Increasing Loan Coast/Decreasing Loan Amounts

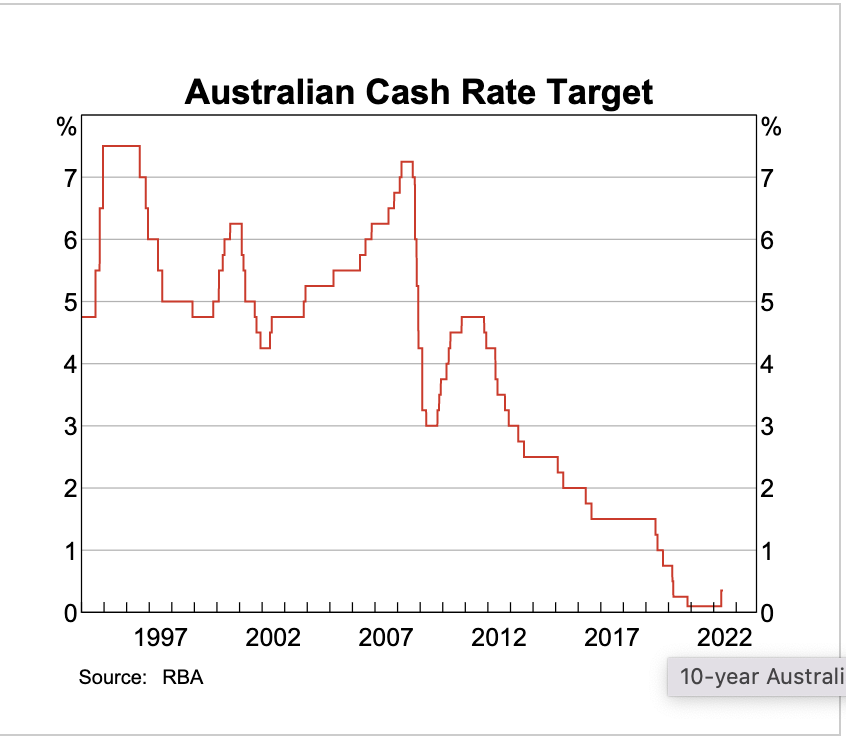

I’m sure you have seen over the past few months that Central Banks globally have been increasing interest rates. As inflation rises, Reserve Banks use interest rates to try and control consumer spending and control inflation.

What does this mean to you from a borrowing perspective?

When applying for a loan in Australia, all lenders are legally required to demonstrate that they have assessed your situation and are comfortable that you can afford the loan you are applying for. One of the factors they use to assess this is the actual cost of the loan, eg the repayments.

When a lender assesses the affordability of a loan, all are required to build in an interest rate buffer, effectively they want to make sure if interest rates rise, you can afford the increase and not default on the loan.

While ASIC removed a prescribed buffer, they recommend a minimum buffer of 2% to 2.5%, many lenders apply a buffer of 2.5% to 2.75%.

This means that if the actual interest rate on the loan you are applying for is 3.25% and the lender is applying a buffer of 2.75%, when they calculate how much you can borrow, they use an interest rate of 6%.

So, as interest rates increase, and the actual rate you are being charged increases, the maximum loan amount you can borrow decreases.

If we look at an example of this, let’s assume you could borrow $1,000,000 before the interest rates started to increase and that the actual rate you were paying was 2.5% and the loan is a 30yr Principle and Intrest (P&I) loan.

Without going into the detail of actual repayments, as interest rates rise, the cost will increase and the loan affordability will decrease, but by how much?

Over the past 2 months, we have seen interest rates increase by 0.75% and are expecting at least one more (probably more) increase in the next month or two, so we would then have seen a full 1% increase.

If we now applied for a loan (after interest rates have increased by 1%) then the maximum loan amount we could borrow will have reduced from $1,000,000 to $897,000, a reduction in borrowings of $103,000.

If interest rates continue to increase this year and into next year, if rates increase by a further 1%, then the same person would now only be able to borrow $808,000. A 2% increase would reduce the available debt to $733,000.

So, in summary, as you can see from the numbers above, as interest rates increase your ability to borrow reduces. The reduction amount can be quite significant,

In this case, a 2% increase, 1% that has already happened, and a further 1% could reduce the potential borrowing capacity by almost 20%.

In some cases, this can be the difference between being able to buy the property you want to buy and not.

I’ve read many articles over the past month suggesting that property prices may fall, this may be the case, it may be that the property you want to buy is slightly cheaper next year,

but can you borrow the funds required to buy that property?

Timing the market is always challenging, two years ago, as the Covid pandemic was starting, the press was reporting that the property market was set for a significant adjustment, but I don’t recall any analysts noting that adjustment was a 30% or more increase. With any long-term investment, the key factor is that it is a long-term investment, it’s time in the market that makes a difference over the long term, not the time you got into the market (generally).

The market is in transition and edging towards a buyer’s market, meaning you will have more power when negotiating on price and terms.

In my experience, when speaking with clients, the majority of regret is not doing something and waiting, so even though being cautious in the market is always recommended, there are many other factors that need considering and many options for you moving forward.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.