Send 14th August 2023 Currency Update by Ian Cragg

The AUD has faced downward pressure against different currencies, impacted by factors such as safe-haven demand, economic data, risk aversion, and monetary policy outlook. This situation is not likely to improve anytime soon, which means that AUD is likely to remain weak for the time being.

Let`s dive in for more details.

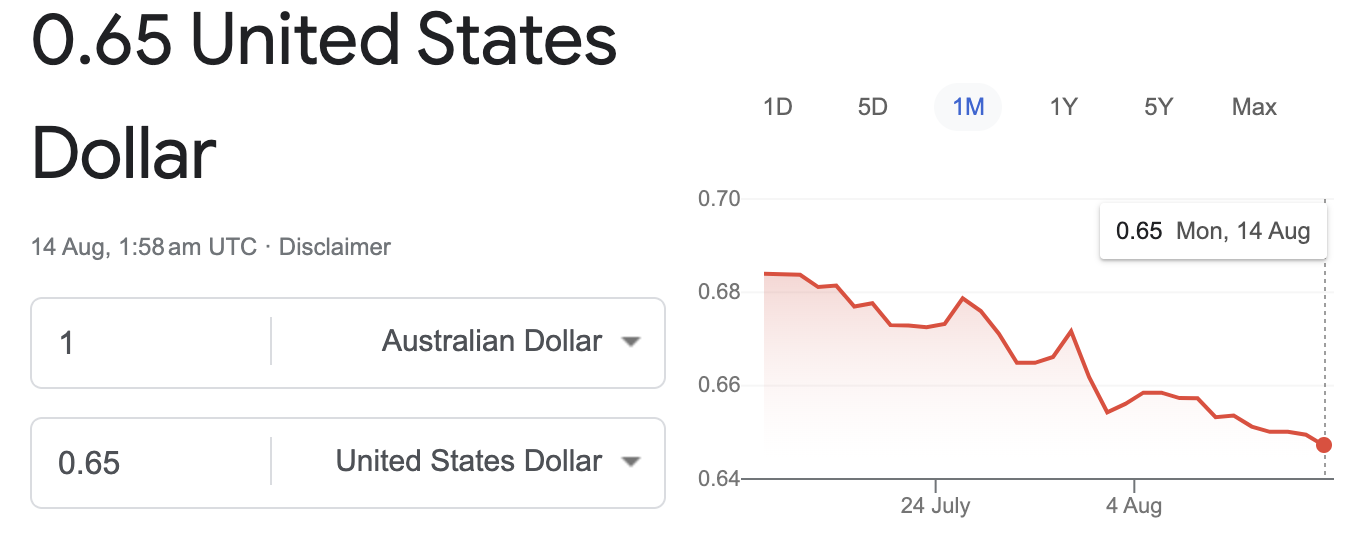

AUD - USD

The AUD/USD pairing experienced a notable decline last week, with a 0.78% decrease in its value. The market sentiment strongly leans towards selling the Australian dollar (AUD) against the US dollar (USD). Several factors have influenced this trend.

One significant factor impacting the AUD/USD pairing is the monetary policy divergence between the two countries. The US dollar has been benefiting from safe-haven demand as poor economic data emerges from China, prompting investors to seek refuge in the USD. On the other hand, Australia's central bank governor, Philip Lowe, indicated that some further tightening may be necessary in Australia, suggesting that the current rate increases should be sufficient to tackle inflation.

In terms of economic data, Thursday's release of US consumer prices for July showed a moderate increase of 0.2%, in line with expectations. This reduced the need for additional monetary tightening from the Federal Reserve, reinforcing market expectations that interest rates will remain unchanged at the next policy meeting. The CPI climbed 3.2% over the past 12 months, slightly higher than the 3.0% rise in June, indicating some inflationary pressures.

Meanwhile, the Australian dollar has faced downward pressure due to the deteriorating economic situation in China. Data revealed that the Chinese economy slipped into deflation last month, increasing the likelihood of additional stimulus measures by the Chinese government. This, in turn, pushed investors toward risk assets and away from the AUD.

AUD - EUR

The AUD/EUR pairing experienced a decline last week, with a 0.70% decrease in its value. The market sentiment leans strongly towards selling the Australian dollar (AUD) against the Euro (EUR). Several factors have influenced this trend.

The recent decision by the Reserve Bank of Australia (RBA) to maintain interest rates for a second time is a key factor influencing the AUD/EUR pairing. This decision holds considerable significance in shaping the dynamics of the currency exchange between the Australian Dollar (AUD) and the Euro (EUR). While this decision was expected, it has raised concerns about the Australian economy's ability to combat inflationary pressures. Stubborn inflation in Australia remains a potential downside risk for the AUD/EUR pairing. The decision to hold rates earlier in April turned out to be a hasty decision as the inflation continued to rise leading to rate hikes, so there is a valid concern about the decision of RBA to hold rates this time.

Furthermore, the AUD/EUR pairing remains closely linked to the ongoing misfortunes of the Chinese economy. China recently received disappointing trade data, and there have been confirmations of deflating consumer prices. This combination of factors has raised concerns about the outlook for the Chinese economy and has led to increased uncertainty in the markets. As Australia's proximity to China is significant, any further deterioration in the Chinese economic situation could negatively impact the AUD/EUR pairing.

On the other hand, the Euro (EUR) has benefited from risk-on flows and an unwinding of bank sector losses triggered by a downsized windfall tax plan. This has boosted the EUR and contributed to the AUD/EUR pairing's decline.

AUD - GBP

The AUD/GBP pairing experienced a decline last week, with a 0.85% decrease in its value. The market sentiment strongly leans towards selling the Australian dollar (AUD) against the British Pound (GBP). Several factors have influenced this trend.

The risk-off sentiment in the market is a crucial factor affecting the AUD/GBP pairing. Concerns over the weak RICS house price balance and worries about the Bank of England's slow retreat from rate hikes have offset any potential support from falling Fed rates relative to BoE rates. This has contributed to a decrease in demand for the AUD/GBP pairing.

AUD - NZD

The AUD/NZD pairing saw a gain of 0.69% in its value last week, indicating a preference to buy the Australian dollar (AUD) against the New Zealand dollar (NZD). Several factors have influenced this market sentiment.

The AUD/NZD currency pairing is significantly impacted by the economic downturn in China. As a result, trade and inflation figures from China have been disappointing, affecting both Australia and New Zealand, which rely heavily on exporting resources. Consequently, prices for Australia's largest export earner, iron ore, have declined, while New Zealand's primary export, dairy products, has experienced subdued demand.

Furthermore, the recent comments from Reserve Bank of Australia (RBA) Governor Philip Lowe, suggesting that interest rates have reached or are near a peak, have shifted market expectations. The anticipation of rates remaining unchanged for an extended period or even a potential rate cut by the RBA has impacted the AUD/NZD pairing.

Looking ahead, traders should closely monitor any further developments in the Chinese economy, including trade and inflation data, which may impact the demand for Australian and New Zealand exports.