Should I fix my mortgage interest rate?

What’s happening with interest rates this year?

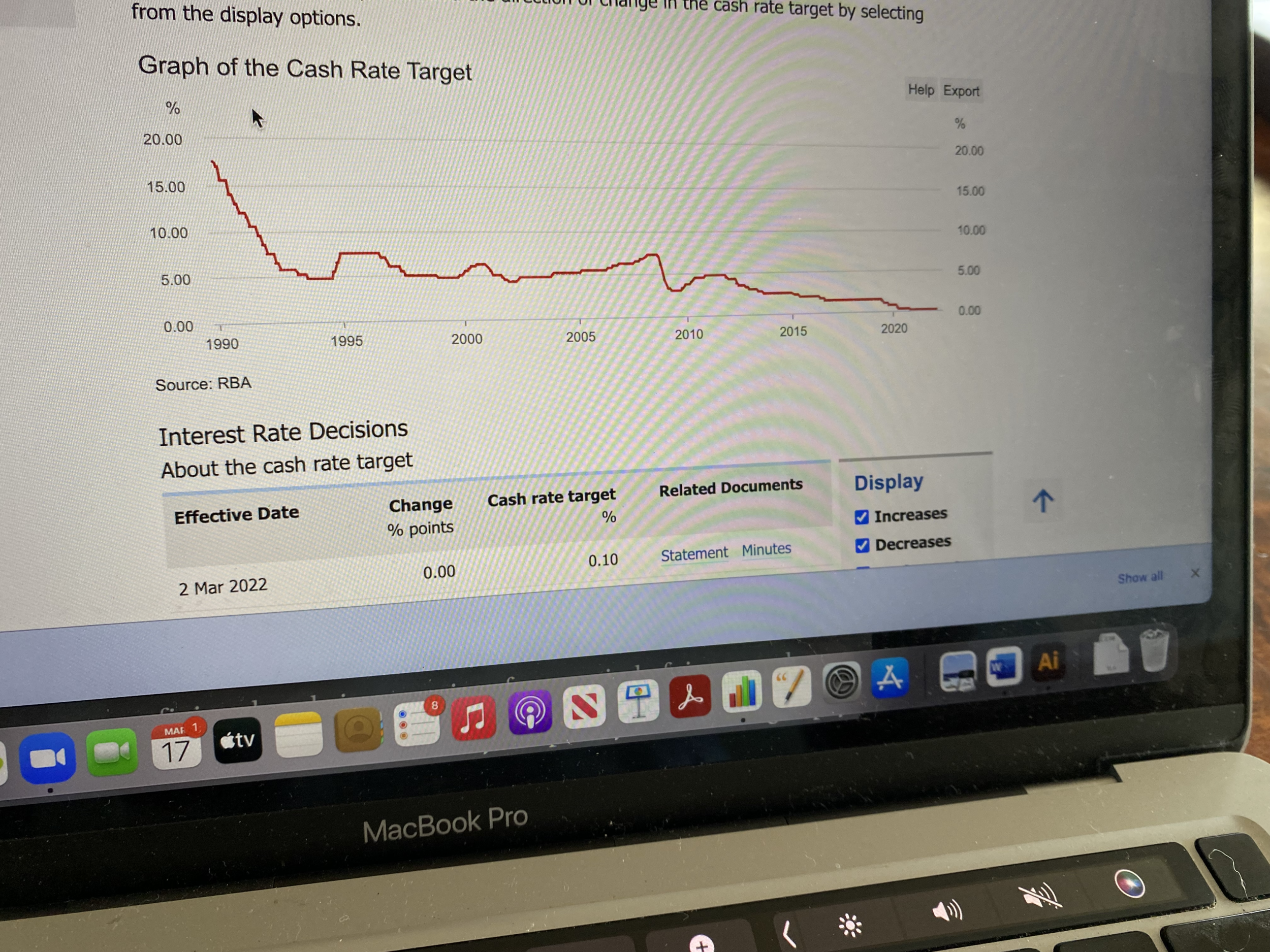

Back in Quarter 3 2021, the Reserve Bank of Australia (RBA) announced that we could see an interest rate increase at some point in 2022. Previously they had suggested no changes until 2024. Since then, we still have not seen the Reserve Bank change interest rates, but we have seen banks increase their fixed rates, some three times during the last six months.

So, should you have a fixed-rate loan or remain variable? Have you missed the boat? (so to speak?)

When I ask most clients their thoughts concerning fixed v variable, the general question that is fired straight back is “what do you think rates will do in the future?”. Not having a crystal ball it’s a tricky question to answer. I can say that rates will definitely rise. I don’t know when. It’s increasingly likely that it will be in the next few months…

Looking at why many people fix, it is generally commented that they are trying to beat the bank. For example, they have a lower fixed rate than the variable rate over a period of time.

Previously, over the past couple of years, this has been reasonably easy to achieve. For the past year, the fixed rates (1,2,3 and 4 yr) have been lower than the variable rates, which I have never witnessed before.

However, this has changed. Fixed rates have increased significantly over the last six months, so is this something that you should still consider? It’s worth noting fixing a loan should be done to provide certainty of repayments, rather than trying to predict the future and beat the bank.

There are a few considerations you should consider when looking at fixed-rate loans. Generally, you can’t make additional repayments over the standard repayments (yes, there can be some but usually very limited). In addition, most lenders won’t allow you to offset a fixed rate. In addition, there may be penalties to repay a fixed rate before the term, so if circumstances change, will this be an issue?

Let’s consider an example. A client is considering to Fix their Interest Rate, and we looked at the maths for them. They currently have an investment loan, it’s a variable loan, P&I at 2.39%, so it’s a very competitive rate. They are considering fixing the interest on the loan. The 2 yr fixed interest rate offered by the lender is 3.39%, the 3yr fixed is 3.69%, so as you can see, the certainty of repayment comes at a premium!

The cost of fixing the interest rate for 2 yrs is 1% higher than the current loan. Fixing the Interest Rate would mean, assuming the Reserve Bank increases rates by 0.25%, they need to make four increases over the next 2 yrs to get to the current rate offered.

Is four Reserve Bank of Australia cash interest rate rises likely? It’s up to you to decide, I will comment, in an increasing interest rate environment, banks look to make a profit on customers nervousness, fixing does bring certainty for a period of time, you have to decide whether the cost of the certainty is a price you are willing to pay.

One consideration would be to split your current loan, have “part-fixed” and part variable, hedge your bets, so to speak…

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.