Discover the latest insights and trends in the real estate market with the CoreLogic HVI (Home Value Index) report for April 2024.

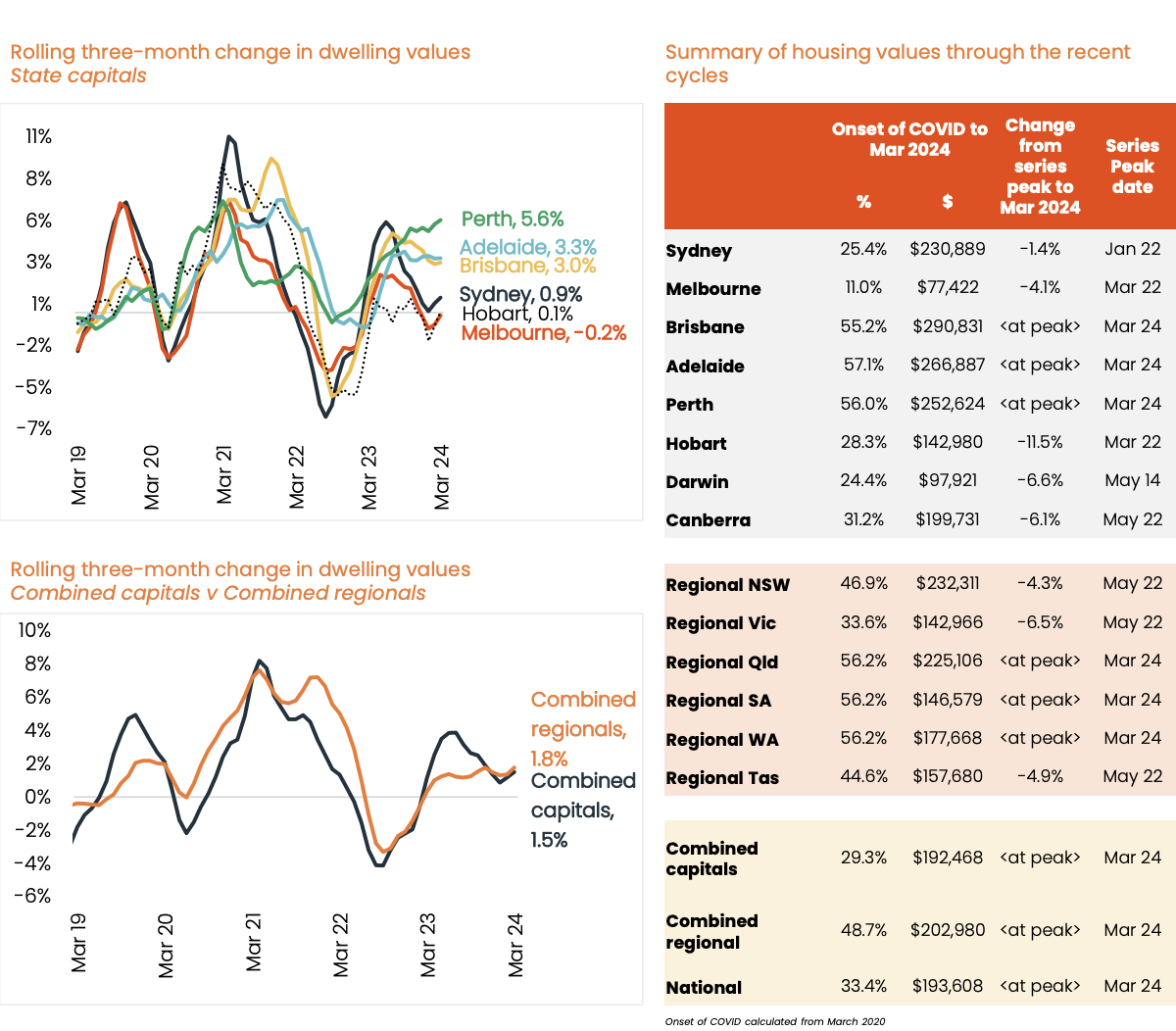

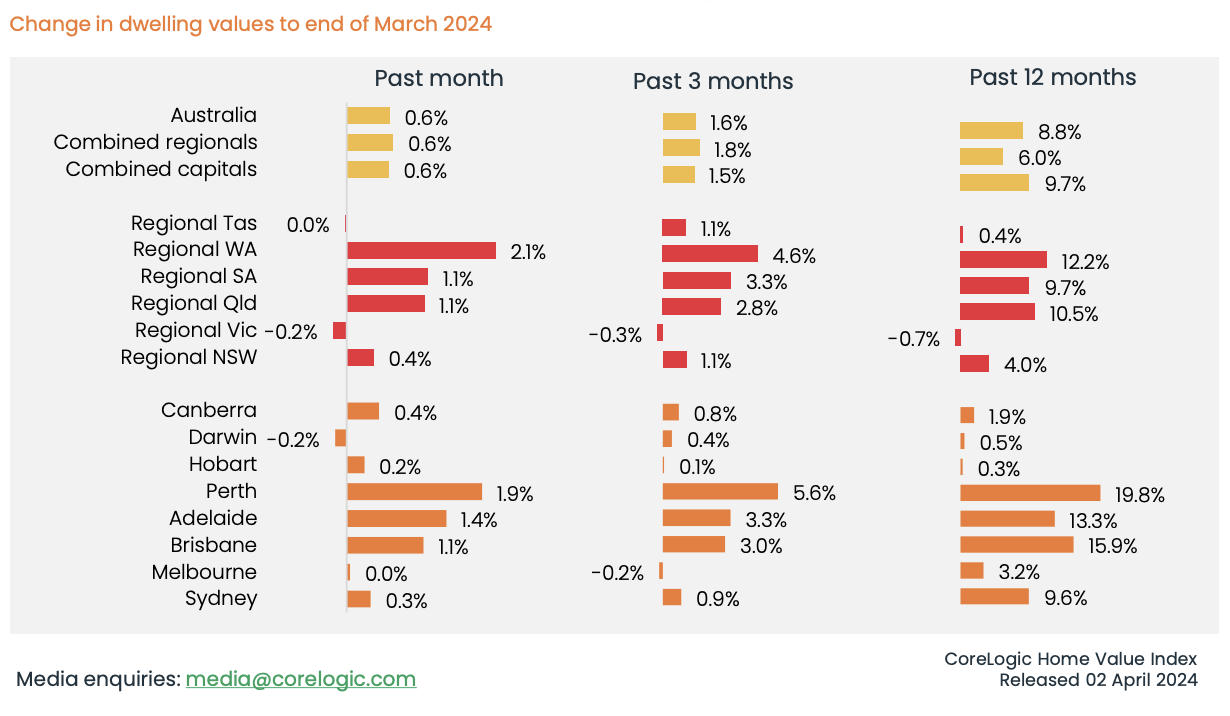

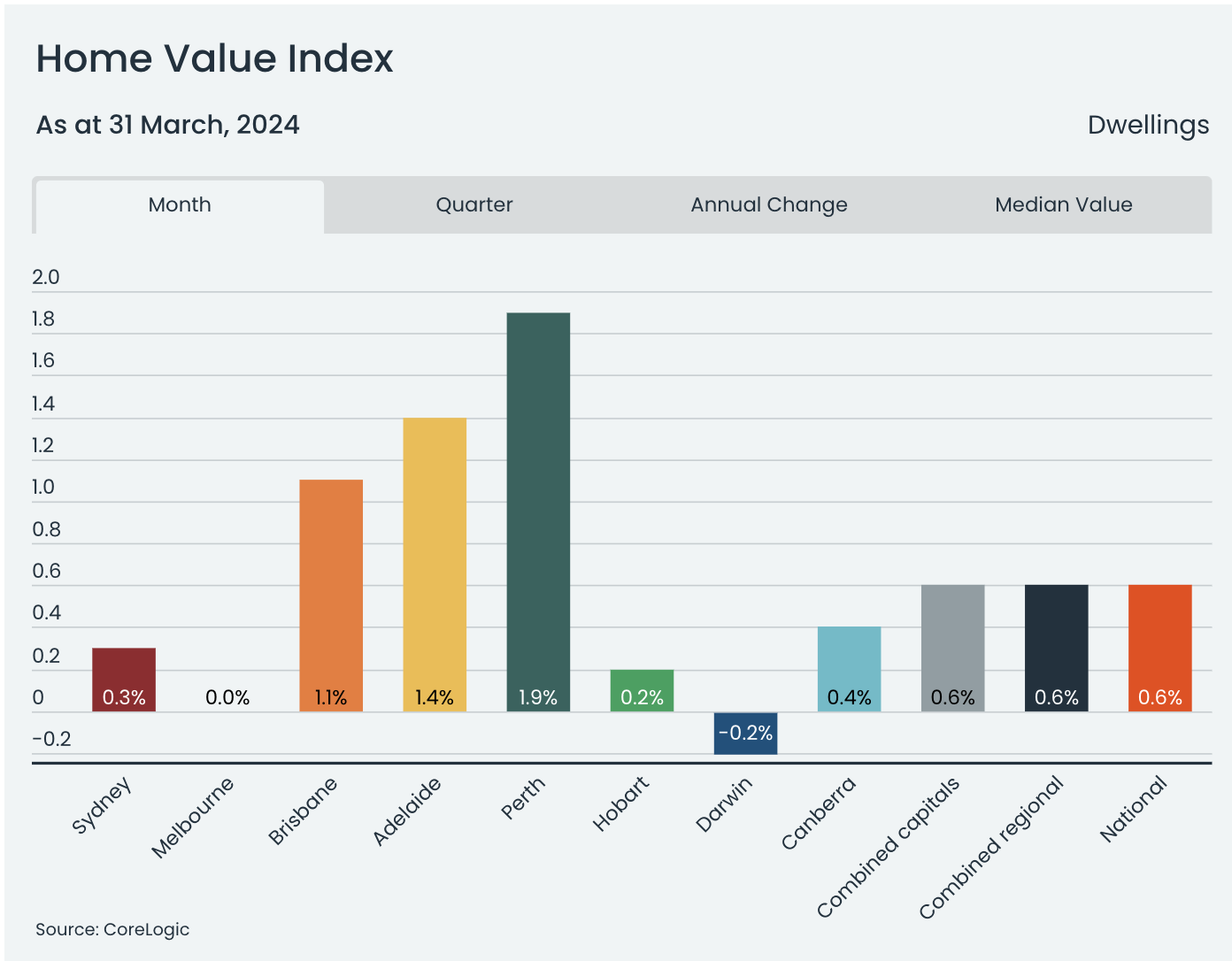

The latest CoreLogic HVI April report highlights the remarkable resilience of the Australian property market; potential buyers are showing no signs of being deterred by interest rates as they continue to enter the market. The data from March (+0.6%) reveals an exceptional 14 months of continuous growth, bouncing back from the decline of -7.5% experienced between April 2022 and January 2023. Australia’s Property Home Value Index (HVI) has surged by 10.2%, which is equivalent to a substantial increase of around $71,832, setting new record highs consistently since November of the previous year. It is worth noting that all capital cities, except Darwin, experienced growth. Darwin experienced a slight decline of -0.2%.

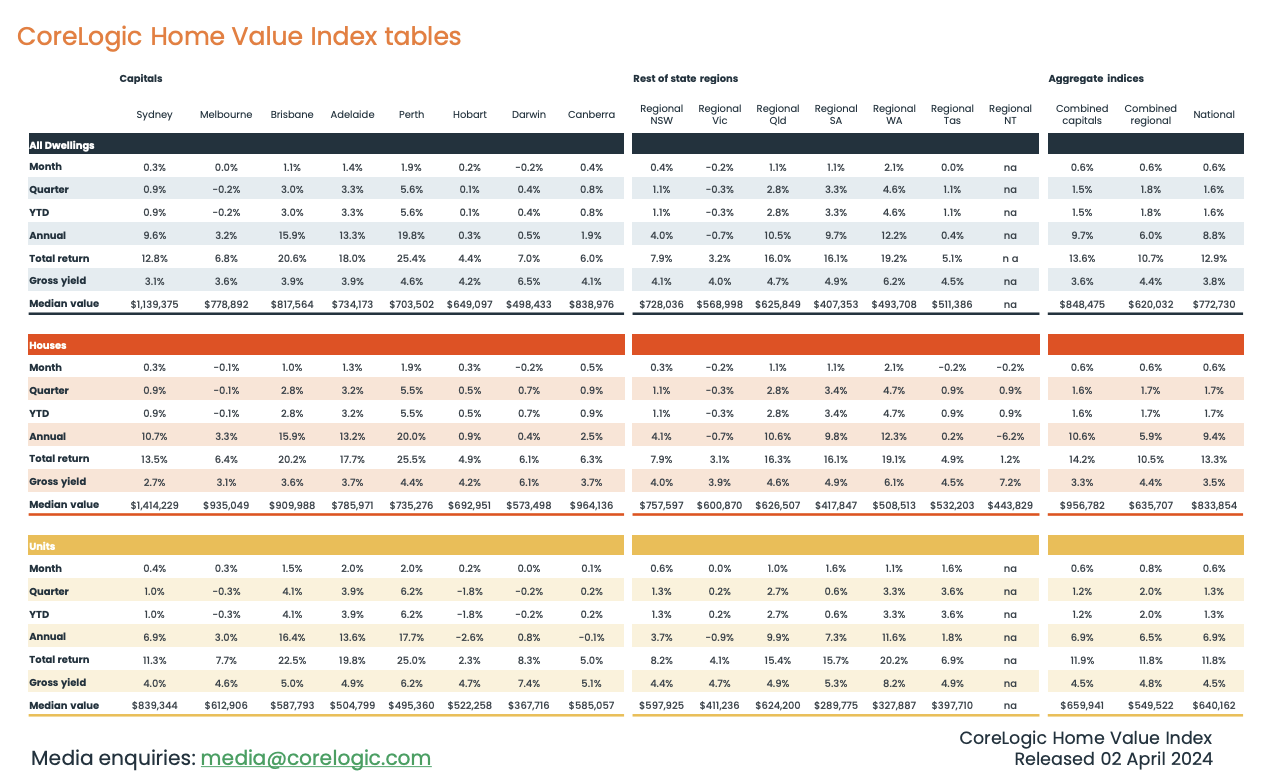

National Housing Market Update at a Glance;

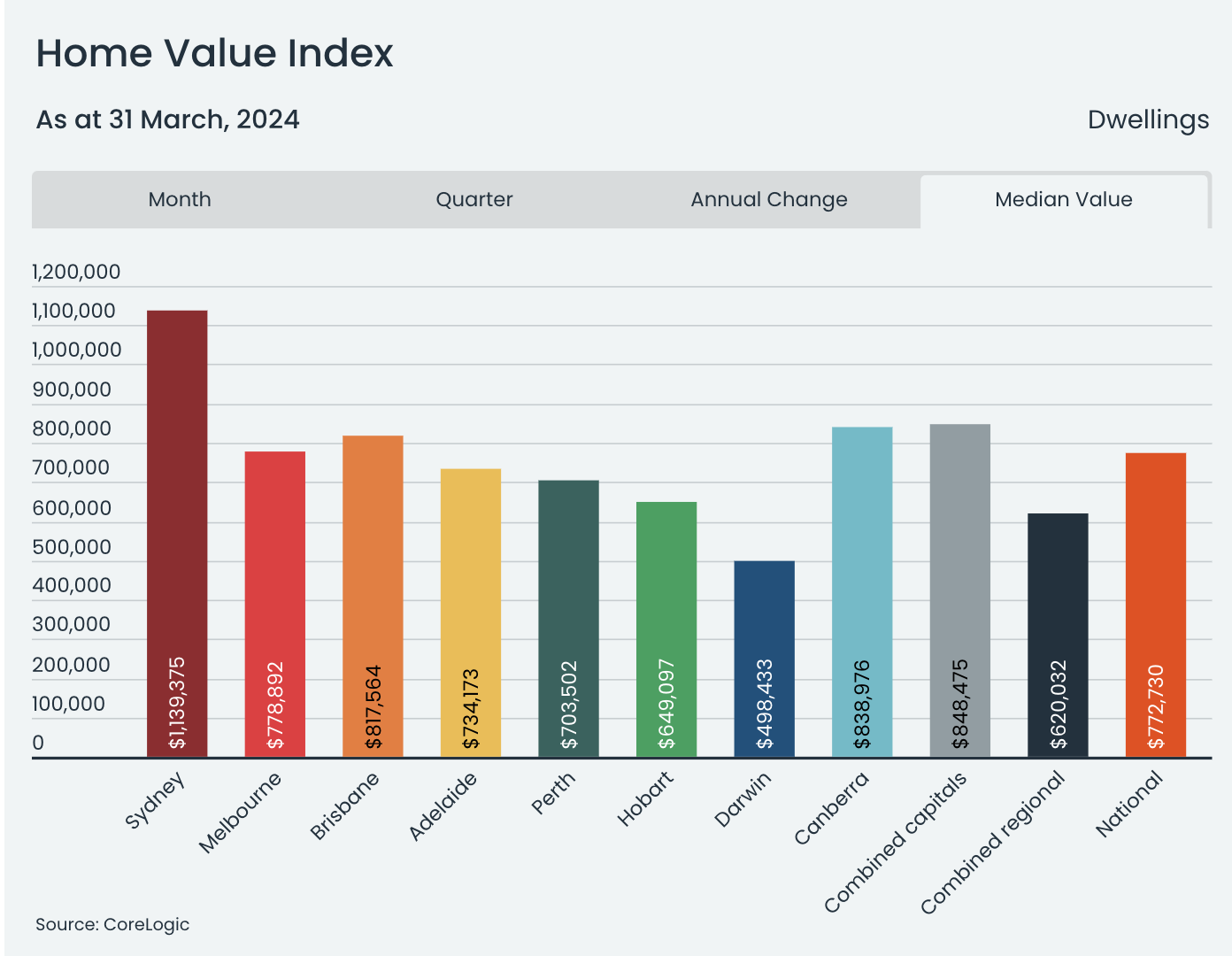

Sydney

+0.3% Month

+0.9% Q1

+9.6% Year

Median Value - $1,139375.00

Melbourne

- 0.0% Month

-0.2% Q1

+3.2% Year

Median Value - $778,882.00

Brisbane -

+1.1% Month

+3.0% Q1

+15.9% Year

$817, 564.00

Adelaide -

+1.4% Month

+3.3% Q1

+13.3% Year

Median Value - $734,173.00

Perth -

+1.9% Month

+5.6% Q1

+19.8% Year

Median Value - $703,502.00

Hobart

+0.2% Month

+ 0.1% Q1

+0.3% Year

Median Value - $649,057.00

Darwin

-0.2% Month

+0.4% Q1

+0.5% Year

Median Value - $498, 433.00

Canberra

+0.4% Month

+0.8% Q1

+1.9% Year

Median Value - $838, 976.00

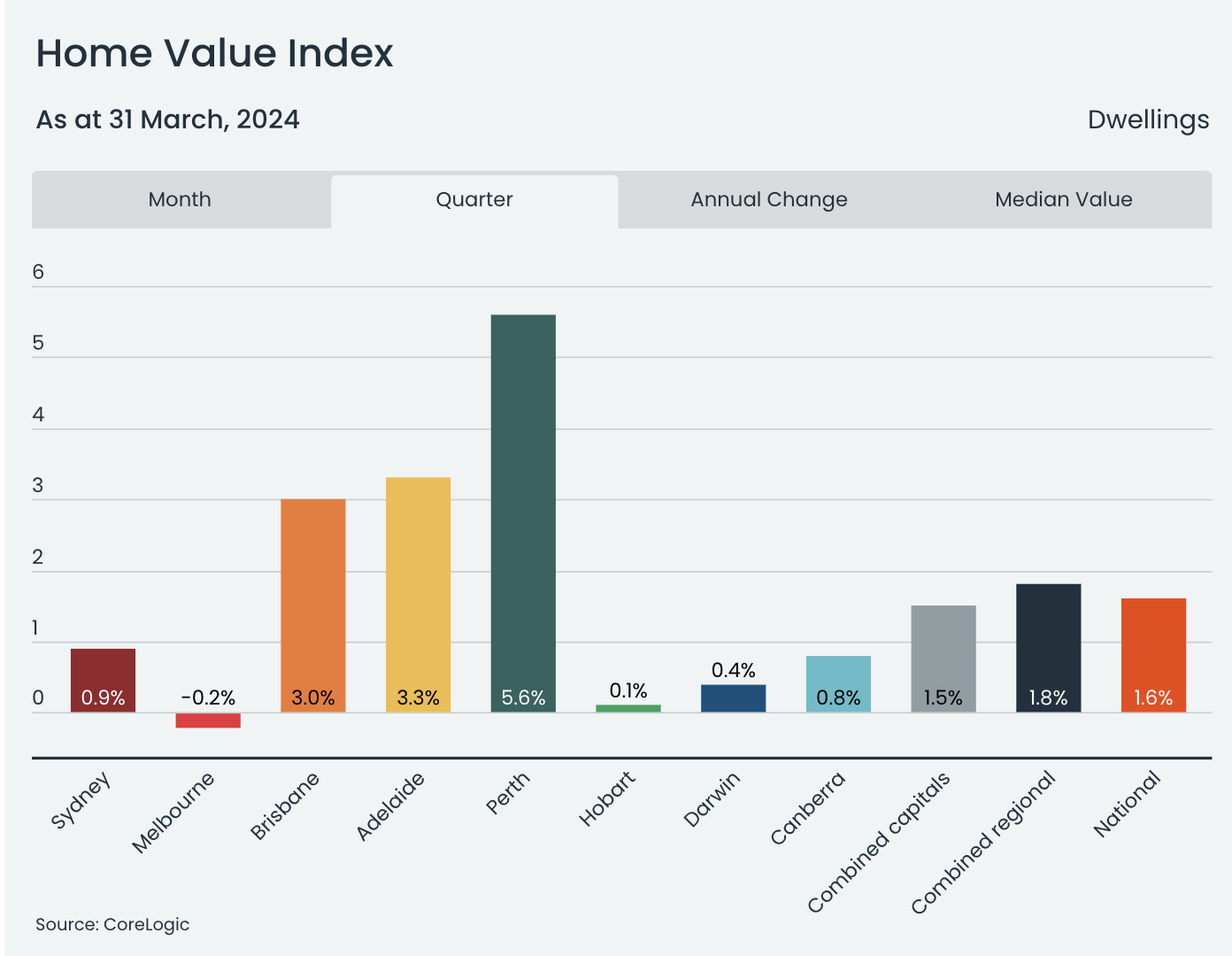

In the first quarter of 2024, the country saw a rise in national growth to 1.6% from the 1.4% recorded in the previous quarter. This uptick was coupled with an increase in housing values; however, it is worth noting that the growth rate in this sector witnessed a significant slowdown compared to the levels seen in the middle of last year.

With this in mind, CoreLogic Property Pulse reported a national Auction Clearance rate for this week of 75.9% for April 8th, indicating consumer confidence is up, and sellers are realistic about the values of their properties in an environment of increased competition between buyers.

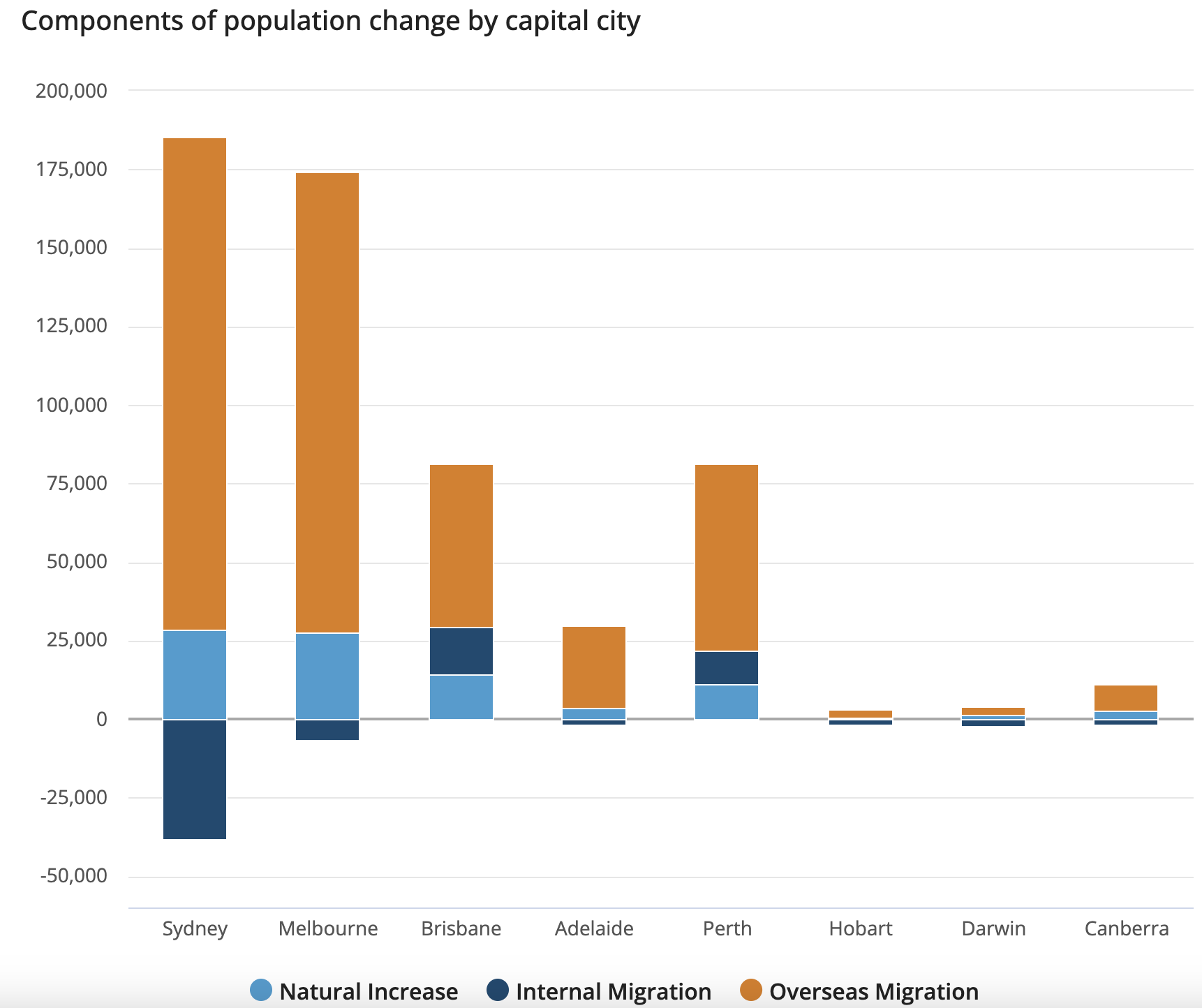

“Rate hikes, cost of living pressures and worsening housing affordability are all factors that have contributed to softer housing conditions since mid-last year. However, an undersupply of housing relative to demand continues to keep upwards pressure on home values despite these headwinds. The diversity in housing value outcomes can be explained by significant differences in factors like housing affordability, demand-side pressures from population growth and shortcomings in housing supply. Focusing on the extreme growth conditions in Perth, despite such a rapid pace of capital gains, housing values remain relatively affordable compared with the larger capital cities. Housing remains in short supply and purchasing demand is still high due to interstate and overseas migration rates that are well above average.

With overseas migration having peaked in the first

quarter of last year, we should see the rate of population

growth easing, however without a catch up in supply,

Australian housing markets are likely to be navigating an

undersupply for a few years yet,”

ABS Population Growth Data for 2023.

Not all parts of the housing market rose by the same amount. In major cities, cheaper homes increased by 3.1% while pricier homes only went up by 0.7% in the first quarter. This pattern was seen in every major city due to rising interest rates affecting affordability.

Regional housing markets are also recording a rise in values, with levels of diversity similar to those of their capital city counterparts. Regional Victoria stands out with the softest growth conditions, with values down -0.3% in the first quarter of the year; the only broad ‘rest of state’ region to record a decline in the year-to-date.

Home sales volume through the first quarter of the year was estimated to be 9.5% higher relative to Q1 last year. However, compared with a year ago, it is from a relatively low base, with the housing market bottoming out from the downturn at the beginning of last year. Unlike the previous decade's average for this time of the year, dwelling sales are estimated to be 3.7% higher.

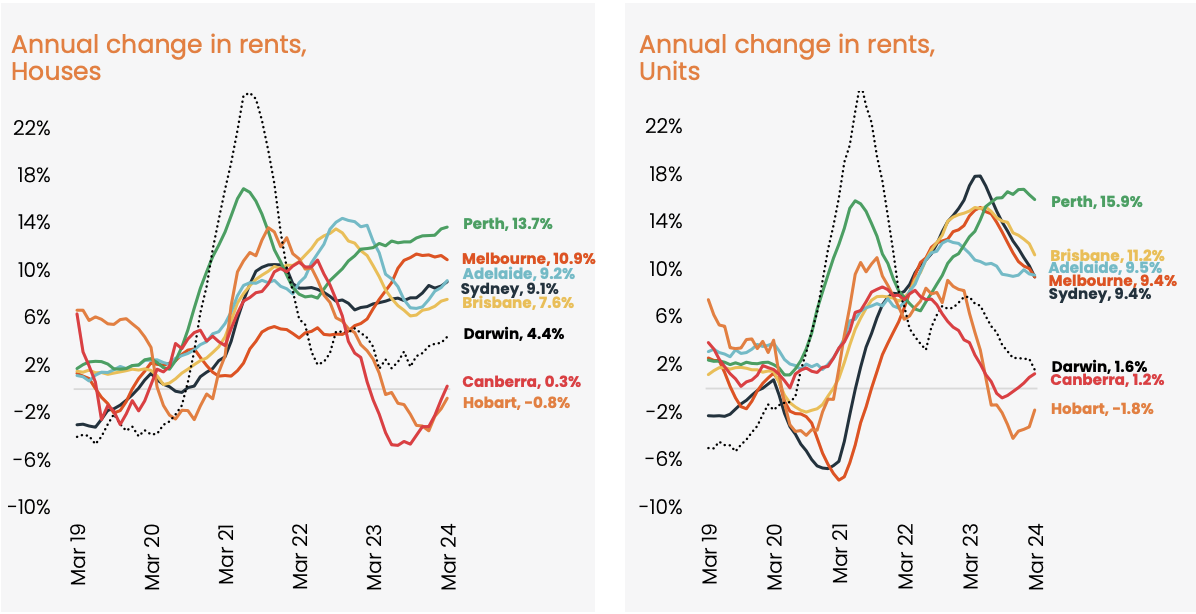

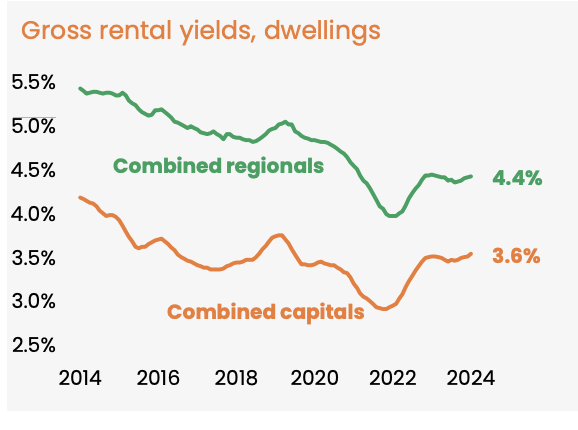

The national rental index rose by 2.8% in March, the fastest since May 2022 (2.9%). Rental growth shows seasonal strength in Q1, contributing to upward pressure on rents. Annual rental growth has been increasing since October. Unit rents outpaced house rents in combined capitals, up by 2.9% and 2.7% respectively in Q1. The gap between house and unit rental growth is narrowing. Gross rental yield stands at 3.75%, the highest since October 2019. Melbourne saw a significant increase in gross rental yields, rising from 2.76% to 3.57% in March 2024 due to a 4.1% drop in dwelling values and a 21.1% spike in rents over the past two years.

Based on the latest housing finance data, investors have experienced a significant surge in activity over the 12 months up to January 2024. The data reveals that the value of lending to investors rose by 18.5%, contrasting with a milder 3.4% uptick in lending to owner-occupiers.

Tim’s key takeaways;

Overall, it looks as though housing markets are continuing to traverse the high-interest rate and high cost of the living environment better than most would have expected.

The fundamentals of housing supply and demand remain out of balance in most regions, placing upwards pressure on the cost of housing.

On the demand side, the rate of growth in Australia’s population reached 2.5% over the year ending September 2023, the fastest pace of annual growth since the commencement of the ABS national population series in 1981.

Housing affordability is deteriorating as home values, rental rates and the cost of servicing a mortgage rise faster than household incomes.

Economic conditions are easing and labour markets loosening. The RBA is expecting economic conditions to ease further through the middle of the year and the unemployment rate to gradually rise from its current low base, implying lower wages growth. Although inflation has beaten forecasts, cost of living pressures remain a key challenge for many households, resulting in lower savings rates, ongoing low sentiment and heightened uncertainty when it comes to making high commitment financial decisions such as purchasing a residential property.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.