Closing the Retirement Gap. Solving a 30-50-year problem by St. James’s Place Financial Adviser Sharon Calderini

Closing the Retirement Gap. Solving a 30-50-year problem by St. James’s Place Financial Adviser Sharon Calderini.

Thank you, Sharon Calderini, Managing Partner, St James’s Place Asia and Middle East for sharing your blog;

Closing the retirement gap.

“How do we solve a potential 30-50 year problem?”

The answer:

“The way we think about retirement needs to change

Know your taxes as an Australian Expat.

Know your taxes as an Australian Expat.

Thank you, Jamie Towers from Mazars, St. James’s Place Asia and Middle East Tax Partner in Australia, for the information webinar titled “Australian expat considerations in Asia and Middle East for those repatriating.” Scan the QR Code below to watch the complimentary information webinar.

Stanford Brown Monthly - August Report

Thank you, Nick Ryder, Chief Investment Officer (CIO), and the Stanford Brown Team, for taking the time to generously share your highly informative and invaluable monthly report with THE EXPATRIATE Community. We appreciate your continuous efforts in keeping our community well-informed and empowered with your expert insights and analysis.

This month, Nick tackles some of the most pressing questions for longer-term investors:

What happened over the month

Performance of major financial markets

Current investment outlook and portfolio positioning

Views on major asset classes

Current portfolios allocations

To read the full report, click on the link below;

Stanford Brown's Monthly Investment Markets Report for July 2023.

Thank You, Chief Investment Officer (CIO) Nick Ryder, for sharing Stanford Brown’s Monthly Investment Markets Report for July 2023.

This month Nick tackle’s some of the most pressing questions for longer-term investors:

What happened over the month

Performance of major financial markets

Current investment outlook and portfolio positioning

Views on major asset classes

Current portfolios allocations

SB Talks, RBA’s Decision, Inflation, US earning reports and more.

Stanford Brown (SB) Talks is an informative conversation with SB CEO Vincent O’Neill and Chief Investment Officer (CIO) Nick Ryder in which they explore the important elements of your financial world – from investments to strategy, from retirement planning to intergenerational wealth.

They discuss:

Why the RBA’s latest rate pause might give hope that inflation is waning

Services and rent are the biggest drivers of inflation

The divergence between cashed-up and stressed homeowners

Why Europe’s inflation remains sticky

Japan’s increased flexibility surrounding bond yield caps

US earnings reporting season

SB Talks Podcast- Video - Monthly Financial Update

Thank You, Stanford Brown CEO Vincent O’Neill and Chief Investment Officer Nick Ryder, for sharing the latest edition of the SB Talks podcast. In this podcast, the SB financial gurus explore the important elements of your financial world – from investments to strategy, from retirement planning to intergenerational wealth.

CEO Vincent O'Neill is hosting this episode of SB Talks, and his guest is Chief Investment Officer Nick Ryder.

They discuss:

The RBA’s “hawkish skip” in July

Mortgage prisoners and the housing sector

US employment and wages data - July

The bond market moves and peak cash rate pricing

Equity market decoupling and the magnificent seven US technology leaders

Stanford Brown Quartlery Review

Thank you, Stanford Brown Chief Investment Officer Nick Ryder, for sharing the link to their Stanford Brown Quarterly Review of Investment Markets Report.

In the Stanford Brown Quarterly Report, you will find:

The ‘Magnificent Seven’ leads the charge.

Inflation – Although it seems to have peaked, why it could prove sticky?

Interest rates – Why expectations for rate cuts in 2023 and 2024 may be premature.

Recession – Why the widely forecasted global recession in 2023 is now less likely.

In-depth Asset Class reviews

Current portfolio positioning as per the end of Q2 2023

SB Talks with Host Vincent O'Neill and guest speaker Nick Ryder

In this episode of SB Talks, CEO Vincent O'Neill is joined by Chief Investment Officer, Nick Ryder to discuss:

The US debt ceiling and financial plumbing risks The Australian labour market and potential for additional rate hikes Whether bonds are back How active management and alternative investments may fare better if equity markets track sideways over coming years

SB Talks with host Vincent and guest speaker Nick Ryder.

We are excited to share the latest edition of the SB Talks podcast, where the financial experts explore the essential elements of your financial world – from investments to strategy, from retirement planning to intergenerational wealth.

In this episode of SB Talks, CEO Vincent O'Neill is joined by Chief Investment Officer Nick Ryder.

They discuss:

Reasons for this month’s RBA rate increase

The impact of the Fair Work Commission’s minimum and award wage decision on the inflation outlook

Why it is still too early to increase fixed-interest allocations

US chipmaker, Nvidia, and its exposure to the artificial intelligence revolution

Why Japanese shares have performed strongly in 2023

NAB Federal Budget Review 2023

NAB Federal Budget Review 2023

Thanks, Alan Oster NAB Group Chief Economist for sharing your Budget Insights for 2023.

What are the big calls?

What were the headline announcements? Read about how they could impact you.

What is the industry impact?

What are the implications for businesses large and small? Read our sector-by-sector analysis.

Where will this budget take our economy?

What will it mean for you and your business?

SB Talks - April

Thank you, Stanford Brown, for sharing the latest edition of our SB Talks podcast with THE EXPATRIATE Community. In this podcast, the SB Team explores your financial world's critical elements – from investments to strategy, retirement planning to intergenerational wealth.

In this episode of SB Talks, CEO Vincent O'Neill is joined by newly appointed Chief Investment Officer Nick Ryder. As part of this change in office, we will also bring you more regular but shorter-form podcasts.

They discuss:

The fallout from the recent banking issues in the US and Europe

How bad news can sometimes be good news for bond and equity markets

The three components of the current inflation spike and why unemployment may need to rise

The cracks appearing in the commercial property sector

Short-term plans to review the asset class mix for portfolios

Stanford Brown Monthly Update

StanfordBrown's Monthly Investment Markets Report

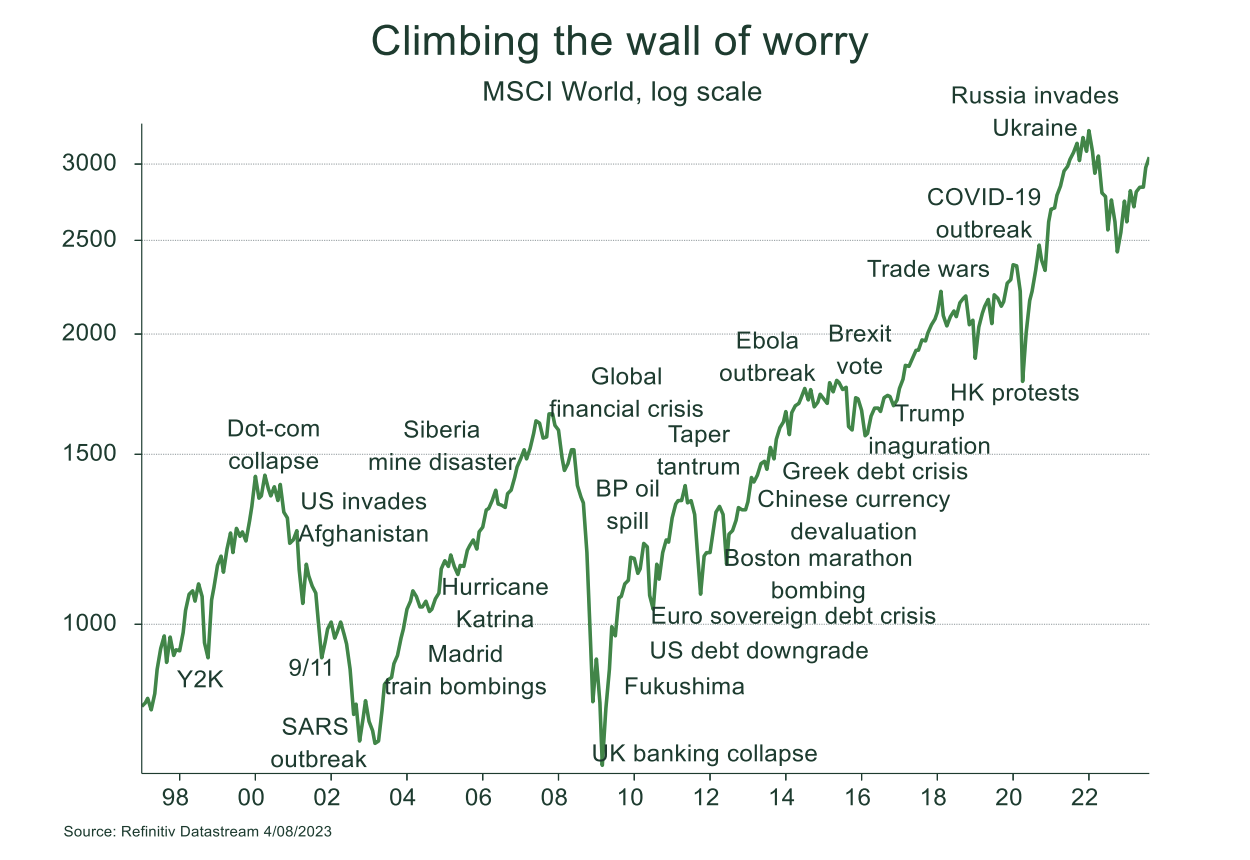

StanfordBrown has put together an easy-to-read report aimed to help investors cut through all the media noise and hype and understand what is really driving investment markets and portfolio returns.

This month we tackle some of the most pressing questions for long term investors:

Outlooks for inflation and interest rates

The ‘Stock Market Olympics’ – who are the winners and losers, and why?

Are we headed for Recessions – and how will share markets react?

Are share markets cheap or still expensive? – how do we measure this?

What is your ‘personal inflation rate’? And will your investments fund it?

The Federal government’s radical new Super tax – what’s the big deal?

Stanford Brown Quartley Market Report February 2023 - Portfolio Changes.

Ashley Owen - Chief Investment Officer from Stanford Brown, has shared with us the SB Quarterly Market Review of Investment Markets and the SB Portfolio Changes.

Key Points from the Stanford Brown Quarterly Review are as follows:

Stanford Brown Podcast

Stanford Brown (SB) has shared the latest edition of our SB Talks podcast. The podcast explores the important elements of your financial world – investments to strategy, retirement planning, and intergenerational wealth.

In the January edition of SB Talks, Stanford Brown CEO Vincent O'Neill speaks with Chief Investment Officer Ashley Owen.

Stanford Brown Market Report November 2022

Thank You, Ashely Owen, Chief Financial Officer from StanfordBrown, for sharing their Monthly Investment Markets Report for November 2022.

This month StanfordBrown tackle some of the most pressing questions for longer-term investors:

Inflation and interest rates – Where are we now? - and how high will they go?

Share markets – Are they cheap yet, or still expensive? – and where to from here?

Spending is slowing, but we still sitting on a huge mountain of cash to spend – where did it all come from?

The FTX collapse – is this the end for crypto? Or just a bump in the road?

StanfordBrown Podcast - CEO Vincent O’Neil and Chief Investment Officer Ashley Owen

THE EXPATRIATE Podcast - StanfordBrown Monthly Market Report November 2022.

In this episode, CEO Vincent O’Neill of StanfordBrown’s (SB) will be speaking with SB Chief Investment Officer Ashley Owen on the following topics: Inflation and rate hikes – is the worst behind us? Share prices – are they cheap yet, or still expensive? What sectors are good value? FTX collapse – the end of crypto, or just a bump in the road? Outlook for 2023 – where are the opportunities?

StanfordBrown (SB) Market Update November, TE In Hong Kong, Congratulations SB on reaching your 35th Birthday.

StanfordBrown Market Update November 28 Nov

THE EXPATRIATE is thrilled to announce that Stanford Brown has just moved through a historic milestone many businesses are not fortunate to see. Congratulations on reaching your 35th Birthday.

10-Point Checklist for Australian Repatriation

James Englebrecht financial advisor from St James’s Place Asia and Summit Financial has put together a 10 Point Checklist for consideration before repatriating to Australia.

10 ways to maximise your wealth as an expatriate living in Singapore

10 ways to maximise your wealth as an expatriate living in Singapore

Living in a foreign country can be exciting and paying lower income tax rates can be rewarding. But, many expatriates are still faced with incredibly complex financial decisions.

As an expatriate living in Singapore, what can you do to maximise your financial position? Here are 10 ways to help you grow and preserve your financial assets.