Tax Depreciation Case Study: A new Townhouse purchased for $890,000

The BMT Tax Depreciation and Quantity Surveyors specialist, Bradley Beer, shared an insightful case study with us, shedding light on the advantages of obtaining a comprehensive tax depreciation schedule for your investment property. This study offers valuable insights that can enhance your understanding of the benefits associated with this strategic financial approach.

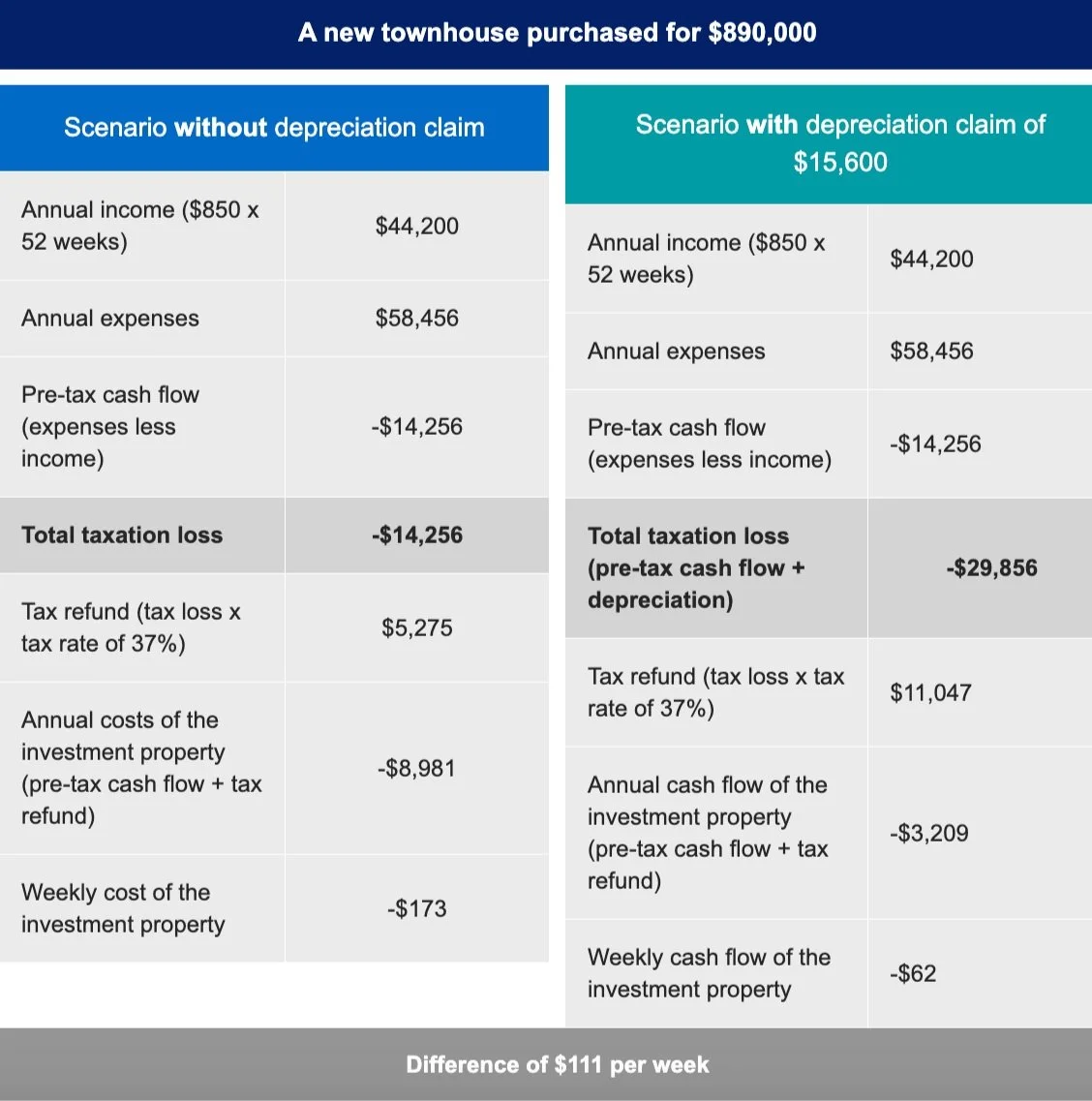

The figures:

John owns a new four-bedroom, two-bathroom townhouse in an inner-city suburb.

He rents the property for $850 per week or $44,200 annually.

Property expenses, including interest, rates, management fees and maintenance costs, totalled $58,456 for the first full financial year.

John was experiencing a cash flow issue and contacted his Accountant, who advised him of his ability to claim depreciation deductions. He also suggested John consider a Pay As You Go (PAYG) withholding variation. John’s Accountant contacted BMT Tax Depreciation to organise his client’s tax depreciation schedule to assist with his claim.

The following tables compare John’s cash flow “without” and “with” a depreciation claim of $15,600.

Before claiming depreciation, John experienced a loss of $173 per week for the first year of ownership of his property. Simply by claiming depreciation, John could turn his cash flow into a more positive one and reduce his loss to a much more manageable $62 per week. With the help of his Accountant, John employed the PAYG withholding variation to reduce the tax applied to his weekly wage, ultimately leading to an improvement in his cash flow situation.

If you’d like to learn more, click on the link below and read about more case studies and information blogs on our website.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.