August Meeting, Reserve Bank Australia held interest rates at 4.10%

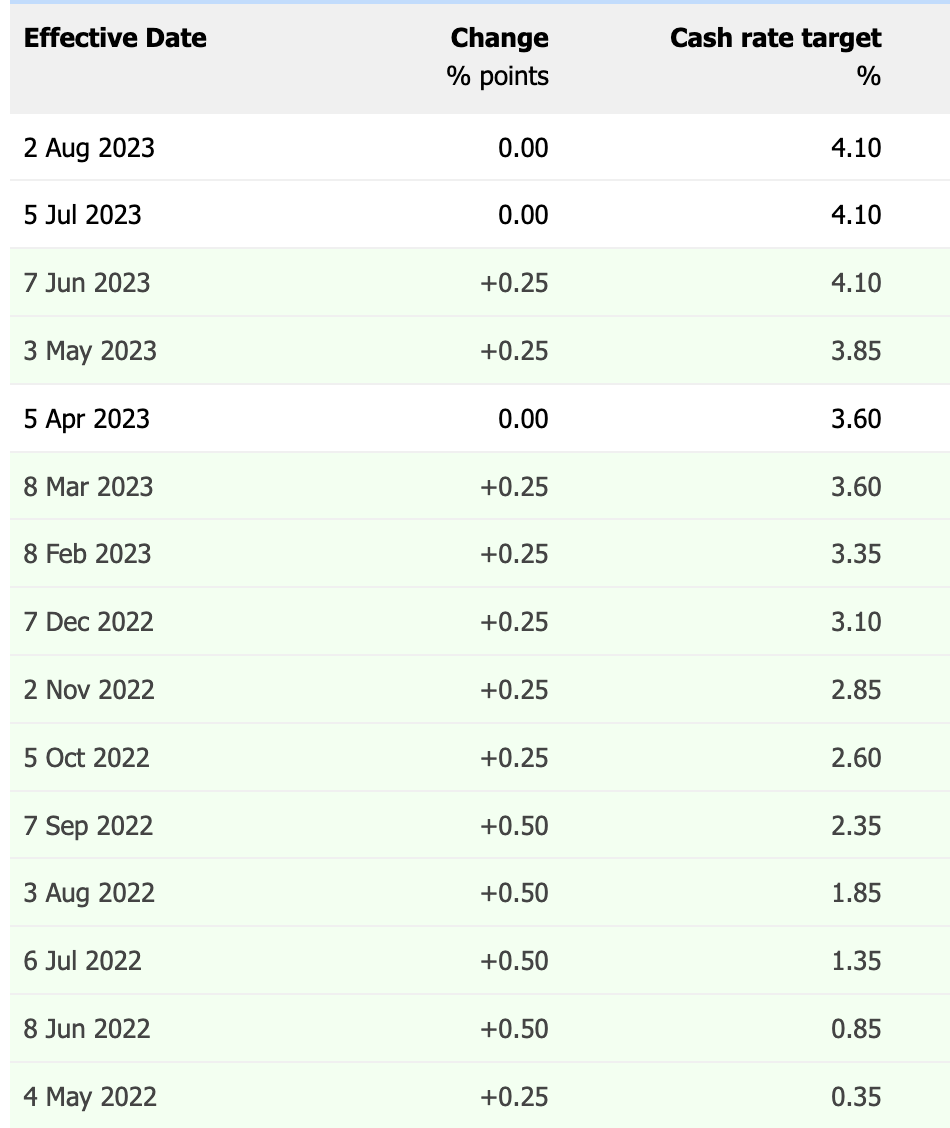

Australians are hopefully reaching the top of the interest rate cycle, with the Reserve Bank of Australia holding the cash rate for the 2nd time at a cash rate of 4.10%. This comes after 13 out of 14 months of interest rate rises since May 2022.

Outgoing Governor Phillip Lowe made the following statement following the monetary policy decision;

“At its meeting yesterday, the Board decided to leave the cash rate target unchanged at 4.10 per cent and the interest rate paid on Exchange Settlement balances unchanged at 4.00 per cent.

Interest rates have been increased by 4 percentage points since May last year. The higher interest rates are working to establish a more sustainable balance between supply and demand in the economy and will continue to do so. In light of this and the uncertainty surrounding the economic outlook, the Board again decided to hold interest rates steady this month. This will provide further time to assess the impact of the increase in interest rates to date and the economic outlook.

Inflation in Australia is declining but is still too high at 6 per cent. Goods price inflation has eased, but the prices of many services are rising briskly. Rent inflation is also elevated. The central forecast is for CPI inflation to continue to decline, to be around 3¼ per cent by the end of 2024 and to be back within the 2–3 per cent target range in late 2025.”

Source RBA Website - Statement Governor Phillip Lowe

Australian Mortgage holders are not out of the woods yet. The Reserve Bank of Australia board warned Australians in the final paragraph of the statement,

“Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon the data and the evolving assessment of risks.”

Source RBA Website - Statement Governor Phillip Lowe

With banks predicting that there will be a rate reduction in 2024, could this be an indication that we’ve reached the top of the interest rate cycle?

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.