What Does the Latest Property Uptick Mean for Australian Expats?

The August 2025 Cotality HVI shows a re-acceleration in Australia’s housing market, marking a potential turning point after months of modest growth. For Australian expats, this shift presents both opportunities and challenges.

Cotality’s August Home Value Index (HVI) has been released with all the latest must-know property market metrics, including:

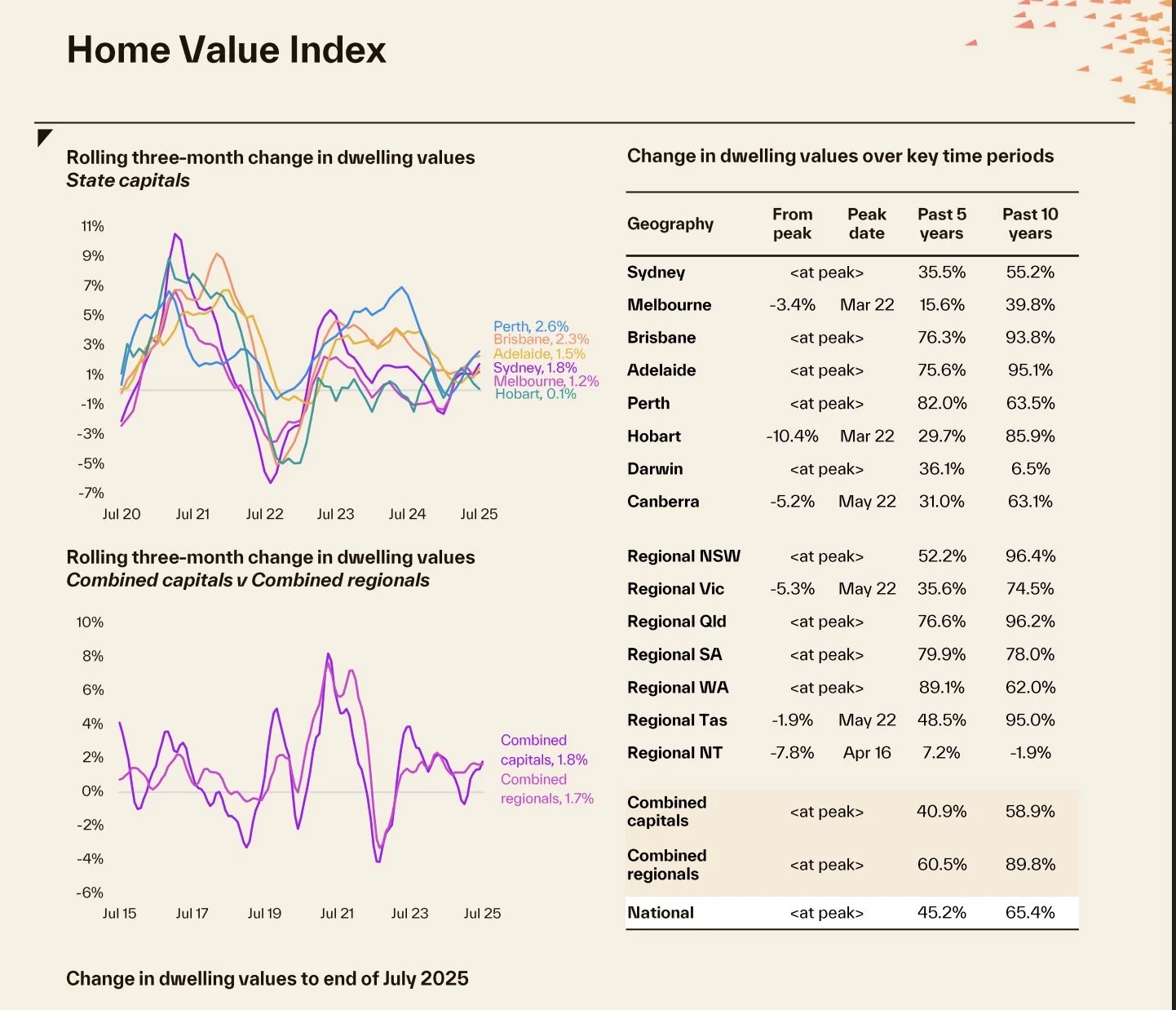

National dwelling values rose by 0.6% in July, with the rate of growth holding firm relative to the prior two months.

That marks the sixth straight month of gains, with the positive inflection aligning with the first rate cut in February.

Every capital city recorded a rise in dwelling values through the month.

The positive trend in housing values is supported by persistently low inventory levels, with national listings tracking -19% below the previous five-year average for this time of the year

The combined regional markets (1.7%) are no longer outperforming, with the rolling quarterly gain once again favouring the combined capitals (1.8%).

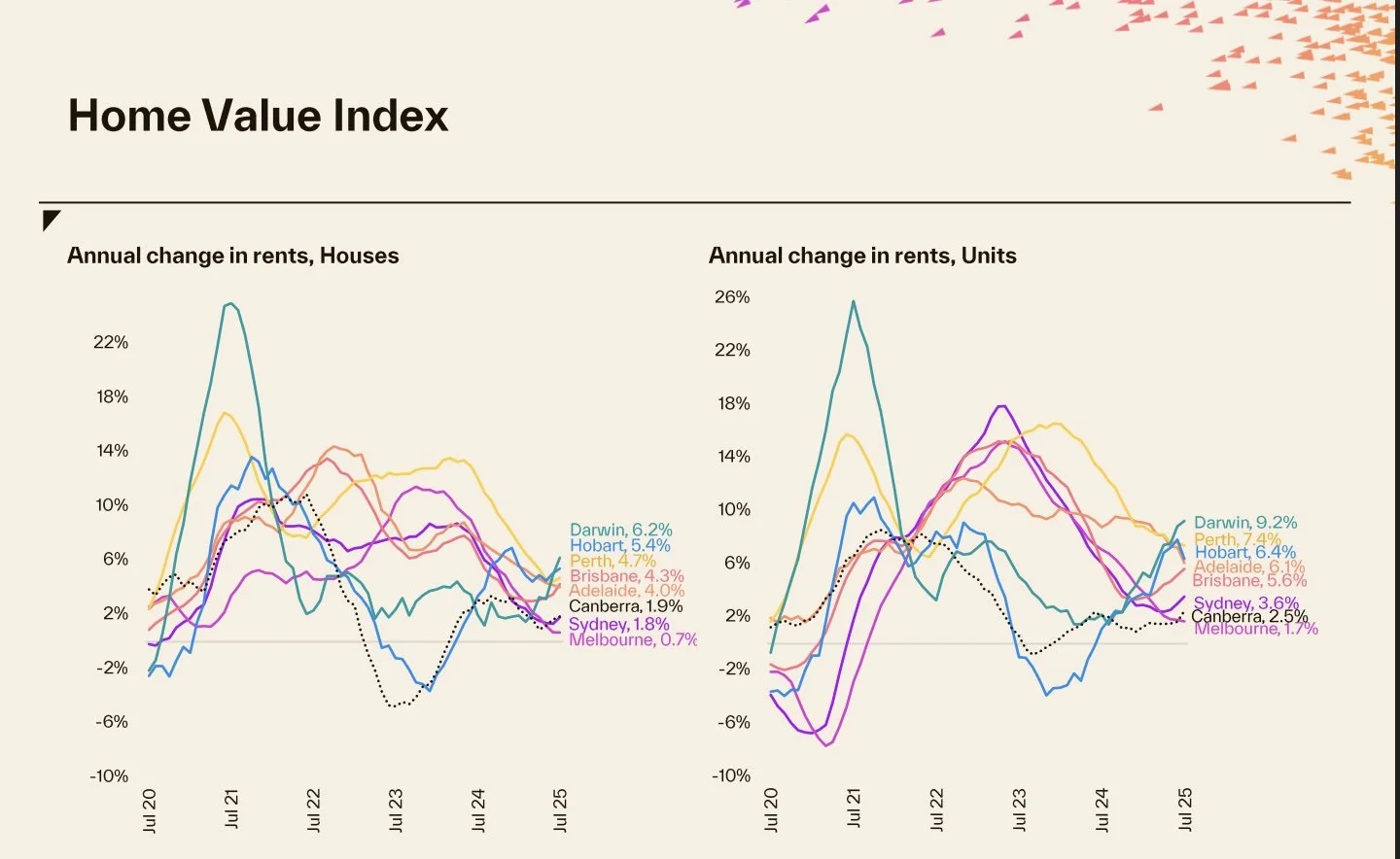

On a seasonally adjusted basis, national rents were up 1.1% over the three months ending July, up from a recent low of 0.5% through the September quarter last year.

With further rate cuts looking likely, housing values are expected to rise further, but at a modest pace.

Key drivers behind this re-acceleration include:

Easing inflationary pressures

Ongoing population growth

A return of investor confidence

Strength in employment figures

1. Rents Remain High – Supporting Strong Yields

For many expats, investing in Australian property is about building a strong, income-generating portfolio while abroad. Fortunately, rental markets across the country remain incredibly tight, with vacancy rates near record lows in major cities. Rents have been rising steadily, and demand continues to outpace supply—particularly for quality apartments and family homes in inner-urban areas.

This creates an ideal environment for expat investors:

Consistent rental income

Low vacancy risk

Potential for positive cash flow (especially with strong foreign currency income)

2. Rising Prices Could Mean Now Is the Time to Act

With housing values subtly increasing again—particularly in capital cities with tight supply—waiting too long could mean paying more down the line. Expats looking to buy property in Australia should consider acting before further gains erode affordability.

3. Exchange Rates Could Amplify Your Buying Power

If you're earning in a strong foreign currency (e.g. USD, EUR, SGD, HKD, GBP), now may be a sweet spot where you can leverage favourable exchange rates before domestic price growth gathers further momentum.

4. Investor Confidence Is Returning

The report points to rising investor interest. For expats, this reaffirms the viability of property as a wealth-building strategy—even from abroad. Rents remain strong, and vacancy rates are low, which supports healthy rental yields.

5. Lending Conditions Are Still Relatively Favourable

While serviceability can be trickier for expats, lenders are becoming more comfortable with non-resident income—especially with strong financials. Now may be a good window to lock in lending terms before competition heats up.

6. Capital Cities Are Leading the Charge

Cities like Sydney, Melbourne, and Brisbane continue to show resilience. These markets often appeal to expats looking for long-term capital growth or a future home base. If you're planning a return to Australia, buying now could be a strategic move.

Takeaway for Expats

The subtle market re-acceleration signals a potential shift from a buyer’s market to a more competitive environment. As an expat, this could be the right time to:

Reassess your buying capacity

Consider leveraging currency advantages

Start the pre-approval process while conditions are favourable

The window is open—but for how long is uncertain.

To read the full report, click on the button below

The information contained is general information only and does not consider your personal objectives, financial situation and needs. We strongly recommend that you do not act on any information provided in this website without individual advice from your trusted advisor. You should also obtain a copy of and consider the Product Disclosure Statement for all financial products before making any decision.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.