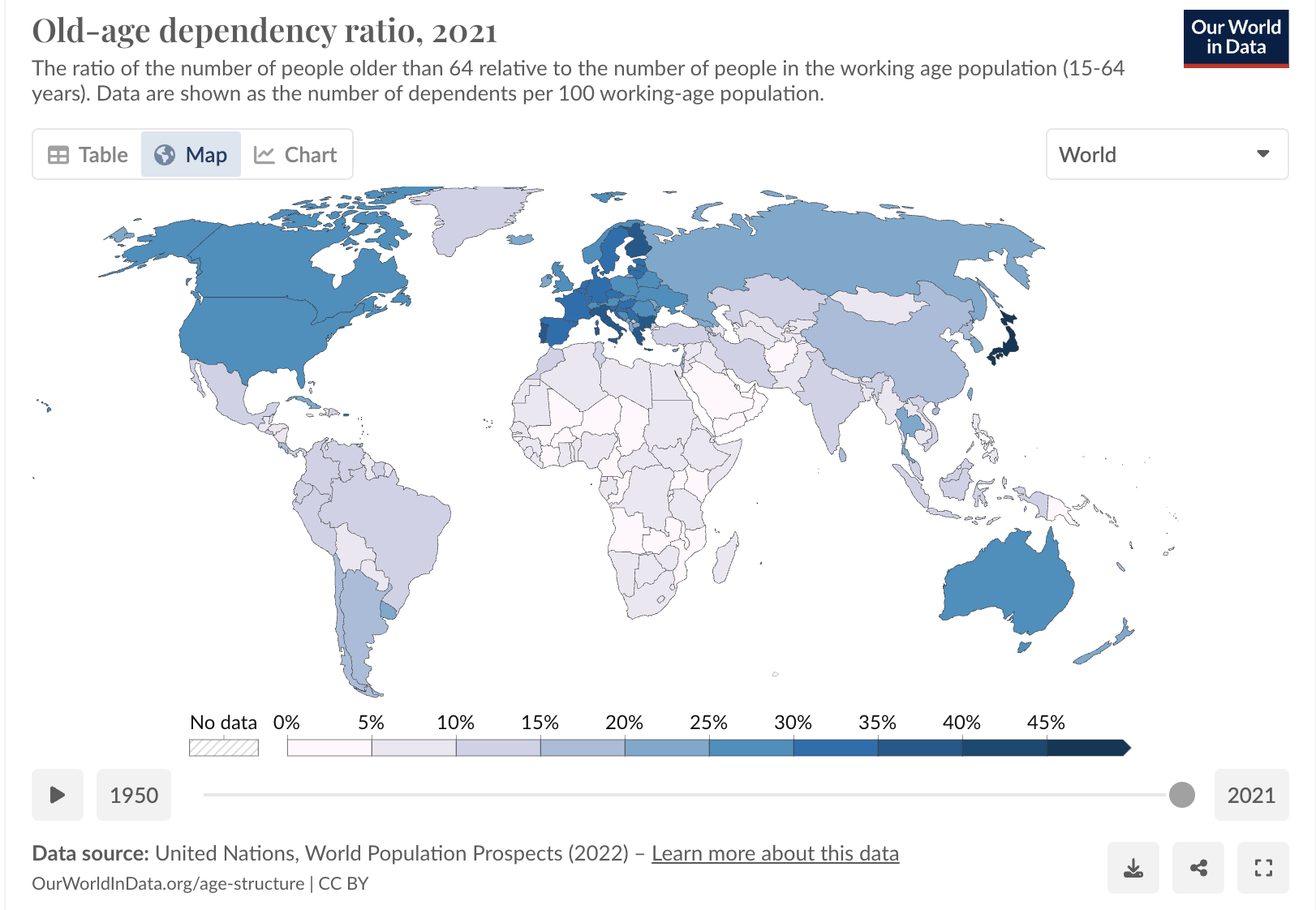

The World Health Organisation (WHO ) and the United Nations (UN) have dedicated 2021-2031 to healthy aging. Governments are getting behind the anti-aging projects, seeing the extended-term economic benefits and investing in preventing age-related diseases. Both private and public sectors agree that this is a huge issue that needs to be addressed globally.

Chi Longevity is a breakthrough anti-aging medical company dedicated to improving people's bio-ages globally by preventing age-related diseases. Headed by leading research scientist, “Women of Power” Woman of the Year 2023, and founder Prof. Andrea Maier, the company has grown from a science-backed research foundation to enhance its clients' vitality. It is now working with the Singapore government, opening the world's first public sector longevity clinic.

To learn more click on the link below;

What’s new with Australian visas in 2024? Luckily, Leona Lees from Claymore Thistle is checking the details for us. With the recent update to the Visa Policy, it is essential to understand the technical ins and outs of the Australian Migration system. Here are some key insights that we think will be beneficial for you.

Migration plans for 2024 and the impact on Australia’s housing market.

The Australian Government released the Migration Strategy on 11 December 2023. It includes significant changes to Australia's migration system to meet the country's future needs and benefit its people, businesses, governments, and migrants. Migrants are an essential part of Australia's economy and society. Currently, over half of all Australians were either born overseas or have a parent who was. The Migration Strategy highlights five main goals for Australia's migration system. The Government plans to implement eight actions to achieve these goals, along with over 25 new policy commitments and existing commitments.

“The reforms focus on:

targeted skilled migration and new streamlined pathways for top global talent

higher standards for international students and education providers to drive quality in international education

visa settings to tackle worker exploitation and protect wages and conditions, Temporary Skilled Migration Income Threshold (TSMIT) from $53,900 to $70,000 from July 1.

support for regional Australia to get fast access to skilled workers

a new approach to migration planning to help return migration to pre-pandemic levels and get the right skills in the right places.”

Source - https://immi.homeaffairs.gov.au/news-media/archive/article?itemId=1153

Let’s look at the numbers.

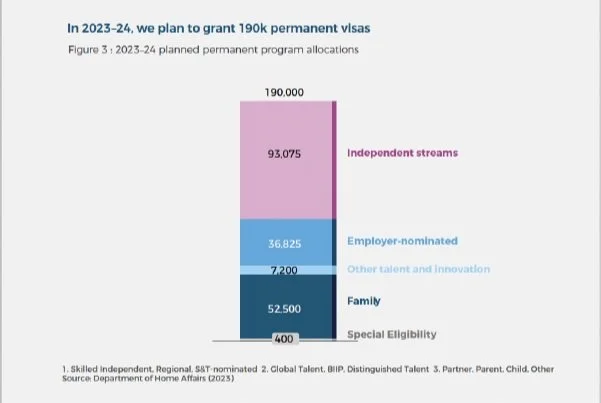

Earlier this year, the Australian government announced that the 2023/2024 permanent Migration Program planning will be set at 190,000 places. Compared to the total of 195,000 places allocated for the 2022/2023 period.

The Migration Program addresses skills shortages in the local workforce by attracting workers with specialist skill sets. The program builds resilience, boosts productivity and supports the local economy. To learn more, read our full blog with helpful links.

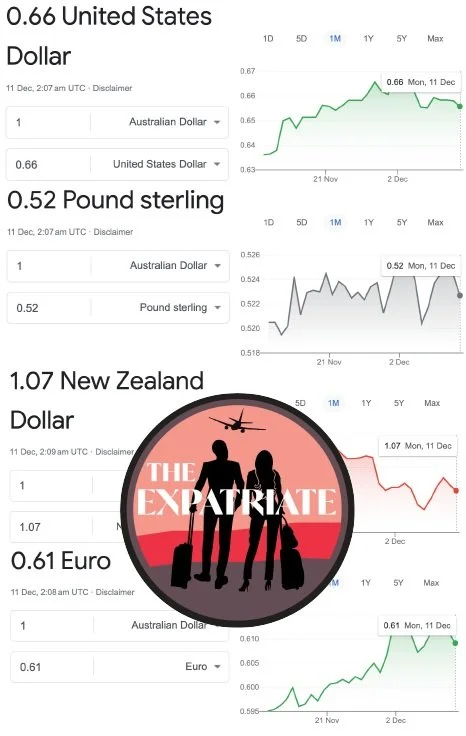

Send Payments currency update on 11 December 2023- AUD/USD Pair – Market Analysis.

AUD/USD rates hit 4-month highs last Monday prior to the RBA interest rate. The increase was mainly due to an increase in gold pricing and risk-on market sentiment, though this was short-lived after the RBA announced interest rates would hold at 4.35%.

The AUD/USD pair has since dipped below the 0.6600 barrier, down 1.6% from last week’s high. Positive US Nonfarm Payrolls data released over the weekend lifted the US Treasury bond yields and the US Dollar.

At the time of writing, the market is trading around the key support level of 0.6580. If maintained, the next target for the pair is 0.6655, December’s peak so far. On the downside, below 0.6580, the pair might find support at 0.6525 ahead of 0.6511.

Recent data from the US indicated an increase in jobless claims, suggesting a potential loosening in the US labour market. This has fuelled speculation that the Federal Reserve might consider rate cuts starting in March.

Things to look out for this week;

Tuesday 12th December - Reserve Bank of Australia Speaks

Tuesday 12th December - GBP; Claimant Count Charge

Wednesday 13th Dec - USD Change in Price of goods and services (CPI y/y)

Thursday 14th Dec - Unemployment rate (AUD)

Thursday 14th Dec - Federal Reserve Bank Funds Rate (USD)

Thursday 14th Dec - Bank of England - Official Bank Rate

Friday 15th Dec - European Central Bank - Main Refinancing Rate

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.