Reserve Bank Australia (RBA) March Monetary Policy Meeting.

RBA Board, during its Monetary Policy meeting today decided to increase the cash rate target by 25 basis points to 3.60 per cent. This is the tenth consecutive increase since May 2022.

Governor Phillip Lowe's statement regarding the March Decision to raise the cash rate by .25 basis points offered the following statement about their monetary policy decision from the RBA today said the following;

“Global inflation remains very high. In headline terms it is moderating, although services price inflation remains elevated in many economies. It will be some time before inflation is back to target rates. The outlook for the global economy remains subdued, with below average growth expected this year and next.”

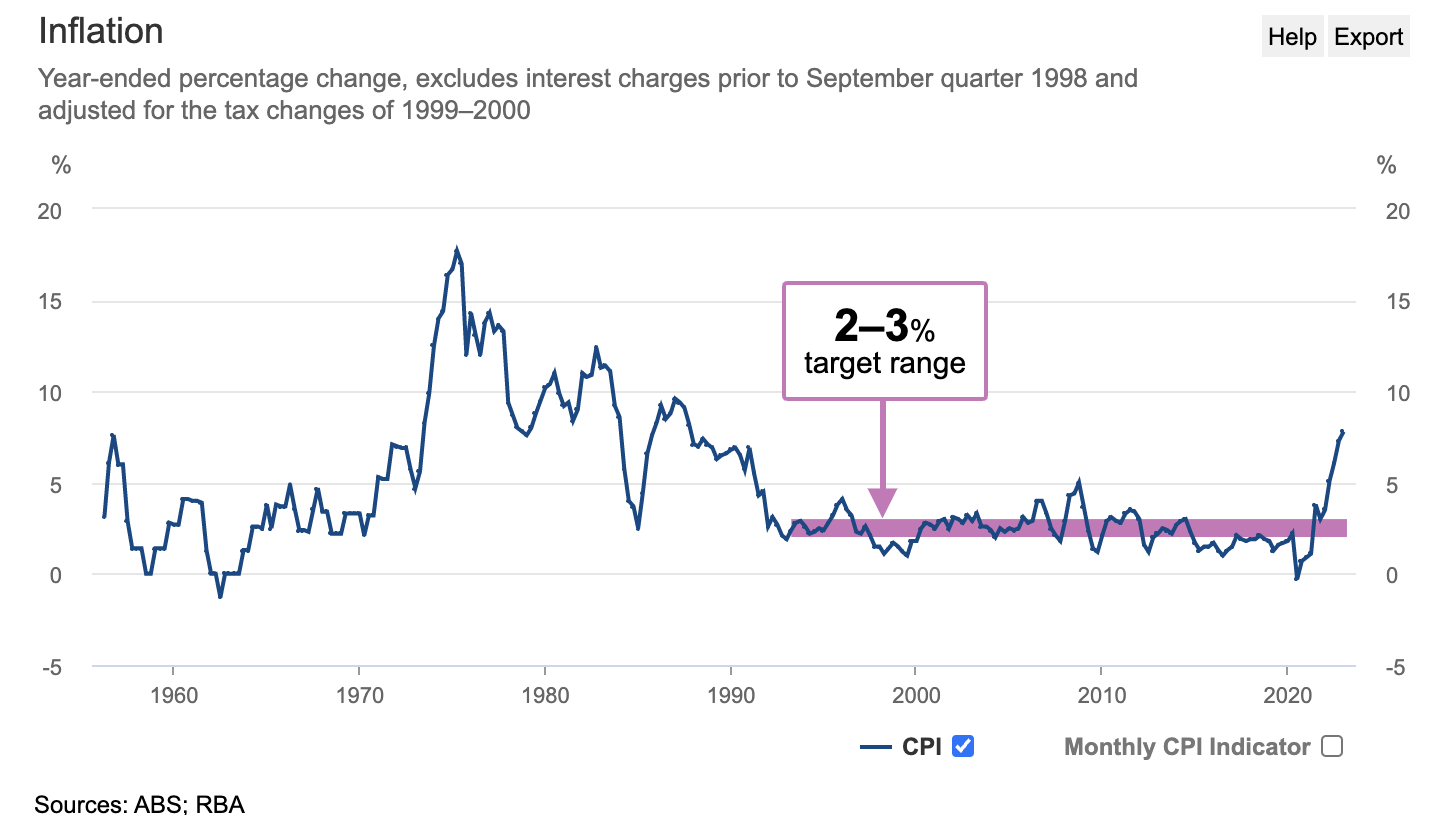

The RBA acknowledged a slowdown across the global economy but not enough to kerb spending to meet the inflationary targets of 2-3%. The current inflation rate in Australia is 7.8%.

“The Board recognises that monetary policy operates with a lag and that the full effect of the cumulative increase in interest rates is yet to be felt in mortgage payments. There is uncertainty around the timing and extent of the slowdown in household spending. Some households have substantial savings buffers, but others are experiencing a painful squeeze on their budgets due to higher interest rates and the increase in the cost of living. Household balance sheets are also being affected by the decline in housing prices. Another source of uncertainty is how the global economy responds to the large and rapid increase in interest rates around the world. These uncertainties mean that there are a range of potential scenarios for the Australian economy.”

The further went on to say that it anticipates further requirements of tightening on the monetary policy to ensure inflation returns to its target of 2-3%. The key factors that it will be paying close attention to are as follows;

Global Economy

Trends in household spending

Outlook for inflation

Labour market

We’ve been warned that there will be a few more increases to the cash rate if inflation is not tracking towards 2-3%. Media coverage on the 7th of March suggests that the RBA may be considering a pause in increasing the cash rate. The April Monetary Policy Board Meeting will be an interesting one. Has the RBA timed a “soft landing” for the Australian economy? We shall see.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.