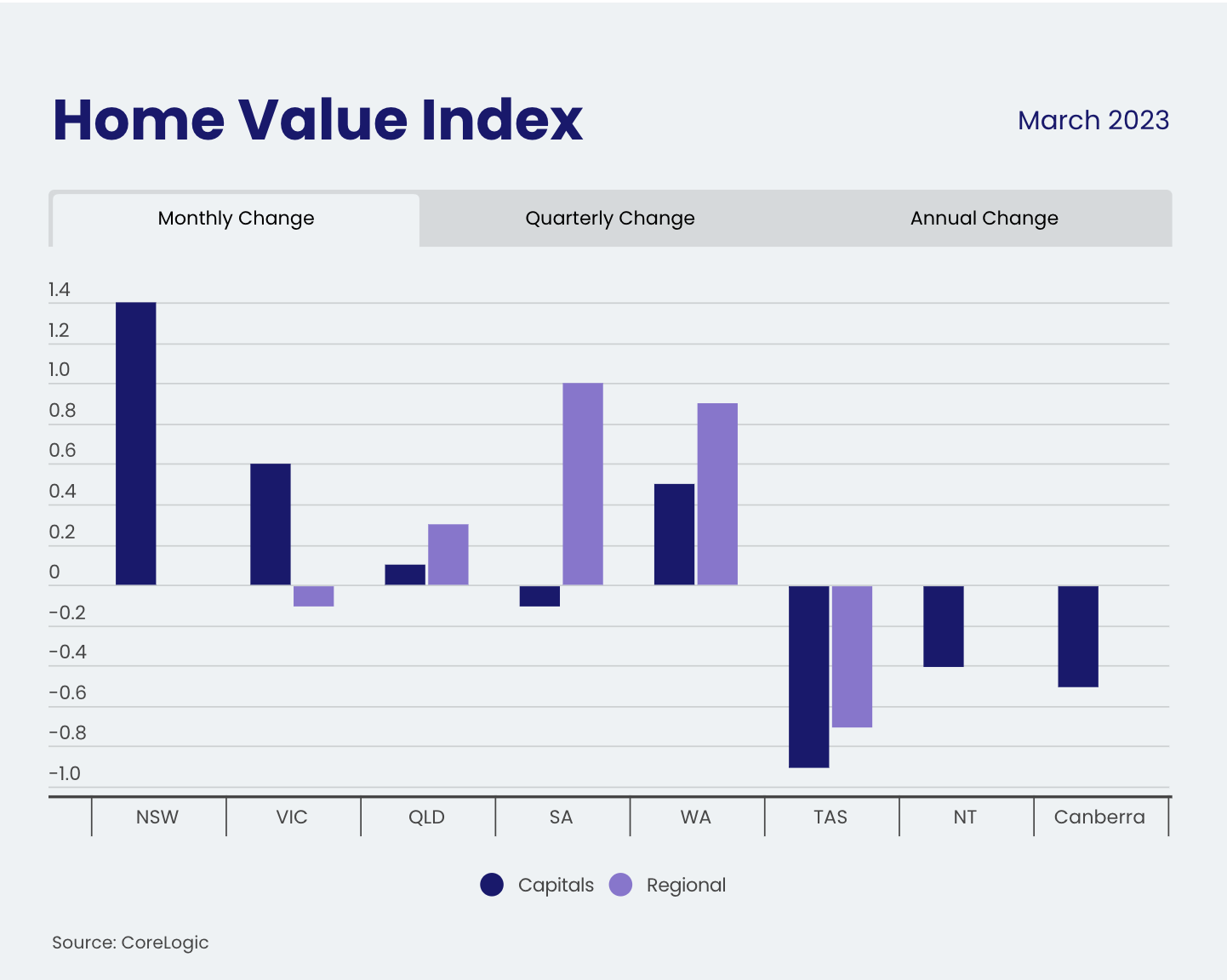

CoreLogic Home Value Index (HVI) posted the first month-on-month rise since April 2022, up 0.6% in March.

Thank you, CoreLogic Australia, for sharing the latest HVI data with us

The lift in HVI, from the flat February -0.1% has been most evident across the blue-chip suburbs in the market, +2.0% in March, and the upper quartile of the Sydney unit market also followed this trend and was + 1.4% for the month.

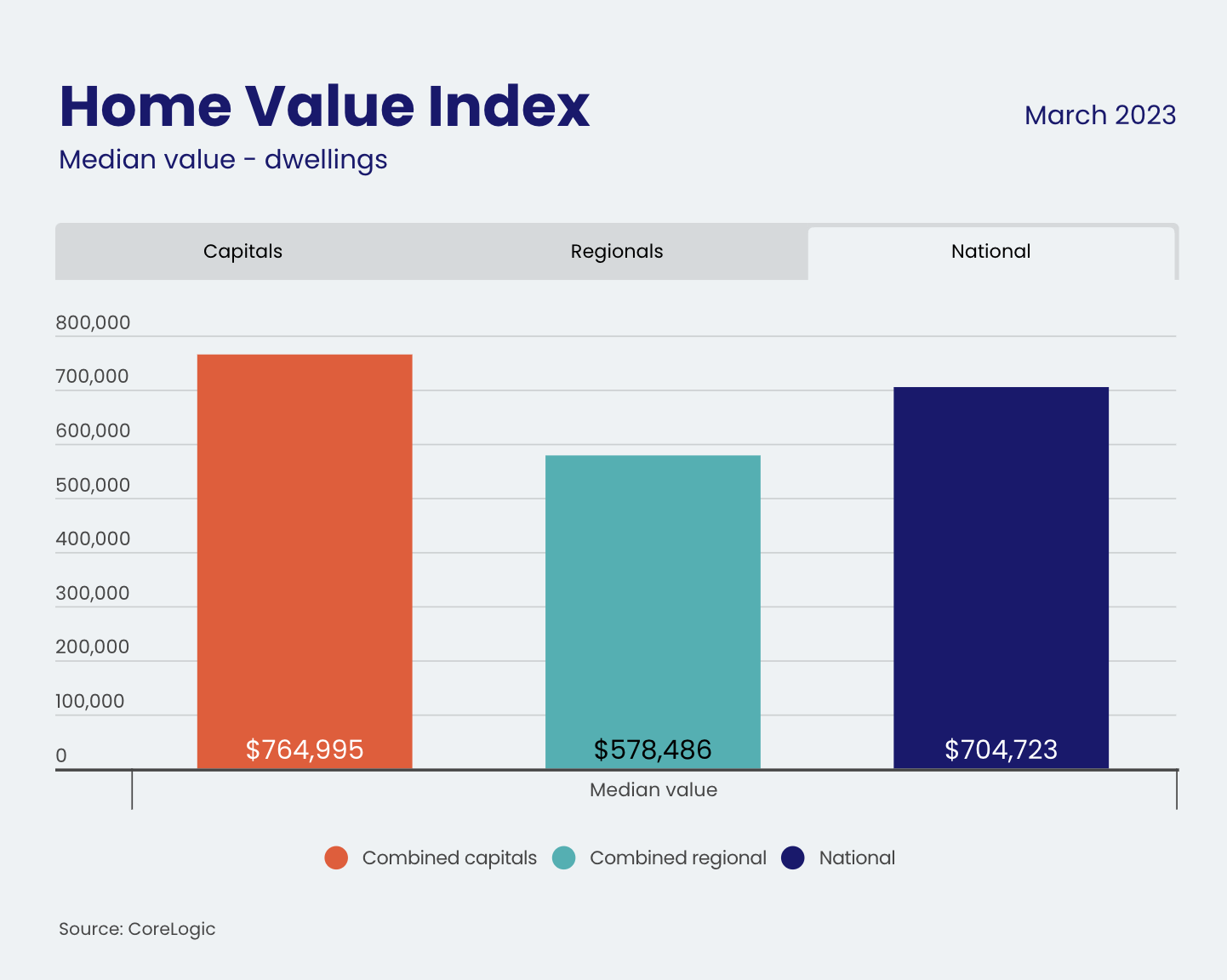

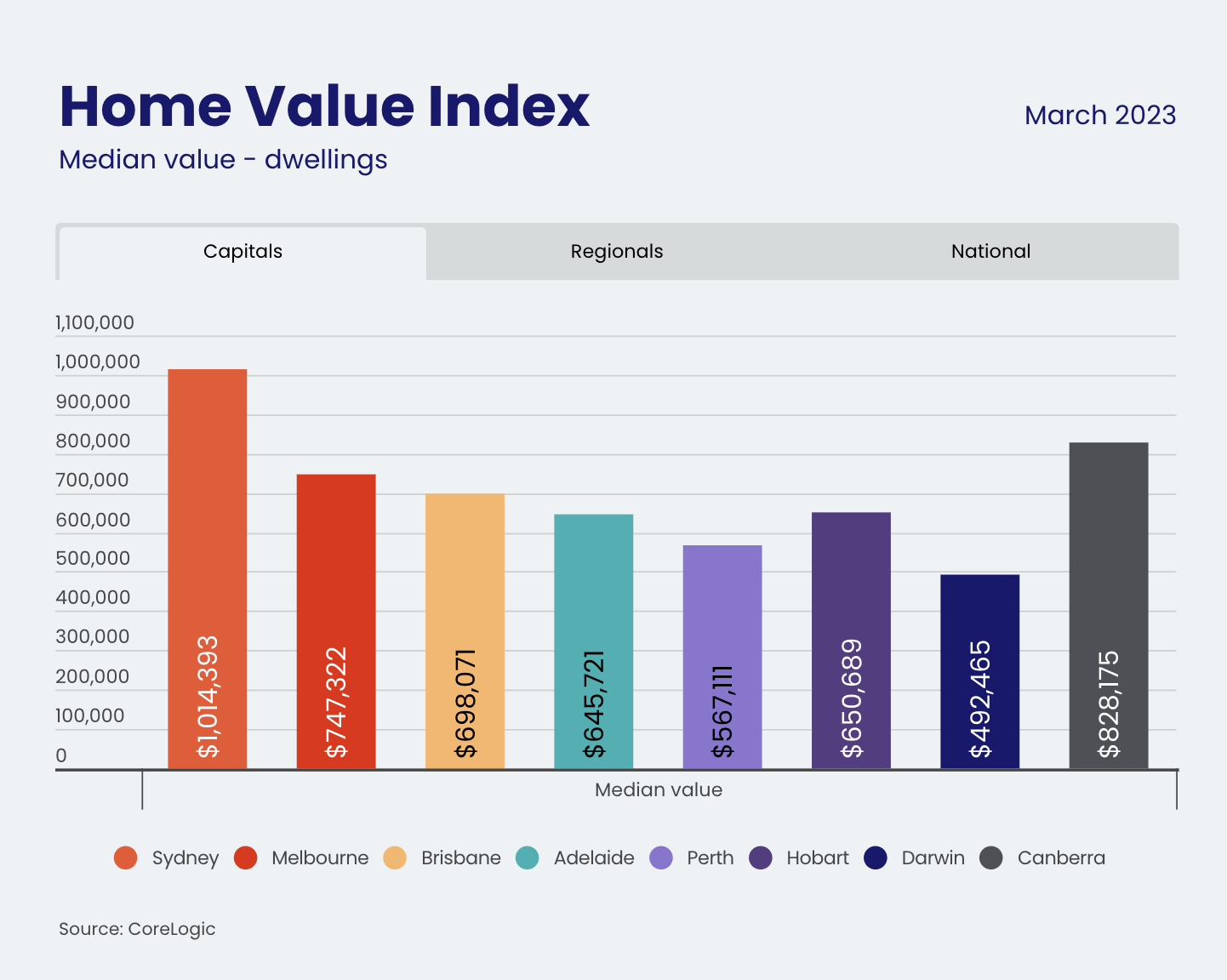

Here are the HVI in order from best - lowest performers from the Capital Cities for Median Dwelling Value (MDV)

Sydney +1.4% MDV - $1,014,393

Melbourne +0.6 % MDV - $747,322

Perth +0.5% MDV - $567,111

Brisbane +0.1+ MDV - $698,071

Adelaide -0.1 MDV - $645,721

Darwin -0.4 MDV - $492,465

Canberra -0.5 MDV - $828,175

Hobart -0.9 MDV - $650,689

Combined Capitals +0.8% Combined Regionals +0.2%

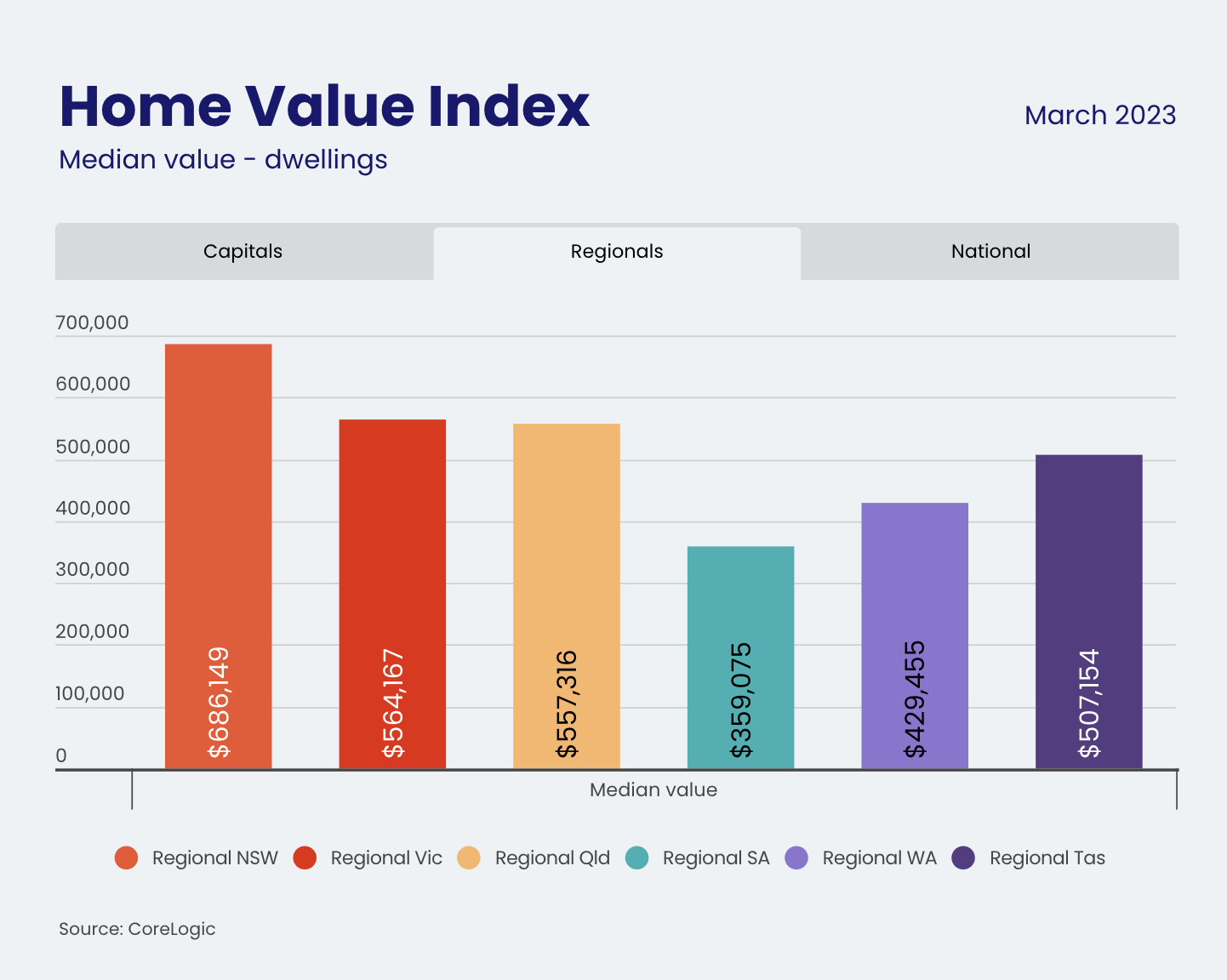

Here are the HVI in order from best - lowest performers from the Regional Areas;

REG SA +1.0% MDV - $359,075

REG WA +0.9% MDV - $429,455

REG QLD +0.3% MDV - $557,316

REG NSW 0.0% MDV - $686,149

REG VIC -0.1% MDV - $564,167

REG TAS -0.7% MDV - $507,154

Combined Capitals +0.8% Combined Regionals +0.2%

There seems to be pent up spending power in the Blue Chip Markets. Buyers are ready to jump into the market with the recent indication from the RBA that they would pause interest rates in the future. Prices are firm with the lack of stock and the tight rental market, meaning that investors are seeing benefits of being in the market and renters swapping their status from renter to owner occupier.

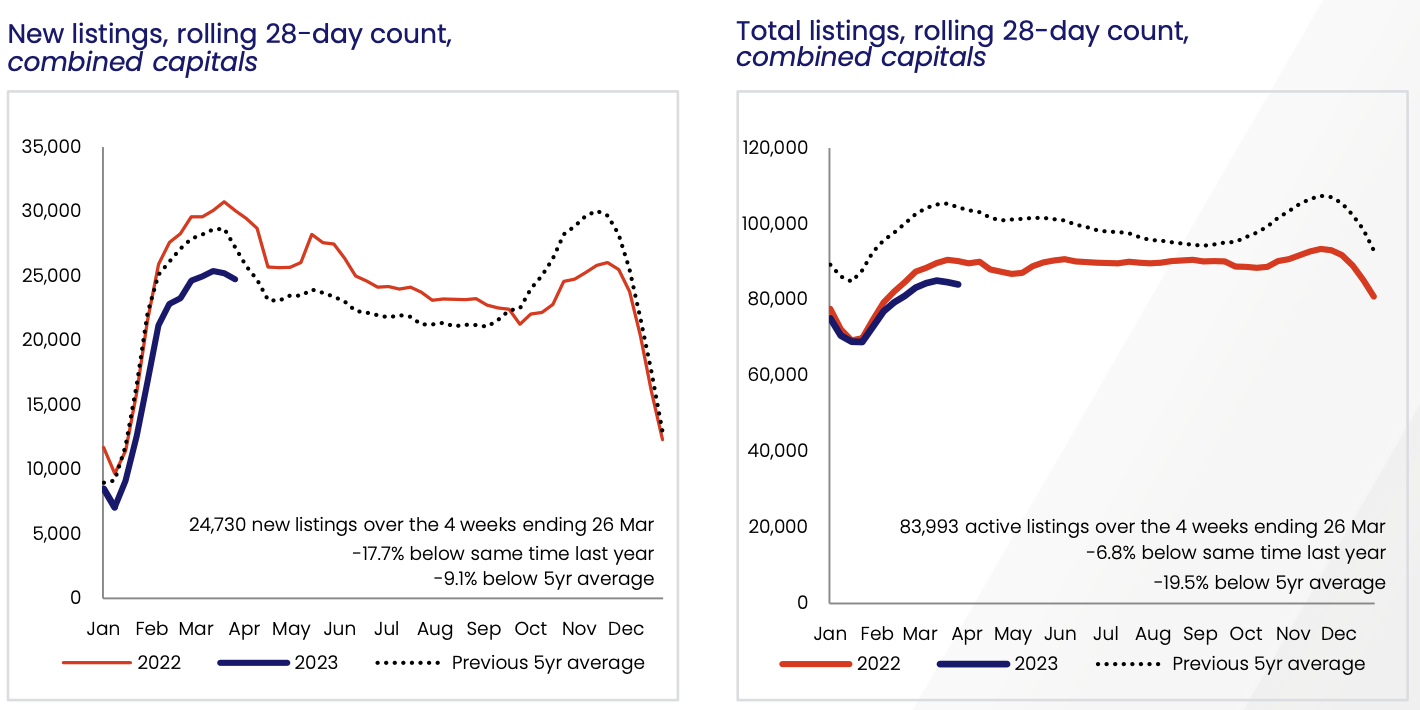

The graph indicates that there was 24,730 new listings in March, -17.7% below the same time in 2022, and 9.1% below the five year average. There are 89,993 active listings over March which is -6.8% below this time in 2022 and 19.5% below the five-year average.

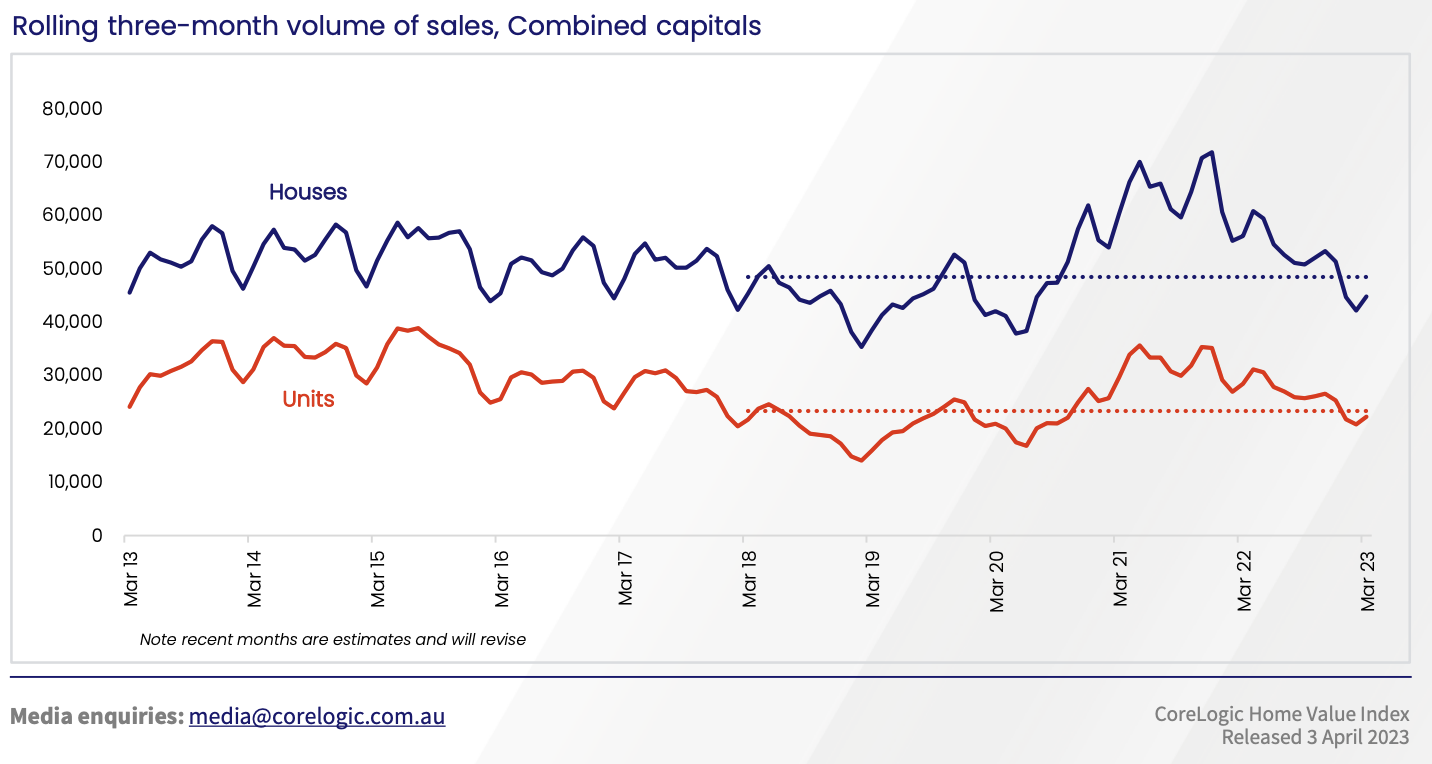

Prospective vendors could be motivated by an indication of an improvement in selling conditions. Auction clearance rates are back to average and, in some cities, above average levels. For private treaty sales, vendor discounting rates have eased slightly in 2023 (from -4.3% in December last year to 4.0% in March), and the median number of days on the market looks to plateau around 34 days across the combined capitals.

Annual change in rent for Houses

Perth +12.7%

Adelaide +11.2% and Brisbane +11.2%

Sydney +9.4%

Melbourne +8.3%

Hobart +4.0%

Darwin +2.6%

Canberra -0.8%

Annual change in rent for Units

Sydney +18.1%

Brisbane +16.1%

Melbourne +14.6%

Perth +13.1%

Adelaide +12.6%

Hobart +7.8%

Darwin +7.3%

Canberra +3.2%

So where is the market going from here?

“Although the recent trend in housing markets is looking increasingly positive, we are still cautious about calling a trough in the cycle.”

Tim Lawless Executive Research director of CoreLogic’s Asia–Pacific Research Division

Tim’s key takeaway points

The full impact of higher interest rates is yet to flow through to borrowers. While changes to the cash rate impact new lending rates almost immediately, there is typically a several month lag between cash rate movements getting passed on to existing borrowers.

Weaker economic activity to keep consumer spirits low. With interest rates firmly in contractionary territory, economic growth will likely slow through the middle of the year.

Looser labour markets. As economic growth slows and skilled migration rises, unemployment will likely rise from the current generational lows.

Tight credit. Lending metrics show a record low portion of home lending is occurring to borrowers with small deposits or high debt levels relative to their income or loan size.

The potential for higher advertised supply without a lift in demand. With the flow of new listings holding consistently below average since September, there is likely to be an accumulation of vendors waiting on the sidelines.

“A range of more positive factors should help to at least partially offset these headwinds:” Tim Says

Inflation is winding down and a (potential) peak in the cash rate is around the corner. The monthly inflation indicator has lost a lot of momentum over the first two months of the year, dragging the annual headline reading lower, from 8.4% in December to 6.8% in February, sending a clearly indicating that inflation has peaked

Net overseas migration is at record highs and set to rise further, adding to housing demand surging migration is a double-edged sword.

Tight labour markets should provide a safety net. Although unemployment will probably rise through the year, it will do so off generational lows and is expected to hold well below the long-run average.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.