Send Currency Update Published on May 6th 2024

In The News 🌏 Market Conditions and What to look out for this week 🗓️

Speculation on RBA Rate Hike:

Capital Economics is forecasting a 25 basis points rate hike, citing stickier and stronger inflation than expected by the Reserve Bank of Australia (RBA).

The RBA has historically increased interest rates when the trimmed mean quarterly inflation has been at least 1 percent, which was the case in the March quarter.

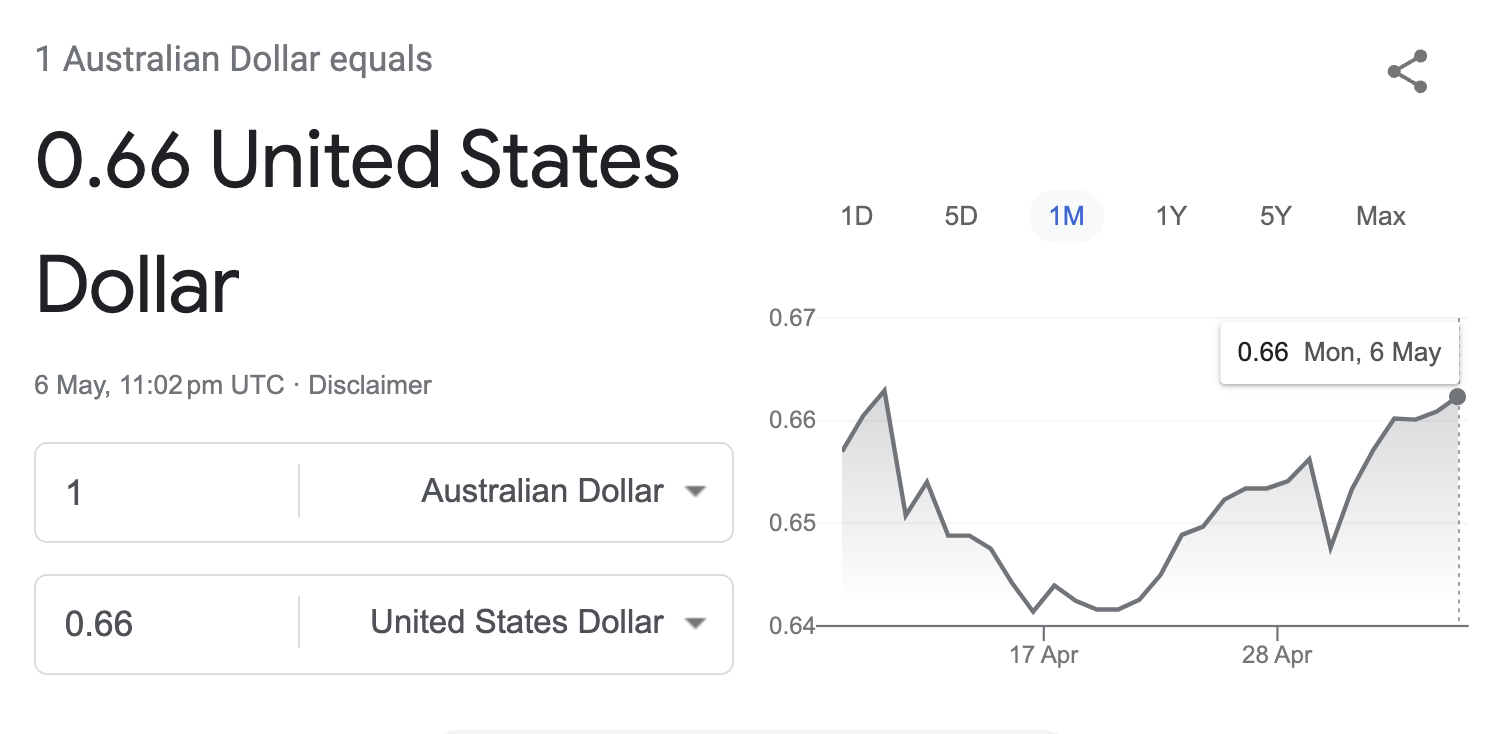

AUD/USD Pair Strength:

The AUD/USD pair extended its upside around 0.6610 during Monday's Asian session.

Downbeat US employment data for April exerted some selling pressure on the US Dollar, supporting the Australian Dollar.

Gold Price Movement:

Gold prices fell more than 2% for the second consecutive week, experiencing renewed bearish pressure despite a small recovery.

The near-term technical outlook suggests a loss of bullish momentum as market focus shifts to Federal Reserve communications.

Oil Market Tightening:

Bloomberg reports price hikes to Asia for crude oil for the third consecutive month as Saudi Arabia works to tighten the oil market.

The June official selling price of Arab Light crude for customers in Asia increased by 90 cents to $2.90 a barrel, exceeding estimates for a 60 cent increase.

Prices for other varieties also saw increases from May levels.

Last Week 🗞️

Australian Dollar Strengthens on Inflation Figures:

Australia's first-quarter inflation figures revealed a stronger-than-expected CPI inflation of 3.5% year-on-year, surpassing the market consensus of 3.4%.

The Australian Dollar (AUD) emerged as the best-performing major currency on the day of the announcement, indicating increased market confidence in the currency.

Notably, the acceleration of inflation on a quarter-to-quarter basis, from 0.6% in Q4 to 1.0% in Q1, suggests a potential uptick in price pressures.

Key measures of core inflation, closely monitored by the RBA, showed signs of increasing price pressures, with the weighed mean and trimmed mean both accelerating quarter-to-quarter.

China's Industrial Profits and Gold Price Movement:

China's industrial profits in March 2024 declined by 3.5% year-on-year, slowing the gains made in the quarter compared to the first two months.

Meanwhile, the gold price edged lower to $2,335 in Monday's early Asian session, influenced by doubts about near-term US Federal Reserve rate cuts amidst firm US inflationary pressures.

GBP/USD Decline Influenced by US Inflation Data:

GBP/USD registered a decline of 0.27%, impacted by US inflation data suggesting potential delays in Federal Reserve rate cuts.

The pair's inability to break above the 200-day moving average highlights its downward bias, with support levels now in focus.

Market Outlook:

The Federal Reserve's interest rate decision on Wednesday will be closely watched, with recent data indicating firm US inflationary pressures.

Potential further losses for GBP/USD may occur, targeting 1.2400 and possibly extending to the year-to-date low of 1.2300.

Things to look out for this week;

Tuesday 7th May

🇦🇺 Cash Rate - AUD

🇦🇺 RBA Monetary Policy Statement - AUD

🇦🇺 RBA Rate Statement - AUD

Thursday 9th May

🇬🇧 BOE Monetary Policy Report - GBP

🇬🇧 Monetary Policy Summary - GBP

🇬🇧 MPC Official Bank Rate Votes - GBP

🇬🇧 Official Bank Rate - GBP

🇬🇧 BOE Gov Bailey Speaks - GBP

🇺🇸 Unemployment Claims - USD

Friday 10th May

🇺🇸 30-y Bond Auction - USD

🇬🇧 GDP m/m - GBP

🇨🇦 Employment Change - CAD

🇨🇦 Unemployment Rate - CAD

Saturday 11th May

🇺🇸 Prelim UoM Consumer Sentiment - USD

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.