2024 Australian Interest Rate Outlook.

How high will Australian Interest rates go in 2024?

I’m asked daily by my clients,

“How high will Australian Interest rates go in 2024?”

Or

“When will interest rates drop?”

To answer the question, we have to consider many factors including economic indicators, global trends, that affect Reserve Bank of Australia's monetary policy decisions. The decision on interest rates is based on factors such as inflation, employment, Gross domestic product growth, household savings, wages growth and overall economic well-being. Considering the current global uncertainties, the Reserve Bank of Australia will likely adopt a cautious approach to maintain stability and encourage economic progress. Financial market observers eagerly await any signals or announcements that could reveal the path of Australian interest rates this year.

The 2024 Australian interest rate scenario is poised to be shaped by multiple determinants, with the Reserve Bank of Australia responsible for setting the official cash rate, which is currently at 4.35%. Analysts monitor employment metrics, GDP performance, and inflation trends for clues on potential monetary policy adaptations.

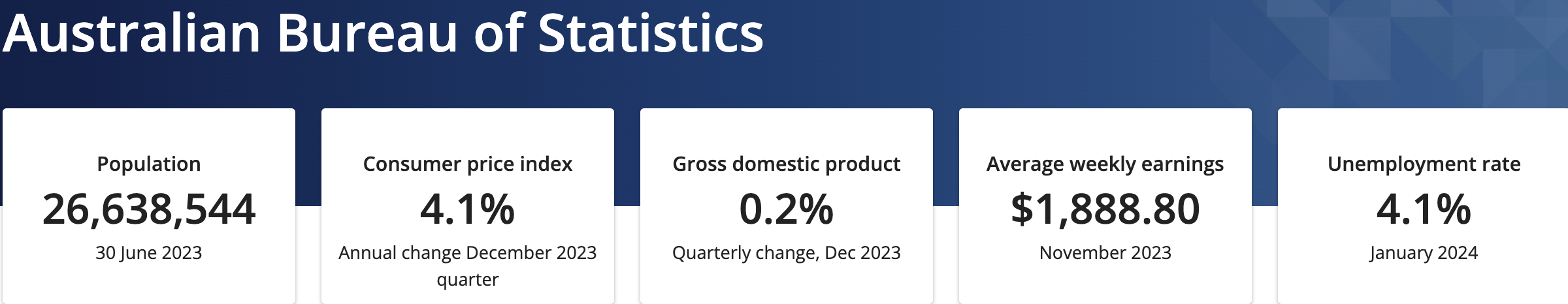

The interplay between domestic and international developments will be pivotal in shaping Australia's interest rate landscape over the year. Since April 2022, we’ve seen the cash rate climb from a historic low of 0.1% to 4.35%, and many clients are now seeking relief and keen to know if there are any indicators or predictions of what will happen in 2024. One of those key indicators was reported yesterday by the Australian Bureau of Statistics. The Gross Domestic Product growth was only 0.2% for the quarter of December 2023.

“Our economy grew 0.2 per cent during the December quarter of 2023 and 1.5 per cent annually. While we experienced a ninth successive quarter of growth, this was the slowest annual growth rate since the COVID-19 pandemic. Strong population growth saw GDP per capita fall 1.0 per cent over the year.”

The Reserve Bank of Australia is committed to returning the inflation target to 2% and 3%. Currently, the inflation is at 4.1%, which is projected to be reduced to the 2% and 3% range by the end of the calendar year.

We’ve seen the cash rate climb from a historic low of 0.1% to 4.35% since April 2022, and many clients are now seeking relief and keen to know if there are any indicators or predictions of what will happen in 2024.

What are the “Big Four” banks’ cash rate forecasts?

The big four bank economic teams, comprising experts in the financial sector, have analysed the prevailing economic indicators to outline their forecasts for the upcoming series of cash rate movements.

Interest Rate Changes

CBA: Peaked at to 4.35% in Nov '23, then decreased to 2.85% by Jun '25

Westpac: Peaked at to 4.35% in Nov '23, then decreased to 3.10% by Dec '25

NAB: Peaked at 4.35% in Nov' 23then decreased to 3.10% by Nov '25

ANZ: Peaked at to 4.35% in Nov '23, then decreased to 3.60% by Jun '25

Should I be on a fixed or variable interest rate for 2024?

The Big Four Banks have predicted that we’ve already seen the peak in interest rates in November 2023 at 4.35%.

When considering whether to opt for a fixed or variable interest rate for 2024, it's crucial to delve into the current economic landscape to make an informed decision that aligns with your financial goals and risk tolerance. Conducting thorough research and consulting with financial experts can provide valuable insights to help you weigh the pros and cons of each option before determining the most suitable choice for your circumstances.

With interest rates predicted to drop in 2024, from June onwards is the earliest prediction; it may be more prudent to remain on a variable interest rate to take advantage of potential cost savings and flexibility in adjusting to changing market conditions.

Suppose you are coming off a fixed interest rate or are already on a variable loan and are starting to feel the pain of higher interest rates biting into your monthly budget. In that case, staying informed about the current economic landscape and the predicted interest rate scenario for 2024 is essential. It's critical to research and consult financial experts. With interest rates predicted to drop in 2024, remaining on a variable interest rate may be prudent. If you're struggling with higher interest rates, it's advisable to reach out to your mortgage broker to explore potential solutions better to manage your finances in the current market conditions. Your mortgage broker should be able to “Go into Bat for You” and negotiate a better rate with your bank.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.